Business Insurance that Attracts & Retains Employees

Great employees can be the fuel to move your business ahead of the competition. Dedicated employees add more and more value over time as they gain increased knowledge and experience. While everyone likes a company that offers great benefits, the best employees and job candidates are likely to view the quality of the benefits you offer as a compelling reason to join, remain at, or leave your firm.

Great employees can be the fuel to move your business ahead of the competition. Dedicated employees add more and more value over time as they gain increased knowledge and experience. While everyone likes a company that offers great benefits, the best employees and job candidates are likely to view the quality of the benefits you offer as a compelling reason to join, remain at, or leave your firm.

With today's cost of purchasing individual insurance, employees are likely to view well-designed employer insurance packages as a deciding factor in selecting one company over another. Furthermore, strong benefits packages help retain your best employees, reducing the high cost of employee turnover.

Designing an Attractive Employee Benefits Package

That's why smart business owners create attractive employee benefits packages that not only include health insurance, but often life insurance, extended disability insurance, dental insurance, and generous retirement plans, among other options. Executive compensation packages may also include deferred compensation plans and higher levels of insurance coverage to retain your best talent. It pays to be well informed on the range of insurance options available to your business. Your independent insurance agent can be a key resource to help you craft an employee benefits package that attracts better employees at a price you can afford.

Commercial Insurance to Protect Your Business in Ways You May Not Have Considered

General liability insurance, property insurance, vehicle insurance, and workers' compensation insurance form the foundation of your business insurance protection. However, there are other types or subcategories of commercial insurance to consider. Among these are key person insurance, individual insurance, and insurance-backed buy-sell agreements.

Key Person Insurance: Thinking Beyond Job Titles Alone

Key person insurance, also known as key man insurance, is designed to reimburse you for the loss of sales or earnings due to losing an executive, business partner, or other key employee due to disability or death. When considering key person insurance, think beyond titles and identify those employees in your organization who, if unavailable, would dramatically impact your sales or the continuity of your business operations.

These may include high-performing sales reps and customer service personnel, as well as employees with deep technical knowledge of your industry or complex internal processes. Such people may be very difficult to replace with someone of similar knowledge or talent, resulting in reduced productivity or lost sales revenues for your firm for years to come. Your independent insurance agent can help you put together a smart key person insurance package to protect your business financially from the impact of losing a key employee.

Backing Buy-Sell Agreements with Business Insurance Protection

In the excitement of starting a new business with your business partner, business owners often overlook the need to work out all the details of a buy-sell agreement that comes into effect as a result of the loss of the other business partner due to retirement, death, or disability. While an attorney may be invaluable in putting together such agreements, don't neglect the need to obtain the proper life insurance on each partner to carry the remaining partner through the transition period and to keep the business financially healthy. The insurance coverage should be sufficient to buy out the departing partner's share of the business due to any of the circumstances mentioned above.

Life Insurance for Business Owners: Obtaining the Right Amount of Coverage

Business owners should carefully determine the amount of personal life insurance protection needed. Unlike employees, owners often have significant personal assets tied up in the business, such as a second mortgage that may have been used to finance the business. If the surviving family members' income drops significantly due to the death of the business owner, the results can be disastrous not only for the family, but for employees as well, even if significant personal loans and assets have not been invested in the business.

Low levels of life insurance may threaten not only the entire business, but also the careers of all employees by potentially forcing the surviving family members to liquidate or sell the business to pay the personal debts of the deceased business owner, or simply to provide the income needed to keep up with day-to-day financial obligations.

We Can Help with All Your Business Insurance Needs

We can help you make sense of your many business insurance options, from key person insurance, to life insurance, health insurance, disability insurance, dental insurance, and other forms of personal and commercial insurance to protect your business, and to attract and retain employees. We serve businesses in Reading, PA, Philadelphia, Allentown, Harrisburg, Lancaster, Lebanon, State College, Pittsburgh, Erie and points in between and beyond.

(800) 947-1270 or (610) 775-3848

Take the challenge - get a quote. We offer the best insurance protection at the best price.

