No one wants to pay more for business or homeowners insurance than they need to, but everyone wants to ensure that that have the right coverage to protect their family and their possessions. It can be tricky to determine whether you need flood insurance. As you may know, standard homeowners and renters insurance policies do NOT cover flood damage.

No one wants to pay more for business or homeowners insurance than they need to, but everyone wants to ensure that that have the right coverage to protect their family and their possessions. It can be tricky to determine whether you need flood insurance. As you may know, standard homeowners and renters insurance policies do NOT cover flood damage.

If you’re in a designated flood zone, the purchase of flood insurance should be a no-brainer, and your lender will probably require flood insurance in that case. But what if you don’t live along a river or by the sea, and you’re far from a designated flood zone? That’s where it gets a little trickier.

Flooding: The Most Common and Costly Natural Disaster

Something to keep in mind: in the US, flooding is the most common and the most costly natural disaster, costing billions of dollars every year. The five most significant flood events in Pennsylvania (based on National Flood Insurance Program Payouts) include Superstorm Sandy in October 2012, Hurricane Ike in September 2008, Hurricane Ivan in September 2004, Hurricane Irene in August 2011, and Tropical Storm Allison in June 2001.

Additionally, flooding isn’t always caused by overflowing rivers or out-of-control oceans. It can also be caused by melting snow, an overflowing creek, or water running down a steep hill. As FEMA states, “Just a few inches of water can cost thousands of dollars in damage to a home.”

If you do decide to purchase flood insurance, there are two types of coverage you need to understand:

Building Coverage covers the repair or replacement of the building. This includes the foundation, electric, plumbing, central air, furnaces, water heaters, refrigerators, stoves, and built-in appliances. Basic building coverage is available for up to $250,000 for residential and up to $500,000 for commercial.

Contents Coverage covers the contents of your home like furniture, clothing, electronic equipment, smaller appliances, etc. Basic contents coverage is available up to $100,000 for residential and up to $500,000 for commercial.

Please keep in mind that you can purchase an Excess Flood Policy if you need more coverage than what’s available in the basic plans. You should also understand replacement costs – the amount you the insured will receive in the event of a loss.

Replacement Cost Value (RCV) is the cost to repair or replace the insured item at the time of the loss. There is no deduction for physical depreciation. The insurer is paid the amount required to replace the insured item (up to the limit). RCV is available when the insured property is the primary residence, and the amount of coverage is equal to 80% or more of the replacement cost of the building.

Actual Cash Value (ACV) is the cost to repair or replace the insured item, less the physical depreciation at the time of the loss. The depreciation is based on the age and the condition of the item. The contents of your property are always paid at ACV.

One more thing to keep in mind: With flood insurance, there is a 30-day waiting period before the coverage goes into effect, so don’t wait until you hear about a flood warning on the morning news to add flood insurance to your business or homeowners insurance policy.

Contact Us for Flood Insurance or Any Type of Insurance You May Need

American Insuring Group can help you determine if you flood insurance is right for your home or business.

American Insuring Group can help you determine if you flood insurance is right for your home or business.

And, regardless of what type of personal or business insurance you may need, we'll help you save because our independtent agents are free to shop among many competing carriers to find the right insurance protection at a great price.

So contact us online or give us a call at (800) 947-1270 or (610) 775-3848 to learn more.

While most Pennsylvania homes and businesses are not considered to be in a flood plain, that doesn't mean that buildings in Pennsylvania don't flood. Even low risk areas suffer flooding due to poor drainage systems, blockages, broken mains, or rapid precipitation. The average homeowner's and business insurance does not cover flood damage, so it merits a discussion whether to purchase a flood insurance policy to protect yourself.

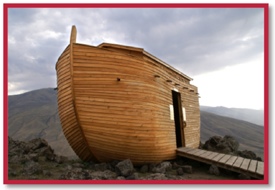

While most Pennsylvania homes and businesses are not considered to be in a flood plain, that doesn't mean that buildings in Pennsylvania don't flood. Even low risk areas suffer flooding due to poor drainage systems, blockages, broken mains, or rapid precipitation. The average homeowner's and business insurance does not cover flood damage, so it merits a discussion whether to purchase a flood insurance policy to protect yourself. So don’t wait until you see the ark float by; find out what kind of flood insurance works for you to protect your home and business! Give us a call at

So don’t wait until you see the ark float by; find out what kind of flood insurance works for you to protect your home and business! Give us a call at