The Largest Minority Group in the U.S: Americans with Disabilities

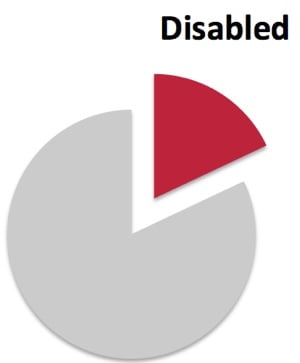

More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.

More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.

There are many reasons for your business to provide accessibility to disabled individuals. First, it’s the right thing to do. Second, each of these individuals is a potential customer and studies have shown that once people with disabilities find a business where they can comfortably and easily shop or get services in, they become repeat customers. And finally, the Americans with Disabilities Act allows individuals and disability rights organizations to bring lawsuits against businesses that do not comply with the Act, knowingly or unknowingly. In such cases having the right commercial insurance can be critical to your financial protection.

What is ADA?

The ADA, signed into law in 1990, is a federal civil rights law that prohibits the exclusion of people with disabilities from everyday activities such as shopping, eating in a restaurant, or seeing a movie. Thanks - in great part - to the ADA, people with disabilities are living more independent lives and participating in more activities within their communities.

The ADA is Confusing, But Your Business Can be Held Liable Regardless of Your Intent

Unfortunately, the ADA laws can be very confusing and often frustrating to small business owners, and although there are some exceptions given to smaller businesses regarding the ADA rules against disability discrimination in employment and the requirement that employers provide reasonable accommodations to disabled employees, the adoption of Title III of the ADA in 2010 applies to every business that serves the public - regardless of the size of the business or the age of the building. How confident are you that your business is in full compliance? Do you have the proper commercial liability insurance protection to help shield you from unknown risks?

Title III applies to businesses that provide goods or services to the public (known as “public accommodations”). There are 12 categories of public accommodations, including stores, restaurants, bars, services establishments, theaters, hotels, recreational facilities, private museums and schools, doctors’ offices, shopping malls, and other businesses. Essentially, any business that regularly serves the public (with the exception of private clubs and religious organizations) is considered a public accommodation.

Know the Most Common ADA Violations and Prepare Accordingly

These businesses must take steps to ensure that their facilities are accessible to individuals with disabilities. Here are seven of the most common areas of violations:

- Parking lots

- Exterior ramps

- Paths of travel

- Signage

- Restrooms

- Lobbies and reception areas

- Accessibility to goods and services

How Can I Protect My Business from ADA Title III Lawsuits?

If your business isn’t compliant, you can lose potential customers and open yourself up to lawsuits, heavy fines, and legal fees. Although it is impossible for businesses that serve the public to completely avoid the risk of ADA lawsuits, there are a number of steps you can take to minimize your risk:

- Have your property inspected by an ADA compliance expert.

- Read through the 2010 ADA Standards for Accessible Design.

- Read through the ADA Small Business Primer.

- Take the online course, “At Your Service: Welcoming Customers with Disabilities.”

- Know the difference between ADA requirements and state and local building codes. “Grandfather” provisions that are often found in local building codes do not exempt businesses from ADA Title III compliance.

- Don’t ignore letters from plaintiff’s attorneys threatening ADA lawsuits. Sometimes claims can be resolved with little cost if addressed prior to extensive litigation.

- Provide training to your employees and staff on how to address questions or concerns about disability access from customers.

- Discuss your liability insurance with your insurance agent

Knowledge is Key to the Right Business Insurance Protection

For more information about commercial liability insurance, contact American Insuring Group at (800)947-1270 or (610)775-3848. We'll help you get the right business insurance protection at the right price using our pool of competing insurance providers. Contact us today.