Our homes are becoming “smarter”! That's a good thing, right? Yes, you proably have homeowner's insurance but have you considered non-traditional threats to your privacy and data in the home?

Our homes are becoming “smarter”! That's a good thing, right? Yes, you proably have homeowner's insurance but have you considered non-traditional threats to your privacy and data in the home?

PCMagazine poses the intriguing question, “What if all the devices in your life could connect to the Internet? Not just computers and smartphones, but everything: clocks, speakers, lights, doors, cameras, windows, window blinds, hot water heaters, appliances, cooking utensils, you name it.

And what if those devices could all communicate, send you information, and take your commands? It's not science fiction; it's the Internet of Things (IoT), and it's a key component of home automation and smart homes.”

This is awesome, right? Well… yes and no. Consider the following:

New Risks: Your Smart Home and the Internet of Things

As consumers add more and more IoT devices to their homes (a 2015 Gartner study estimates that approximately 5.5 million IoT devices are added to homes around the world every day), experts anticipate the number of attacks also to increase. In fact, in October 2016, hackers took over 100,000 IoT devices and used them to block traffic to well-known websites, including Twitter and Netflix.

This doesn’t mean that you need to forego the latest IoT device that becomes available; it means that you need to be smarter than ever about protecting yourself from Cyber Risk in the home.

To be precise, the actual IoT devices themselves do not contain your personal identity information - so they are not the security risk directly. The risk is that once they are working, they are often “forgotten” and rarely updated or monitored, if at all. If a hacker should find a way to compromise them, they could be used as a pathway to infiltrate your home. Once inside, a hacker could eavesdrop on your network for any unprotected information passing within it or possibly gain access to other devices that do contain your personal information such as computers, smart phones, and tablet devices.

Here are 5 steps to help you protect your home from a cyber attack

- Use proper software

At the very least, you should have antivirus and malware software on your computers, smartphones, and tablets. You should also turn off unwanted or unused features and stay on top of firmware. And finally, when using a public Wi-Fi (like in an airport or coffee shop), use a virtual private network (VPN). - Protect your privacy with a good password

Regularly changing your password and using different sophisticated passwords is one of the quickest and easiest ways to protect yourself from cyber-attacks. If your device has a two-factor authentication - such as a fingerprint and a password - turn it on. - Consider privacy concerns vs. benefits before purchasing a smart device

Before purchasing a smart device, ask yourself if it will really enhance or simplify your life or if you just want it because it’s a snazzy new device that no one else has yet. Then, decide if it’s worth potentially giving up some of your privacy. - Be selective when purchasing smart home devices

When deciding which smart home devices to purchase, chose from well-known brands whenever possible and find out what security measures they are taking to protect your data. This is still a relatively new issue, so do some research. Find out which manufacturers are talking about security and being proactive in communicating how they’re delivering that security to you. - Install a firewall

This may seem obvious, but do you have a quality, up-to-date firewall in your home? If you are not sure then consult a local provider and installer of routers and request an in-home review.

2 steps to blunt the impact of a cyber attack

Even if you take all the responsible preventative meaures, cyber attacks can sometimes occur. Here are two things you can do to lessen the impact:

- Sign Up for Identity Protection

Do you have an identify protection policy? There are various plans available with varying levels of monitoring and assistance should your identity be stolen.

- Freeze your credit

If you won’t be using your credit anytime soon, contact each of the credit bureaus individually, and ask them to temporarily freeze your credit. There is a form on each credit bureau’s site to do that. If you find you need to procure a loan, it takes about ten days to unfreeze your credit, and it’s a fairly easy process.

Home cyber threats are real

The fact is that there are cyber criminals out there ready to steal your information and wreak havoc. Although nothing is guaranteed to protect you from these criminals, following these measures will make it harder for those criminals to hack into your IoT devices.

For related information on cyber insurance for your business read our blog post: Combat Data Breaches with Cyber Liability Insurance.

Contact Us for All Your Insurance Needs

Are you sure your homeowner's policy offers the right amount of protection at a good price? Do you need cyber insurance for your business?

Contact American Insuring Group online or give us a call at (800) 947-1270 or (610) 775-3848 for a free and thorough homeowner's insurance review. You'll be glad you did!

As you listen to the news about the devastating fires in Tennessee, tornado outbreaks in the Midwest, or destructive hurricanes pounding the coast of Florida, you may feel safe and sound here in Pennsylvania, especially if you have

As you listen to the news about the devastating fires in Tennessee, tornado outbreaks in the Midwest, or destructive hurricanes pounding the coast of Florida, you may feel safe and sound here in Pennsylvania, especially if you have

On the surface, home sharing looks like a simple idea. You, the homeowner, offer accommodations to a guest--a home sharer--in exchange for an agreed-upon fee and, in some cases, help with household tasks.

