When people think of homeowner's insurance the first thing that often comes to mind is fire in the home. We can’t think of many scenarios that are scarier than a home fire. Fire can spread very quickly. In just two minutes, a fire can become life-threatening. In five minutes, a residence can be engulfed in flames.

When people think of homeowner's insurance the first thing that often comes to mind is fire in the home. We can’t think of many scenarios that are scarier than a home fire. Fire can spread very quickly. In just two minutes, a fire can become life-threatening. In five minutes, a residence can be engulfed in flames.

There’s an estimated $7.3 billion in property loss due to home fires each year. More importantly, more than 2,500 people die, and 12,600 people are injured in fires every year.

Most fires occur in the kitchen. Other common causes include carelessly discarded cigarettes, sparks from fireplaces, and heating appliances that are too close to furniture and other combustibles.

Heat and smoke are often more dangerous than flames. Breathing in super-hot air can sear your lungs, and poisonous gasses produced by a fire can make you disoriented and drowsy. More fire deaths are caused by asphyxiation than burns (a three-to-one ratio).

The good news is that home fires are preventable, but you need to be aware of potential hazards, and you need to be diligent about eliminating those risks. As a bonus, you'll reduce the likelihood of a homeowners insurance claim and potentially lower your long term house insurance costs.

Here are five tips to prevent fires and help keep your family, your home, and your possessions safe from fire

- Cooking

Stay in the kitchen when you are cooking. Create a 3-foot “kid-free zone” around your stove. Keep outside grills at least 10 feet from siding and deck railings and out from under eaves and overhanging branches. - Portable space heaters

Keep combustible objects at least three feet away from portable heaters and only use heaters that have been evaluated by a nationally recognized laboratory, such as Underwriters Laboratories (UL). Before purchasing a kerosene heater, check on the legality of a kerosene heater with your local fire department. - Fireplaces and woodstoves

Inspect and clean fireplaces and woodstoves annually. Use a fireplace screen and make sure the fire is completely out before leaving the house or going to bed. - Smoking

If you smoke, do it outside (especially if oxygen is used inside the house) and make sure your cigarettes are completely extinguished in an ashtray or can filled with sand. Soak butts and ashes in water before placing them in a trash can. - Electrical

Use products that have been evaluated by a nationally recognized laboratory, such as Underwriters Laboratories (UL). Check for and replace worn or damaged cords, and never try to force a three-prong plug into a two-slot outlet. Don’t overload extension cords or wall sockets.

A few more practical tips

Finally, check your smoke detectors and replace the batteries regularly. A simple way to remember to check them is to do it in the spring and fall when we change our clocks for Daylight Saving Time.

You should also have a professional inspect your home - electric wiring, plumbing (gas), heating, and air conditioning – regularly for potential hazards.

You may also want to consider installing a fire alarm system and a home sprinkler system that can help detect and extinguish fires even if you aren’t home.

“An ounce of prevention is worth a pound of cure” couldn’t be truer than when you’re protecting your home and family from fire. To learn more about fires and how to prevent them, go to https://www.ready.gov/home-fires.

For related information on protecting your home, see our blog post: How to Recover Quickly From Water Damage.

Avoid Regrets - Get a Free Homeowners Insurance Checkup

Your home is your castle and the source of many fond memories. Don't take a chance with your safety or your memories. Contact American Insuring Group online or give us a call at (800) 947-1270 or (610) 775-3848 to review your home owner’s policy.

We're experts at finding the right policy at the right price by searching for you among many competing insurance providers. Contact us today to start saving and for your peace of mind.

