Attention: restoration contractors! You may have lucrative opportunities from an unlikely source—mold. Yes, the fungus that grows in moisture-laden areas of many old homes has created a demand for professional mold remediation services. Done right, you can grow your mold remediation business while controlling your contractors insurance rates.

Attention: restoration contractors! You may have lucrative opportunities from an unlikely source—mold. Yes, the fungus that grows in moisture-laden areas of many old homes has created a demand for professional mold remediation services. Done right, you can grow your mold remediation business while controlling your contractors insurance rates.

Mold is one problem that homeowners cannot just ignore. Not only does it look disgusting, but it can also weaken the walls, ceilings, floor, and foundation of a house. And it presents a substantial risk to the health and safety of its inhabitants.

Income vs. Risk

But along with the possibility of additional income, mold has created new risks for businesses that work on water damage restoration, mold removal, or construction. By implementing a mold risk management strategy, however, contractors can participate in these business openings without endangering their company with uninsured liability.

A recent history of mold and insurance

Around 2001, the number of insurance claims for mold damages soared, as did the income for restoration contractors. Unfortunately, the insurance industry had not expected this rush of claims, and they had not priced them into their policies. In response, insurance companies were compelled to begin issuing mold exclusions and limitations. While these exclusions are not standardized, almost every type of property and liability insurance policy has them.

Liability exposure increases for contractors

Without contractors insurance to help resolve their mold problems, some property owners tackled the mold themselves (bad idea!) or sought out mold remediation experts. But these experts are not the only contractors who come up against mold on a regular basis. Restoration contractors, plumbers, and electricians also encounter mold on their job sites. Even though they have not been hired to eliminate a mold issue, these contractors should always inform the property owner when they discover mold. So, why should this put any contractor at risk?

Disgruntled homeowners often blame their contractor

In an ironic twist, many homeowners began filing lawsuits against the contractors who pointed out the mold to them. This shoot-the-messenger mentality put contractors at risk of liability. The Commercial General Liability Insurance (CGL) policy, usually a protective tool for a contractor, has the same pollution exclusion clause as the homeowner’s policy. This exclusion states that the insurance does not cover any bodily or property harm caused by the escape, dispersal, or release of pollutants.

Is mold a pollutant? There is no universal agreement on this from the courts. Some have found the policies to be vague in their definition of pollution, while other courts have defined mold as an airborne pollutant.

Contractors are advised not to expose their business to chance

Contractors need to protect themselves against potentially devastating lawsuits. There are now insurance policies that specifically cover mold and pollutants. Contractors Pollution Liability (CPL) can be added to your CGL to cover liability for these pollutants and provide an unambiguous definition that includes mold or fungi.

CPL is probably the best available policy for contractors wanting to avoid liability when they discover mold on a job site. And there are other methods contractors can use to manage their mold risks.

Reduce Your Risk With an Arsenal of Protection

- Choose your customers wisely: If your client is aware of a mold problem and knows the insurance company won’t cover it, you may want to walk away from this job.

- Document your work: Leave nothing to chance. Use photos, notes, and witnesses to corroborate your findings.

- Treat your customer with empathy: Approach your client with a plan of action that shows you understand his problem and will work with him to solve it.

- Protect yourself: Adding CPL to your contractors insurance will complete an arsenal that will mitigate your mold risks.

Get Help For All Your Business Insurance Needs

To learn more about Commercial General Liability and Contractors Pollution Liability insurance, or for any business insurance need, contact American Insuring Group online or call us at (800) 947-1270 or (610) 775-3848. We offer insurance from over 25 competing carriers, so we're sure to find you the right insurance at the right price. Call or click today!

To learn more about Commercial General Liability and Contractors Pollution Liability insurance, or for any business insurance need, contact American Insuring Group online or call us at (800) 947-1270 or (610) 775-3848. We offer insurance from over 25 competing carriers, so we're sure to find you the right insurance at the right price. Call or click today!

A recent national survey of small businesses yielded some sobering statistics. It found that 66 percent of these businesses do not have business interruption insurance—even though an estimated 25 percent of them will not be able to reopen following a major loss, such as a fire, a break-in, or a storm.

A recent national survey of small businesses yielded some sobering statistics. It found that 66 percent of these businesses do not have business interruption insurance—even though an estimated 25 percent of them will not be able to reopen following a major loss, such as a fire, a break-in, or a storm. The storm was ferocious. Luckily, your buildings were spared damage from the high winds and heavy rains; however, a few miles away the storm brought down power lines that supply your business with electricity. While there is no physical damage to your property, you’re still out of business without power. Does your

The storm was ferocious. Luckily, your buildings were spared damage from the high winds and heavy rains; however, a few miles away the storm brought down power lines that supply your business with electricity. While there is no physical damage to your property, you’re still out of business without power. Does your

Every small business should conduct a risk management assessment prior to reassessing their

Every small business should conduct a risk management assessment prior to reassessing their

You’re about to become an employer. Maybe you’ve been in business for a while, but now you’re ready to hire your first employee. You’re excited; this means your business is growing. Or, maybe you’re just starting a business and you need employees to help run that business.

You’re about to become an employer. Maybe you’ve been in business for a while, but now you’re ready to hire your first employee. You’re excited; this means your business is growing. Or, maybe you’re just starting a business and you need employees to help run that business.

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA).

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA). In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an

In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an  For more information about drone insurance and other commercial insurance needs,

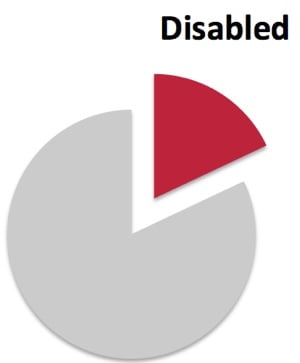

For more information about drone insurance and other commercial insurance needs,  More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.

More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.  Whether you’re a subcontractor or a general contractor – whether you build small backyard sheds or giant commercial buildings – whether you’re a one-man remodeling business or a multi-million dollar construction company, there are three types of insurance you need to consider. In other words, the size of your business and the size of the project make little difference. If you want to protect your investment, your employees, and even your business, there are three types of

Whether you’re a subcontractor or a general contractor – whether you build small backyard sheds or giant commercial buildings – whether you’re a one-man remodeling business or a multi-million dollar construction company, there are three types of insurance you need to consider. In other words, the size of your business and the size of the project make little difference. If you want to protect your investment, your employees, and even your business, there are three types of  For more customized information about your construction insurance or

For more customized information about your construction insurance or  Every employer is responsible for insuring a safe working environment for his or her employees. If you’re in construction, workplace safety should move to the top of your priorities because more than 20% of the work-related fatalities in 2013 occurred in the construction industry.

Every employer is responsible for insuring a safe working environment for his or her employees. If you’re in construction, workplace safety should move to the top of your priorities because more than 20% of the work-related fatalities in 2013 occurred in the construction industry.

Let’s say you own a restaurant. One night, a group of friends enjoy dinner and a few drinks at your restaurant. They decide to go to a club where they dance and consume more alcohol. Then, they go to a corner pub to wind down with a few more drinks. On the way home, one of those friends causes an accident that injures or – God forbid – kills someone in the process.

Let’s say you own a restaurant. One night, a group of friends enjoy dinner and a few drinks at your restaurant. They decide to go to a club where they dance and consume more alcohol. Then, they go to a corner pub to wind down with a few more drinks. On the way home, one of those friends causes an accident that injures or – God forbid – kills someone in the process.