If you own a house, you have homeowners insurance. It’s required by the financial institution that holds your mortgage, and even if you don’t have a mortgage, you still need the coverage to protect your investment. With the median sales price of existing homes at a current level of $234,900, that’s a rather significant investment.

If you own a house, you have homeowners insurance. It’s required by the financial institution that holds your mortgage, and even if you don’t have a mortgage, you still need the coverage to protect your investment. With the median sales price of existing homes at a current level of $234,900, that’s a rather significant investment.

Even though almost every homeowner understands the necessity for homeowners insurance, few are aware of what is typically covered in a standard policy.

There are six areas of protection that make up your homeowners insurance. Make sure your policy has the right balance.

1. Dwelling Coverage

If your house is damaged or destroyed in a covered peril—fire, wind, hail, or lightning—your insurance policy will provide the funds to repair or rebuild it. Keep in mind, however, that floods and earthquakes are not included in this coverage and will require separate polices to protect your property from them.

2. Other Structures

This part of the policy covers what the name implies—any detached buildings on your property. Sheds, workshop, detached garage, and even fences are covered for damage or destruction from any covered peril. Your policy will usually provide 10% of the dwelling coverage as the limit for other structure protection. So, if you have set the cost of rebuilding your home at $200,000, then your other structure coverage will be $20,000.

3. Personal Property

Personal property coverage, sometimes referred to as contents coverage, pays for replacing your possessions that were destroyed in a covered peril. In most policies, the coverage limit is set at 50% to 70% of the dwelling coverage limit. While $100,000 to $140,000 for a $200,000 house might sound like more than enough, you should perform a home inventory to be certain.

4. Loss of Use

If your home is damaged or destroyed, you might have to look for a temporary place to live while repairs are being made. Loss of use coverage will help you maintain your standard of living by providing for hotels, restaurants, and other living expenses when your house is uninhabitable. Loss of use protection is set at 20% of your dwelling coverage limit.

5. Personal Liability

This part of your home insurance policy protects you from lawsuits. Suppose a visiting neighbor falls because of a rotten floorboard on your front porch. Or your usually mild-mannered dog bites the utility meter reader and puts him out of work for a few weeks. You could be subjected to a lawsuit, in which case your coverage would protect you up to the policy limit, generally at least $100,000.

6. Medical Payments

Medical payments insurance, commonly called MedPay, covers the medical costs of someone who is injured on your property and chooses not to sue. In the previous example, your neighbor and the meter reader were injured but this time did not file a lawsuit. Their medical costs were paid because of the MedPay section of your policy.

Keep in mind that medical payments coverage is the only part of your policy whose limits are not determined by your dwelling coverage. It typically pays $1000 per injured person, but you have the option to request a higher limit.

Go Beyond House Insurance Basics: Contact Us for the Right Coverage!

What you have read here is Home Insurance 101. To ensure that you are adequately covered, talk to one of our experts at American Insuring Group. We will help you acquire a homeowner's policy that has the appropriate coverage for your situation at a great price. Contact us online or call us at (800) 947-1270 or (610) 775-3848.

What you have read here is Home Insurance 101. To ensure that you are adequately covered, talk to one of our experts at American Insuring Group. We will help you acquire a homeowner's policy that has the appropriate coverage for your situation at a great price. Contact us online or call us at (800) 947-1270 or (610) 775-3848.

It's every homeowner's worst fear. Imagine… You pull into your driveway after a lovely evening with your spouse and as you approach your front door – key in hand - you see broken glass and notice that the door isn’t shut completely. For a few seconds, you’re confused. Then, you realize that someone has obviously forced their way into your house. Your heart starts pounding and your mind begins racing. Your home has been burglarized. What do you do now?

It's every homeowner's worst fear. Imagine… You pull into your driveway after a lovely evening with your spouse and as you approach your front door – key in hand - you see broken glass and notice that the door isn’t shut completely. For a few seconds, you’re confused. Then, you realize that someone has obviously forced their way into your house. Your heart starts pounding and your mind begins racing. Your home has been burglarized. What do you do now? To ensure that your valuables are properly protected in the event of a home burglary,

To ensure that your valuables are properly protected in the event of a home burglary,  2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

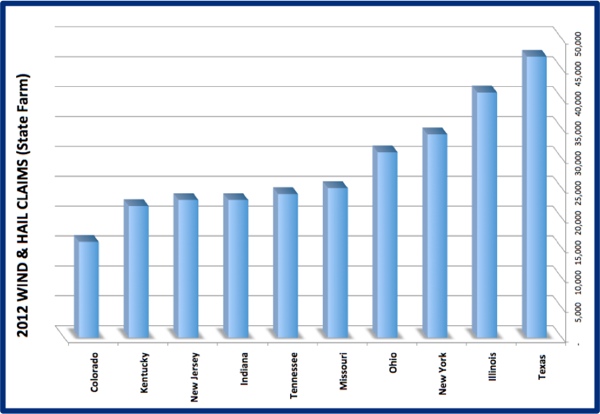

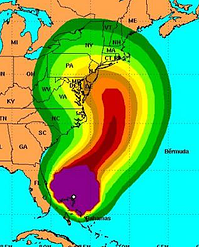

It's Not Just About the Midwest

It's Not Just About the Midwest

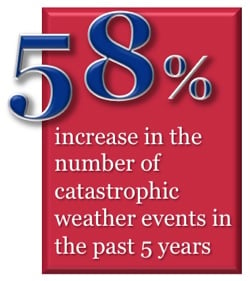

Why the Big Homeowner’s Insurance Cost Increases?

Why the Big Homeowner’s Insurance Cost Increases? Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

According to WFMZ-TV: "

According to WFMZ-TV: " Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report.

Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report. Homeowners in Pennsylvania, and in eastern and southeastern states in general, tend to live in humid climates with plentiful rainfall. This combination makes these homes more susceptible to moisture and mold buildup, especially in older homes with porous foundations. Therefore, homeowners must take extra care to watch for signs of moisture and mold, and to act quickly to resolve such problems before they become a serious health threat.

Homeowners in Pennsylvania, and in eastern and southeastern states in general, tend to live in humid climates with plentiful rainfall. This combination makes these homes more susceptible to moisture and mold buildup, especially in older homes with porous foundations. Therefore, homeowners must take extra care to watch for signs of moisture and mold, and to act quickly to resolve such problems before they become a serious health threat. With the average homeowners insurance policy renewal premium rising by as much as 25% or more, most home insurance buyers are asking themselves how to pay less for a house insurance policy.

With the average homeowners insurance policy renewal premium rising by as much as 25% or more, most home insurance buyers are asking themselves how to pay less for a house insurance policy.