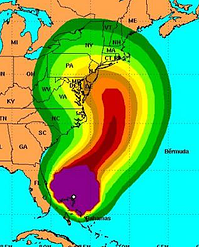

As you listen to the news about the devastating fires in Tennessee, tornado outbreaks in the Midwest, or destructive hurricanes pounding the coast of Florida, you may feel safe and sound here in Pennsylvania, especially if you have proper homeowners insurance protetion.

As you listen to the news about the devastating fires in Tennessee, tornado outbreaks in the Midwest, or destructive hurricanes pounding the coast of Florida, you may feel safe and sound here in Pennsylvania, especially if you have proper homeowners insurance protetion.

It is true that we are relatively lucky when it comes to natural disasters; however, we are not entirely immune to them.

Pennsylvanians still face damaging winter storms, flooding, the occasional hurricane (Agnes in 1972 and Sandy in 2012), and even earthquakes (2003 and 2007 in Flying Hills), hailstorms (May 2014 in Berks County) and tornadoes (in 2015 tornadoes were reported near Reading, Montoursville, and Selinsgrove).

Here are some tips to prepare for natural disasters in PA and beyond

Take a Home Inventory

Your first step is to create a home inventory, which is simply an itemized list of your possessions to help you establish what you have and what those items are worth. Your inventory should include photos, serial numbers, receipts, and any other pertinent information you have about the item.

You can record the information on a sheet of paper or in an Excel or Word Document – whatever makes sense for you but do make sure that you store it in multiple places. Make several copies, having both a hard copy and an electronic copy are good ideas, and at least one copy should be kept outside of your home – electronically it can be saved to the Cloud, and hard copies can be stored in a safety deposit box at a bank.

A home inventory is easy to create. Start in one room and list all of your possessions in that room, including make and model, features, purchase price, and a photograph. Then, go to the next room and do the same, and so on. It can actually be kind of fun to take inventory of all your possessions.

If you do suffer damage from a natural disaster, this document will make the insurance claim process run more smoothly, and allow you to focus on the emotional recovery.

Prepare your Home for a Potential Disaster

The following steps may not only minimize the damage you incur from a natural disaster, they may even help you avoid minor insurance claims (which may increase your premiums), enhance the value of your home, and make it look nicer.

- Trim foliage – Thinning out trees and bushes can minimize or eliminate damage from wind, freezing rain, and fire.

- Install fortified or impact-resistant windows

- Check your roof

Review your House Insurance Coverage

Standard homeowner’s policies usually cover damage from wind, fire, lightning strikes, and winter storms. However, not all policies cover damage from floods, sinkholes, or earthquakes. If you live near a body of water, you should talk to your agent about flood insurance. And keep in mind that the Federal Emergency Management Agency reports that 20% of flood insurance claims are from homeowners in moderate to low risk areas!

File Your Homeowners Insurance Claim Promptly!

If you do suffer damage from a natural disaster, contact your insurance company immediately to make a claim. The quicker you can start the claims process, the quicker you can get back to normal.

Contact Us for a Free Homeowners Insurance Assessment

Now is a great time to review your homeowner’s policy to avoid any unpleasant surprises should a natural disaster strike your home.

Contact American Insuring Group online or call us at (800) 947-1270 or (610) 775-3848, and we’ll be happy to review your policy to determine if you are properly protected against potential natural disasters in your area.

Look! Up at the sky! It’s a bird! It’s a plane! No, it’s a drone! And it’s coming to a neighborhood near you. The Consumer Electronics Association estimates that consumer drone purchases this year will put 300,000 more recreational drones in the skies. And while many consumers are now eyeing these unmanned, remote-controlled aerial toys as one of their next purchases, they don’t necessarily want their neighbors to buy one. Furthermore, few consider whether their homeowners insurance will cover them for drone-related accidents.

Look! Up at the sky! It’s a bird! It’s a plane! No, it’s a drone! And it’s coming to a neighborhood near you. The Consumer Electronics Association estimates that consumer drone purchases this year will put 300,000 more recreational drones in the skies. And while many consumers are now eyeing these unmanned, remote-controlled aerial toys as one of their next purchases, they don’t necessarily want their neighbors to buy one. Furthermore, few consider whether their homeowners insurance will cover them for drone-related accidents. Why Home Security Should be a Priority

Why Home Security Should be a Priority Get a Homeowners Insurance Checkup for Your Peace of Mind

Get a Homeowners Insurance Checkup for Your Peace of Mind 2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

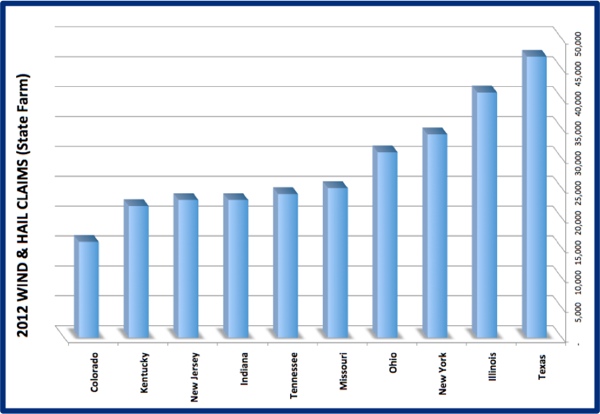

It's Not Just About the Midwest

It's Not Just About the Midwest

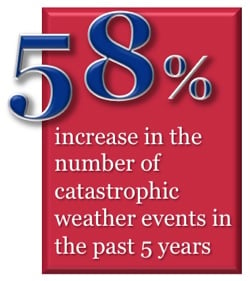

Why the Big Homeowner’s Insurance Cost Increases?

Why the Big Homeowner’s Insurance Cost Increases? Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Are You at Risk?

Are You at Risk?

According to WFMZ-TV: "

According to WFMZ-TV: " October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.

October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.  To receive your free report, courtesy of PuroClean,

To receive your free report, courtesy of PuroClean,  The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie!

The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie!