Every small business should conduct a risk management assessment prior to reassessing their business insurance needs – preferably before they even open their doors. Basically, this means imagining the “What ifs” and thinking about worst-case scenarios. Think about any event that could lead to a loss for your business, estimate the cost of that loss, and determine how to best address each risk. These losses may include material losses, liability, business interruption, or injury to employees.

Every small business should conduct a risk management assessment prior to reassessing their business insurance needs – preferably before they even open their doors. Basically, this means imagining the “What ifs” and thinking about worst-case scenarios. Think about any event that could lead to a loss for your business, estimate the cost of that loss, and determine how to best address each risk. These losses may include material losses, liability, business interruption, or injury to employees.

There are several factors that will determine the list of risks to your business. The risks to a company that produces large machinery will be very different from a service business. A caterer who rarely if ever has customers coming to their location will have very similar and – at the same time - very different risks and insurance needs than a restaurant that has customers coming and going all the time. Each business is unique.

Here are 7 types of risk/loss to consider before purchasing or changing your commercial insurance coverage:

- Loss of physical assets due to accidents (fires) and nature (floods)

- Loss of Intellectual Data

- Theft of physical assets

- Business liability – customers or employees getting injured on your premises

- Business product liability – A product that you manufacture/sell causes injury

- Advertising slander or personal injury

- Loss of income

How to Deal with business risks and help lower your commercial insurance costs:

Some business risks can be minimized or eliminated with specific actions; many risks are best managed by purchasing commercial insurance. For example, if you’re concerned about damage to your property, you could lease the property instead of purchasing it - or you could purchase insurance. If you’re concerned about theft, you could install an alarm system to minimize loss, but you would probably want to purchase insurance as well (the alarm system may afford you a discount).

Business insurance can reduce, mitigate or compensate for exposure to business risks. An insurance agency will do a risk assessment to determine how much insurance you need and what you need to cover, and they’ll do it at no cost. This assessment might include visiting your business, talking to you about the business or service you provide, reviewing your inventory, and reviewing any procedures to determine all the risks your business could be exposed to. By conducting your own assessment, you can combine your knowledge of your business with your insurance agent’s knowledge of insurance to create the best insurance policy to protect your business.

Growth is Good, But ..

As your business grows, so do your liabilities! If you purchase or replace equipment or expanded operations, you should contact your insurance broker to discuss changes in your business and how they can affect your need for expanded insurance coverage. Should disaster strike, you don't want to be caught underinsured.

Getting the Right Business Insurance is Key

For more help creating a risk management assessment and aligning your business insurance needs with your risk, contact American Insuring Group at (800) 947-1270 or (610) 775-3848.

For more help creating a risk management assessment and aligning your business insurance needs with your risk, contact American Insuring Group at (800) 947-1270 or (610) 775-3848.

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA).

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA). In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an

In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an  For more information about drone insurance and other commercial insurance needs,

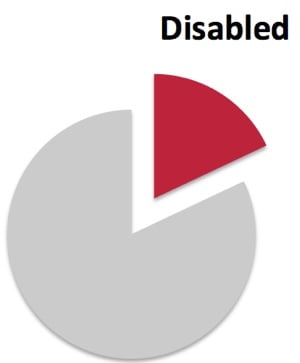

For more information about drone insurance and other commercial insurance needs,  More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.

More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.  Every employer is responsible for insuring a safe working environment for his or her employees. If you’re in construction, workplace safety should move to the top of your priorities because more than 20% of the work-related fatalities in 2013 occurred in the construction industry.

Every employer is responsible for insuring a safe working environment for his or her employees. If you’re in construction, workplace safety should move to the top of your priorities because more than 20% of the work-related fatalities in 2013 occurred in the construction industry.

Let’s say you own a restaurant. One night, a group of friends enjoy dinner and a few drinks at your restaurant. They decide to go to a club where they dance and consume more alcohol. Then, they go to a corner pub to wind down with a few more drinks. On the way home, one of those friends causes an accident that injures or – God forbid – kills someone in the process.

Let’s say you own a restaurant. One night, a group of friends enjoy dinner and a few drinks at your restaurant. They decide to go to a club where they dance and consume more alcohol. Then, they go to a corner pub to wind down with a few more drinks. On the way home, one of those friends causes an accident that injures or – God forbid – kills someone in the process.

Contact us

Contact us What About Dishonest Worker's Comp Claims?

What About Dishonest Worker's Comp Claims? On March 25, 1911, the US witnessed one of the deadliest industrial disasters in American history – the Triangle Shirtwaist Factory Fire in New York City. The fire resulted in the deaths of 146 garment workers – 123 women and 23 men – who were working on the eighth, ninth, and tenth floors. Some died from the fire, but many were killed by smoke inhalation or falling or jumping to their deaths.

On March 25, 1911, the US witnessed one of the deadliest industrial disasters in American history – the Triangle Shirtwaist Factory Fire in New York City. The fire resulted in the deaths of 146 garment workers – 123 women and 23 men – who were working on the eighth, ninth, and tenth floors. Some died from the fire, but many were killed by smoke inhalation or falling or jumping to their deaths.  Electrically-Related Worker's Comp Injuries

Electrically-Related Worker's Comp Injuries Following these suggestions will help ensure the safety of your employees, reduce workers comp claims, and avoid fire-related business costs.

Following these suggestions will help ensure the safety of your employees, reduce workers comp claims, and avoid fire-related business costs.  Working in the food service industry often means hard work and long hours. You also face many unique challenges, including the responsibility of ensuring that the food you serve to your customers is safe. As any restaurant owner knows, a foodborne-illness can cause the loss of thousands of dollars and, in some cases, your entire business.

Working in the food service industry often means hard work and long hours. You also face many unique challenges, including the responsibility of ensuring that the food you serve to your customers is safe. As any restaurant owner knows, a foodborne-illness can cause the loss of thousands of dollars and, in some cases, your entire business.  You’ve worked hard to establish your restaurant business. Don't leave things to chance. Be sure you can survive any potential issues with a comprehensive

You’ve worked hard to establish your restaurant business. Don't leave things to chance. Be sure you can survive any potential issues with a comprehensive