Bill is 50-year-old department manager for a mid-sized manufacturer. Even though he has never been seriously ill and has a clean family health history, he was recently told that he has cancer.

Bill is 50-year-old department manager for a mid-sized manufacturer. Even though he has never been seriously ill and has a clean family health history, he was recently told that he has cancer.

While the treatment will be long and difficult, Bill can take comfort in knowing that his employer-sponsored health insurance will pay most of his hospital and physician costs.

But Bill is about to be blindsided for a second time when he realizes that he will have no income to help support his family as he recovers from the difficult medical treatments.

Disability Insurance Myths - An Employee’s Perspective

During the working years, an employee is over three times more likely to be disabled than to die. At Bill’s age, the odds are still 1.8 to 1 in favor of a disability. In fact, thanks to advances in medical treatments over the last twenty years, deaths from the major illnesses (cancer, stroke, and heart disease) are down nearly one third, while disabilities from these same diseases are up by over 50%!

Yet Bill, like many workers, is only protected against the lesser risk.

Based on these statistics, you would think that every employee would ensure that he has disability insurance coverage. Unfortunately, many of today’s workers do not see the necessity for this insurance because, like Bill, they have been lulled into a false sense of security by a lifetime‘s worth of good health or the naive belief that unforeseen illnesses and accidents happen only to the unlucky few.

Disability Insurance Considerations From an Employer’s Perspective

Unlike the readily understandable benefits like paid vacation or health and dental insurance, disability income insurance can be more difficult to use as an incentive for workers to remain loyal, yet in time of need it will be the most appreciated part of the benefit package. Workers of all ages (yes, even those young employees who believe they are invincible) need protection from those surprises that can neither be predicted nor prevented. Disability Insurance is a benefit that a caring employer can provide, even if it is never needed, and it will engender a sense of loyalty when it is established with a thorough explanation.

2 Types of Disability Insurance

There are two basic types of disability insurance: short term (STD) and long term (LTD), neither of which should put an undo strain on a company’s budget. Employers have the option of adjusting the waiting period (the interval from the injury or illness to the start of payments) and the benefit period (the maximum amount of time for which the worker will receive payments).

In the case of STD the waiting period is generally up to two weeks, while the benefit period can be as little as thirteen weeks or as much as two years. With LTD the waiting period ranges from six months to two years, and the benefit period would last from a few years to a lifetime.

Employers also have the flexibility to require employees to contribute a portion of the premium, or they may choose to pay the entire amount themselves. There are a variety of paths that an employer can take to establishing a plan that fits the company’s budget and, at the same time, addresses the potential needs of the workers.

Disability Insurance - Putting it all Together

There is little doubt that disability insurance has advantages for both your employees and your company. Consider these:

- Group rates are lower than individual rates and, with the option of employee contributions, a plan can be established at a reasonable cost

- There are no medical exams, so all of your employees are automatically covered regardless of medical history

- Those valued employees who become temporarily disabled return to the company with a sense of loyalty and gratitude

- Waiting and benefit periods can be adjusted, which gives your business flexibility in designing a plan

- Hiring managers can use this benefit as a recruiting tool for inducing new talent to the company

Get the Right Disability Insurance Coverage

Get the Right Disability Insurance Coverage

To learn more about your disability insurance options, give us a call at (800) 947-1270 or (610) 775-3848, or click here to contact us. We offer health and disability insurance protection from multiple competing insurance providers, so unlike single-brand companies, we're free to shop around to find the best deal on quality insurance protection. Contact us today to get started.

You’re about to become an employer. Maybe you’ve been in business for a while, but now you’re ready to hire your first employee. You’re excited; this means your business is growing. Or, maybe you’re just starting a business and you need employees to help run that business.

You’re about to become an employer. Maybe you’ve been in business for a while, but now you’re ready to hire your first employee. You’re excited; this means your business is growing. Or, maybe you’re just starting a business and you need employees to help run that business.