An affordable policy can help you save money without straining your budget. Here are seven tips to help you pay less for insurance:

An affordable policy can help you save money without straining your budget. Here are seven tips to help you pay less for insurance:

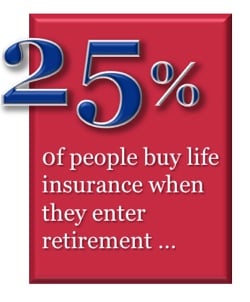

With the large baby boom generation entering retirement age, retirement planning is getting more and more attention. Interestingly, while marriage is still the leading cause for people to buy life insurance, retirement is also a major motivation. In fact, research from Northwestern Mutual Life, as conducted by Harris Interactive, shows that 25 percent of people buy life insurance products when they enter retirement -- almost as much as the 32 percent of people that buy it after getting married.

With the large baby boom generation entering retirement age, retirement planning is getting more and more attention. Interestingly, while marriage is still the leading cause for people to buy life insurance, retirement is also a major motivation. In fact, research from Northwestern Mutual Life, as conducted by Harris Interactive, shows that 25 percent of people buy life insurance products when they enter retirement -- almost as much as the 32 percent of people that buy it after getting married.

According to WFMZ-TV: "

According to WFMZ-TV: "

For example, many people earn $100,000 or more annually, and if you are responsible for another's inability to work for the next 10 years, they may receive a $1,000,000 award for which you would be responsible. With only $100,000 of auto liability insurance coverage, the injured party’s attorney will be going after your personal assets to cover the $900,000 balance. One accident could permanently change your financial future.

For example, many people earn $100,000 or more annually, and if you are responsible for another's inability to work for the next 10 years, they may receive a $1,000,000 award for which you would be responsible. With only $100,000 of auto liability insurance coverage, the injured party’s attorney will be going after your personal assets to cover the $900,000 balance. One accident could permanently change your financial future.

Back in the good old days, getting

Back in the good old days, getting  So why not just buy "Cheap Life Insurance" from those companies that constantly bombard you with ads for low cost life insurance? Why not call 1-800-Low-Cost-Life-Insurance and have them write the coverage you think you need? The reason is your family is too important for that! You need an Independent broker who represents many competing life insurance companies who offer many different types of life insurance policies for many different situations. More choices help ensure you get the best deal, and one that best meets your unique needs.

So why not just buy "Cheap Life Insurance" from those companies that constantly bombard you with ads for low cost life insurance? Why not call 1-800-Low-Cost-Life-Insurance and have them write the coverage you think you need? The reason is your family is too important for that! You need an Independent broker who represents many competing life insurance companies who offer many different types of life insurance policies for many different situations. More choices help ensure you get the best deal, and one that best meets your unique needs. Too many consumers buy a life insurance policy that they "think is right for them" but is often not thought through. One big question your agent should ask you when getting life insurance quotes is "what needs will you have after the Term Life Insurance expires"? The last place you want to be is facing a mortgage or need for an income to a spouse and finding your term life insurance is going to be canceling the policy due to the term expiring or finding out that the price for a new term policy will be skyrocketing at the end of the term. I cannot stress enough the importance of having an experienced agent review your individual needs and help you develop the best life insurance plan for you and your family.

Too many consumers buy a life insurance policy that they "think is right for them" but is often not thought through. One big question your agent should ask you when getting life insurance quotes is "what needs will you have after the Term Life Insurance expires"? The last place you want to be is facing a mortgage or need for an income to a spouse and finding your term life insurance is going to be canceling the policy due to the term expiring or finding out that the price for a new term policy will be skyrocketing at the end of the term. I cannot stress enough the importance of having an experienced agent review your individual needs and help you develop the best life insurance plan for you and your family.

a corporation to be its own entity, and even you, the owner (officer), are considered an employee. Therefore you must either have Workers Compensation Insurance coverage or have the proper exclusion paperwork filed with the Department of Labor and Industry. At American Insuring Group, our licensed staff can help you with all the forms necesasary to be legal.

a corporation to be its own entity, and even you, the owner (officer), are considered an employee. Therefore you must either have Workers Compensation Insurance coverage or have the proper exclusion paperwork filed with the Department of Labor and Industry. At American Insuring Group, our licensed staff can help you with all the forms necesasary to be legal.