Safer drivers mean fewer accidents, and fewer accidents mean lower Truck Insurance premiums. While the months of snow, ice, and freezing rain may be behind us, now is not the time for drivers to let down their guard.

Safer drivers mean fewer accidents, and fewer accidents mean lower Truck Insurance premiums. While the months of snow, ice, and freezing rain may be behind us, now is not the time for drivers to let down their guard.

According to the National Safety Council, in 2019, the highest number of motor-vehicle deaths – 3,351 – occurred in August. The number of deaths was also high in June (3,189) and July (3,294). Meanwhile, February – one of the snowiest months in the U.S. - had the lowest motor-vehicle deaths at 2,388.

Why are Roads More Deadly in the Summer?

Drivers should understand why roads tend to be more dangerous in the summer, so they can address the very issues that cause it.

- More Drivers – There are more drivers on the road during the summer months. Many teens are enjoying their summer breaks going places – visiting friends, summer jobs, going to the beach. Also, according to Gallup, July is the most popular month for summer vacations, followed by August, June, and September. And, finally, there are more motorcycles on the road during the summer months.

- Less Experienced Drivers – And many of these additional drivers have less experience. Teens have fewer hours on the road, and adults may be driving in unfamiliar areas or driving an unfamiliar vehicle such as an RV or motorcycle or towing a trailer.

- More Congestion – Certain locations – such as beach areas or amusement parks – attract more people during the summer months. More vehicles in one area can cause more traffic and heavier congestion. There are also more walkers, runners, and bicyclists out on the roads during the warmer months.

Truck Driver Safety Tips

Watch for Construction Zones

Check the Department of Transportation’s website for each state you’ll be traveling through to find areas that may be under construction. If you can’t avoid roads with construction, at least try to avoid them during rush hour.

Watch the Weather

The heat and storms of summer can bring unique challenges to truck drivers. Check the weather when you plan a trip and have a contingency plan if it looks like you’re heading a bad storm. Drivers can Dial 511 - a transportation and traffic information hotline - or go on the state’s Department of Transportation’s website to see if the weather is affecting road conditions.

Also, ensure your truck is prepared for the heat. As temperatures rise, the chance of mechanical failure also rises. During your pre-trip inspection, make sure the air conditioner in your cab is working, and check the engine’s coolant level and tire pressure, as the heat of summer can cause more blowouts.

And, finally, take care of yourself. Excessive heat can cause dehydration and fatigue. Prevent dehydration by drinking plenty of water, wear sunglasses to protect your eyes from UV rays, wear sunscreen, and take breaks as needed.

Watch Yourself

Truck drivers should always exercise extra caution because large trucks can cause more damage and more severe injuries than smaller vehicles. Safety becomes even more important as you face more traffic and more inexperienced drivers during the summer months.

When there’s a lot of traffic, drivers can become more impatient, follow you too closely, or cut you off. Drivers on unfamiliar roads may slow down to read signs or suddenly take a turn or an exit. Be particularly vigilant if you see an out-of-state license plate, which could mean the driver is unfamiliar with the roads, and use extra caution when passing a vehicle towing a trailer to avoid causing a sway in your wake.

Also, avoid distractions, such as talking or texting on your phone. Look for other drivers who may be distracted and be extra careful and extra vigilant around them.

And finally, wear your seatbelt. According to the Centers for Disease Control and Prevention (CDC), 22,697 drivers and passengers died in motor vehicle crashes in 2018. More than half (between the ages of 13 and 44) were not wearing their seatbelt at the time of the crash.

Save Now on Truck Insurance

When an accident does occur, the right insurance can help protect your business and get your truck back on the road. We help you save by quoting a variety of quality trucking insurance providers.

Give the Truck Insurance experts at American Insuring Group a call today at (800) 947-1270 or (610) 775-3848, or connect with us online.

Every small business should conduct a risk management assessment prior to reassessing their

Every small business should conduct a risk management assessment prior to reassessing their

You’re about to become an employer. Maybe you’ve been in business for a while, but now you’re ready to hire your first employee. You’re excited; this means your business is growing. Or, maybe you’re just starting a business and you need employees to help run that business.

You’re about to become an employer. Maybe you’ve been in business for a while, but now you’re ready to hire your first employee. You’re excited; this means your business is growing. Or, maybe you’re just starting a business and you need employees to help run that business.

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA).

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA). In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an

In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an  For more information about drone insurance and other commercial insurance needs,

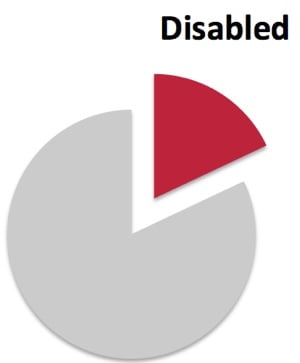

For more information about drone insurance and other commercial insurance needs,  More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.

More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.  Every employer is responsible for insuring a safe working environment for his or her employees. If you’re in construction, workplace safety should move to the top of your priorities because more than 20% of the work-related fatalities in 2013 occurred in the construction industry.

Every employer is responsible for insuring a safe working environment for his or her employees. If you’re in construction, workplace safety should move to the top of your priorities because more than 20% of the work-related fatalities in 2013 occurred in the construction industry.

Let’s say you own a restaurant. One night, a group of friends enjoy dinner and a few drinks at your restaurant. They decide to go to a club where they dance and consume more alcohol. Then, they go to a corner pub to wind down with a few more drinks. On the way home, one of those friends causes an accident that injures or – God forbid – kills someone in the process.

Let’s say you own a restaurant. One night, a group of friends enjoy dinner and a few drinks at your restaurant. They decide to go to a club where they dance and consume more alcohol. Then, they go to a corner pub to wind down with a few more drinks. On the way home, one of those friends causes an accident that injures or – God forbid – kills someone in the process. Business insurance is important because if you’re a small business owner, chances are good that you have a lot of heart, sweat, and maybe even a few tears invested in your business. Sometimes, your business becomes your “baby” – something that you want to protect from danger, just like you protect your family. Aside from getting good commercial insurance coverage, how do you go about protecting “your baby” from outside threats, such as fire, flood, or theft?

Business insurance is important because if you’re a small business owner, chances are good that you have a lot of heart, sweat, and maybe even a few tears invested in your business. Sometimes, your business becomes your “baby” – something that you want to protect from danger, just like you protect your family. Aside from getting good commercial insurance coverage, how do you go about protecting “your baby” from outside threats, such as fire, flood, or theft?

Contact us

Contact us