INSURING YOUR CASTLE

The biggest and most important investment the average american family will make in a lifetime is his or her home. The all-American dream is owning a home. Of course, choosing the right house insurance to protect that cherished home is an extemely important decision.

Most homeowners insurance policies are similar in the types of perils that are insured. The typical homeowners insurance policy is written under a form HO-3 "Special Form Perils" policy. This policy typicallly insures your home against all direct perils with "named exclusions". This which means that if the cause of loss is not excluded, then the peril is covered. Standard exclusions are:

FLOOD, EARTHQUAKE, SINKHOLE, NUCLEAR, WAR, WEAR & TEAR

GUARD AGAINST THE PITFALLS OF CHEAP HOME INSURANCE

Even if most insurance companies cover the same perils, (things that can happen to your home), it doesn't mean all policies are equal. The problem with cheap home insurance is that you often do not have a comprehensive policy, and, tragically, often this goes undiscovered until you have a claim.

WHAT IS THE RIGHT AMOUNT OF HOMEOWNERS INSURANCE?

Often we see new home buyers getting house insurance quotes from companies insuring the dwelling for the purchase price. Although your lender will be fine with insurance covering the dwelling amount provided it is at least equal to your loan amount, dwelling amount coverage will not be adequate in the event of a loss.

An Example of the Pitfalls of Underinsuring Your Home:

Mr. & Mrs Smith just purchased their first home, an underpriced beauty in an older neighborhood. Their real estate agent congratulates them for having achieved the American dream. They sign an agreement of sale and call the 1-800-cheap-home-insurance number they hear every night on TV. Since they are purchasing their home for $100,000, the agent on the other end has no idea of the neighborhood or specific features of Mr. & Mrs. Smith's dream home.

The agent quotes the Smith's a standard house insurance policy, and suggests insuring the dwelling for the amount they paid for the home ($100,000). The bank is fine with the quote and accepts the policy because the dwelling is being insured for what the Smith's are paying for the home, which more than covers the bank loan. Settlement goes through and the Smith's feel safe and secure.

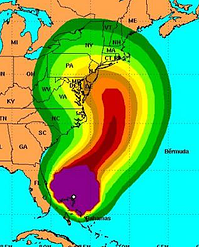

Six months later, a northeaster slams the area and knocks out power to the Smith's home. Candles are lit to shed some light in the home and boy, what a mistake. Next thing you know, a call to 911 and the Smith's evacuate their dream home with just the clothes on their backs.

The house is a total loss! Everything is gone. The Smith's call up 1-800-cheap-insurance to file their claim as they sit in their hotel room worrying if they made a good decision with their homeowners insurance policy.

A few days later, the Smith's find out that the home they purchased for $100,000 will actually cost $225,000 to rebuild at today's costs for materials and labor. They start to get a sick feeling when they realize their cheap home insurance is not going to even remotely cover their loss.

WHY YOU SHOULD BUY FROM A LOCAL "INDEPENDENT" INSURANCE BROKER

What could the Smith's have done differently to get the proper homeowners insurance coverage? First, they should have contacted a local, independent insurance broker who could have gotten homeowners insurance quotes from a number of house insurance companies, resuting in the best price available. Secondly, an experienced local agent would have encouraged the Smith's to consider the age, area and square footage of the home in calculating a proper rebuilding cost for the home.

What could the Smith's have done differently to get the proper homeowners insurance coverage? First, they should have contacted a local, independent insurance broker who could have gotten homeowners insurance quotes from a number of house insurance companies, resuting in the best price available. Secondly, an experienced local agent would have encouraged the Smith's to consider the age, area and square footage of the home in calculating a proper rebuilding cost for the home.

Thirdly, an experienced independent agent would know the "out of the ordinary" local perils that could damage the home such as a sinkhole, earthquake, or surface water runoff. For example, homes in a low lying areas should homeowners insurance policies with an extention of coverage for sewer back-up & sump pump overflow.

THE AMERICAN INSURING GROUP DIFFERENCE

At The American Insuring Group LTD, our licensed professional agents will take the time to properly advise you on the house insurance you need and the optional coverage available. We strive to give our clients exceptional advice and professional customer service so they know they will be covered in the event of a claim. We review your home insurance quotes in detail and explain each item of coverage and how it applies in real life. All homeowners insurance policies have limitations and conditions, so our agents will take the time to explain them and discuss whether your needs justify a modification of the house insurance policy.

It's always a good idea to get a second opinion on your home insurance policy. Call American Insuring Group, LTD today at 1-800-947-1270.

Are You at Risk?

Are You at Risk?

According to WFMZ-TV: "

According to WFMZ-TV: " October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.

October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.  To receive your free report, courtesy of PuroClean,

To receive your free report, courtesy of PuroClean,  The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie!

The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie! Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report.

Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report. Homeowners in Pennsylvania, and in eastern and southeastern states in general, tend to live in humid climates with plentiful rainfall. This combination makes these homes more susceptible to moisture and mold buildup, especially in older homes with porous foundations. Therefore, homeowners must take extra care to watch for signs of moisture and mold, and to act quickly to resolve such problems before they become a serious health threat.

Homeowners in Pennsylvania, and in eastern and southeastern states in general, tend to live in humid climates with plentiful rainfall. This combination makes these homes more susceptible to moisture and mold buildup, especially in older homes with porous foundations. Therefore, homeowners must take extra care to watch for signs of moisture and mold, and to act quickly to resolve such problems before they become a serious health threat. Many homeowners throughout Berks County, Lancaster County, and elsewhere in Pennsylvania experienced surprising homeowners insurance claims in 2011 due to flooding. Sadly, many lacked proper flood insurance resulting in denied claims and financial hardships that could have easily been avoided. From Reading PA to Allentown, from Lancaster to Erie, and Philadelphia to Pittsburgh, homeowners were caught uninsured, underinsured, and unprotected against flooding.

Many homeowners throughout Berks County, Lancaster County, and elsewhere in Pennsylvania experienced surprising homeowners insurance claims in 2011 due to flooding. Sadly, many lacked proper flood insurance resulting in denied claims and financial hardships that could have easily been avoided. From Reading PA to Allentown, from Lancaster to Erie, and Philadelphia to Pittsburgh, homeowners were caught uninsured, underinsured, and unprotected against flooding. With the average homeowners insurance policy renewal premium rising by as much as 25% or more, most home insurance buyers are asking themselves how to pay less for a house insurance policy.

With the average homeowners insurance policy renewal premium rising by as much as 25% or more, most home insurance buyers are asking themselves how to pay less for a house insurance policy.

What could the Smith's have done differently to get the proper homeowners insurance coverage? First, they should have contacted a local, independent insurance broker who could have gotten homeowners insurance quotes from a number of house insurance companies, resuting in the best price available. Secondly, an experienced local agent would have encouraged the Smith's to consider the age, area and square footage of the home in calculating a proper rebuilding cost for the home.

What could the Smith's have done differently to get the proper homeowners insurance coverage? First, they should have contacted a local, independent insurance broker who could have gotten homeowners insurance quotes from a number of house insurance companies, resuting in the best price available. Secondly, an experienced local agent would have encouraged the Smith's to consider the age, area and square footage of the home in calculating a proper rebuilding cost for the home.