On the surface, home sharing looks like a simple idea. You, the homeowner, offer accommodations to a guest--a home sharer--in exchange for an agreed-upon fee and, in some cases, help with household tasks. Before you commit to becoming a host, check with American Insuring Group to understand what your existing homeowner’s policy covers and what exclusions might apply. Then you can purchase a policy that closes all of the gaps.

Before you commit to becoming a host, check with American Insuring Group to understand what your existing homeowner’s policy covers and what exclusions might apply. Then you can purchase a policy that closes all of the gaps. Like most homeowners, you’ve spent thousands (possibly hundreds of thousands) of dollars to purchase your home, most likely making it the largest purchase you will ever make. In order to protect your investment, you (hopefully) bought a homeowner’s insurance policy that will provide funds to replace your house if it is destroyed or to repair it if it is damaged.

Like most homeowners, you’ve spent thousands (possibly hundreds of thousands) of dollars to purchase your home, most likely making it the largest purchase you will ever make. In order to protect your investment, you (hopefully) bought a homeowner’s insurance policy that will provide funds to replace your house if it is destroyed or to repair it if it is damaged. Want to save on homeowners insurance? As independent agents, we're well qualified to find you the best homeowners insurance at the right price because we represent MANY competing insurance carriers.

Want to save on homeowners insurance? As independent agents, we're well qualified to find you the best homeowners insurance at the right price because we represent MANY competing insurance carriers. Look! Up at the sky! It’s a bird! It’s a plane! No, it’s a drone! And it’s coming to a neighborhood near you. The Consumer Electronics Association estimates that consumer drone purchases this year will put 300,000 more recreational drones in the skies. And while many consumers are now eyeing these unmanned, remote-controlled aerial toys as one of their next purchases, they don’t necessarily want their neighbors to buy one. Furthermore, few consider whether their homeowners insurance will cover them for drone-related accidents.

Look! Up at the sky! It’s a bird! It’s a plane! No, it’s a drone! And it’s coming to a neighborhood near you. The Consumer Electronics Association estimates that consumer drone purchases this year will put 300,000 more recreational drones in the skies. And while many consumers are now eyeing these unmanned, remote-controlled aerial toys as one of their next purchases, they don’t necessarily want their neighbors to buy one. Furthermore, few consider whether their homeowners insurance will cover them for drone-related accidents. It's every homeowner's worst fear. Imagine… You pull into your driveway after a lovely evening with your spouse and as you approach your front door – key in hand - you see broken glass and notice that the door isn’t shut completely. For a few seconds, you’re confused. Then, you realize that someone has obviously forced their way into your house. Your heart starts pounding and your mind begins racing. Your home has been burglarized. What do you do now?

It's every homeowner's worst fear. Imagine… You pull into your driveway after a lovely evening with your spouse and as you approach your front door – key in hand - you see broken glass and notice that the door isn’t shut completely. For a few seconds, you’re confused. Then, you realize that someone has obviously forced their way into your house. Your heart starts pounding and your mind begins racing. Your home has been burglarized. What do you do now? To ensure that your valuables are properly protected in the event of a home burglary,

To ensure that your valuables are properly protected in the event of a home burglary,  Why Home Security Should be a Priority

Why Home Security Should be a Priority Get a Homeowners Insurance Checkup for Your Peace of Mind

Get a Homeowners Insurance Checkup for Your Peace of Mind 2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

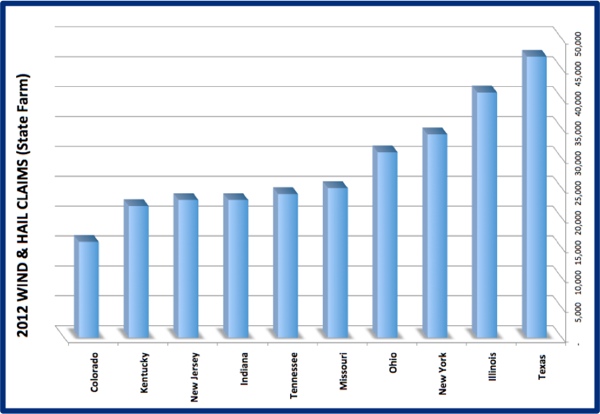

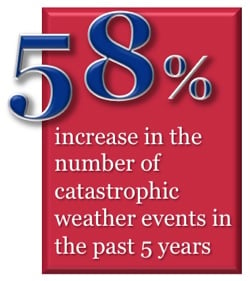

It's Not Just About the Midwest

It's Not Just About the Midwest

Why the Big Homeowner’s Insurance Cost Increases?

Why the Big Homeowner’s Insurance Cost Increases? Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.