Managed health care started to become commonplace in the US after the enactment of the Health Maintenance Organization Act of 1973, which was created in an attempt to control health care medical insurance costs by stimulating greater competition within health care markets. It marked a significant shift in the US health care industry by introducing the concept of for-profit health care to an industry that was traditionally not-for-profit.

Managed health care started to become commonplace in the US after the enactment of the Health Maintenance Organization Act of 1973, which was created in an attempt to control health care medical insurance costs by stimulating greater competition within health care markets. It marked a significant shift in the US health care industry by introducing the concept of for-profit health care to an industry that was traditionally not-for-profit.  For more information about MCOs and Worker’s Compensation Insurance and to find the right insurance for your business, please

For more information about MCOs and Worker’s Compensation Insurance and to find the right insurance for your business, please  Workers’ Compensation claims cost American employers $77.1 billion in 2011. Traditionally, one of the only ways for employers to decrease workers’ compensation costs was to offer proactive safety measures to reduce the number of claims. This is still an important practice, but for years, many insurance agents have suspected that an employer offering voluntary accident or disability insurance will see a decrease in the frequency and expense of workers’ compensation claims.

Workers’ Compensation claims cost American employers $77.1 billion in 2011. Traditionally, one of the only ways for employers to decrease workers’ compensation costs was to offer proactive safety measures to reduce the number of claims. This is still an important practice, but for years, many insurance agents have suspected that an employer offering voluntary accident or disability insurance will see a decrease in the frequency and expense of workers’ compensation claims.

Let's Get Honest About Disability Insurance

Let's Get Honest About Disability Insurance The average long-term disability claim is 34.6 months (just shy of 3 years!). If you rely on your paycheck (and who doesn't?) you should have disability insurance.

The average long-term disability claim is 34.6 months (just shy of 3 years!). If you rely on your paycheck (and who doesn't?) you should have disability insurance.  Most people don’t want to think about life insurance; it’s something they pay for and hope they never use. But, let’s face it - you just never know when life is going to throw you a curveball. It’s what makes life so incredibly exciting sometimes and so very scary at other times.

Most people don’t want to think about life insurance; it’s something they pay for and hope they never use. But, let’s face it - you just never know when life is going to throw you a curveball. It’s what makes life so incredibly exciting sometimes and so very scary at other times.  Insurance Protection for Those Curveballs!

Insurance Protection for Those Curveballs! Great employees can be the fuel to move your business ahead of the competition. Dedicated employees add more and more value over time as they gain increased knowledge and experience. While everyone likes a company that offers great benefits, the best employees and job candidates are likely to view the quality of the benefits you offer as a compelling reason to join, remain at, or leave your firm.

Great employees can be the fuel to move your business ahead of the competition. Dedicated employees add more and more value over time as they gain increased knowledge and experience. While everyone likes a company that offers great benefits, the best employees and job candidates are likely to view the quality of the benefits you offer as a compelling reason to join, remain at, or leave your firm.

Dirty Harry Was Right About Disability Insurance

Dirty Harry Was Right About Disability Insurance

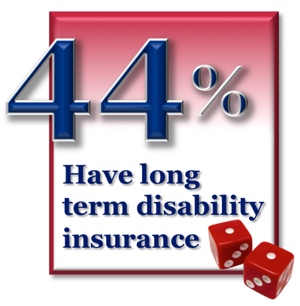

According to a May 2013 report by the non-profit Council for Disability Awareness (CDA), there is a sharp mismatch between the high value employees place on their ability to earn a living vs. their financial preparedness to handle a disability that would threaten their income as evidenced by having adequate levels of disability insurance.

According to a May 2013 report by the non-profit Council for Disability Awareness (CDA), there is a sharp mismatch between the high value employees place on their ability to earn a living vs. their financial preparedness to handle a disability that would threaten their income as evidenced by having adequate levels of disability insurance.