Our homes are becoming “smarter”! That's a good thing, right? Yes, you proably have

Our homes are becoming “smarter”! That's a good thing, right? Yes, you proably have  As you listen to the news about the devastating fires in Tennessee, tornado outbreaks in the Midwest, or destructive hurricanes pounding the coast of Florida, you may feel safe and sound here in Pennsylvania, especially if you have

As you listen to the news about the devastating fires in Tennessee, tornado outbreaks in the Midwest, or destructive hurricanes pounding the coast of Florida, you may feel safe and sound here in Pennsylvania, especially if you have

On the surface, home sharing looks like a simple idea. You, the homeowner, offer accommodations to a guest--a home sharer--in exchange for an agreed-upon fee and, in some cases, help with household tasks.

On the surface, home sharing looks like a simple idea. You, the homeowner, offer accommodations to a guest--a home sharer--in exchange for an agreed-upon fee and, in some cases, help with household tasks. Before you commit to becoming a host, check with American Insuring Group to understand what your existing homeowner’s policy covers and what exclusions might apply. Then you can purchase a policy that closes all of the gaps.

Before you commit to becoming a host, check with American Insuring Group to understand what your existing homeowner’s policy covers and what exclusions might apply. Then you can purchase a policy that closes all of the gaps. Look! Up at the sky! It’s a bird! It’s a plane! No, it’s a drone! And it’s coming to a neighborhood near you. The Consumer Electronics Association estimates that consumer drone purchases this year will put 300,000 more recreational drones in the skies. And while many consumers are now eyeing these unmanned, remote-controlled aerial toys as one of their next purchases, they don’t necessarily want their neighbors to buy one. Furthermore, few consider whether their homeowners insurance will cover them for drone-related accidents.

Look! Up at the sky! It’s a bird! It’s a plane! No, it’s a drone! And it’s coming to a neighborhood near you. The Consumer Electronics Association estimates that consumer drone purchases this year will put 300,000 more recreational drones in the skies. And while many consumers are now eyeing these unmanned, remote-controlled aerial toys as one of their next purchases, they don’t necessarily want their neighbors to buy one. Furthermore, few consider whether their homeowners insurance will cover them for drone-related accidents. It's every homeowner's worst fear. Imagine… You pull into your driveway after a lovely evening with your spouse and as you approach your front door – key in hand - you see broken glass and notice that the door isn’t shut completely. For a few seconds, you’re confused. Then, you realize that someone has obviously forced their way into your house. Your heart starts pounding and your mind begins racing. Your home has been burglarized. What do you do now?

It's every homeowner's worst fear. Imagine… You pull into your driveway after a lovely evening with your spouse and as you approach your front door – key in hand - you see broken glass and notice that the door isn’t shut completely. For a few seconds, you’re confused. Then, you realize that someone has obviously forced their way into your house. Your heart starts pounding and your mind begins racing. Your home has been burglarized. What do you do now? To ensure that your valuables are properly protected in the event of a home burglary,

To ensure that your valuables are properly protected in the event of a home burglary,  Why Home Security Should be a Priority

Why Home Security Should be a Priority Get a Homeowners Insurance Checkup for Your Peace of Mind

Get a Homeowners Insurance Checkup for Your Peace of Mind 2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

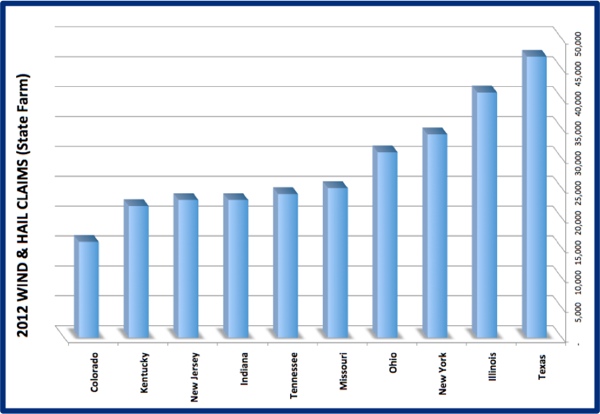

It's Not Just About the Midwest

It's Not Just About the Midwest

Why the Big Homeowner’s Insurance Cost Increases?

Why the Big Homeowner’s Insurance Cost Increases? Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.