Look! Up at the sky! It’s a bird! It’s a plane! No, it’s a drone! And it’s coming to a neighborhood near you. The Consumer Electronics Association estimates that consumer drone purchases this year will put 300,000 more recreational drones in the skies. And while many consumers are now eyeing these unmanned, remote-controlled aerial toys as one of their next purchases, they don’t necessarily want their neighbors to buy one. Furthermore, few consider whether their homeowners insurance will cover them for drone-related accidents.

Look! Up at the sky! It’s a bird! It’s a plane! No, it’s a drone! And it’s coming to a neighborhood near you. The Consumer Electronics Association estimates that consumer drone purchases this year will put 300,000 more recreational drones in the skies. And while many consumers are now eyeing these unmanned, remote-controlled aerial toys as one of their next purchases, they don’t necessarily want their neighbors to buy one. Furthermore, few consider whether their homeowners insurance will cover them for drone-related accidents.

Drone safety and privacy issues

With the possibility that a drone could crash-land into a car or injure a child or pet, there’s little wonder that a recent survey by a property-casualty insurer revealed a good deal of concern about hobby drones:

- Three quarters of respondents were concerned that an unmanned drone could crash into their house.

- Half believed that a drone was likely to injure someone

- Half thought the aircraft might be able to hack into a wireless network

- A full sixty percent feared that drones would take unauthorized photos of family members

- And a third of them believed that drones could somehow steal their possessions

Check your homeowners insurance policy to be sure you’re protected

While the Federal Aviation Administration worries about the threat that personal drones pose to private and commercial aircraft, the insurance industry is concerned about their potential effect on home insurance. As more drones are sent skyward, there will be a commensurate increase in claims against their owners for accidents that cause personal injury and property damage. Many insurers worry that they will see a significant increase in recreational operators seeking coverage under existing homeowners' insurance policies. But will the drone operators’ homeowners’ insurance cover damages?

The quick answer: probably. While the standard homeowners' policy provides coverage for damages that the insured becomes legally obligated to pay for bodily injury or property damage, this coverage may be limited by policy exclusions. One of those exclusions is coverage for injuries or damage caused by the ownership, use, or maintenance of aircraft. “Aircraft” refers to any apparatus used or designed for flight, except model or hobby aircraft not used or designed to carry people or cargo. Many insurers, however, don’t make this exception for hobby aircraft. Since there are substantial differences in policy wording, one cannot assume coverage for drone use.

Business usage and intentional acts exclusions

Domino's is hoping to have drones deliver pizzas in the near future, and Amazon is testing them for deliveries as well. Agents are taking aerial photos for real estate listings, and home insurers are using drones for everything from underwriting to documenting damage from natural disasters. But keep in mind that none of these business applications will likely be covered under a personal homeowners’ policy, because those policies usually exclude business activities.

Homeowners’ insurance policies also often exclude coverage for intentional acts. And it can be difficult to separate the intentional from the accidental in drone incidents. If a local jurisdiction deems invasion of privacy to be an intentional act, any claims against you may not be paid if your policy specifically excludes intentional acts.

Drone operators need to look closely at the commercial-usage, "aircraft" and intentional-acts exclusions of their homeowners’ policy prior to liftoff. As with all insurance, the availability of coverage depends on the policy’s specific language – including the definitions, the exclusions, the exceptions to the exclusions and other conditions.

Questions about drones and homeowners insurance? Call us!

Before you send that new recreational drone on its maiden flight, contact American Insuring Group or call us at (800) 947-1270 or (610) 775-3848 to be sure that you are fully protected.

Before you send that new recreational drone on its maiden flight, contact American Insuring Group or call us at (800) 947-1270 or (610) 775-3848 to be sure that you are fully protected.

Our independent agents represent a multitude of competing insurance providers, so we're well equipped to find you the right insurance at the right price, so contact us today.

Why Home Security Should be a Priority

Why Home Security Should be a Priority Get a Homeowners Insurance Checkup for Your Peace of Mind

Get a Homeowners Insurance Checkup for Your Peace of Mind 2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

2013 was a good year for the real estate industry. The price of homes increased by more than 20% in certain hotspots, and experts predict that home prices will continue to rise in 2014 – albeit, at a more moderate rate of 3-5%. This is great news if you’re a realtor or if you’re trying to sell your home. But you might be asking yourself, “Does this mean I need to reevaluate the insurance coverage on my home? Does this mean I have to pay higher house insurance premiums?”

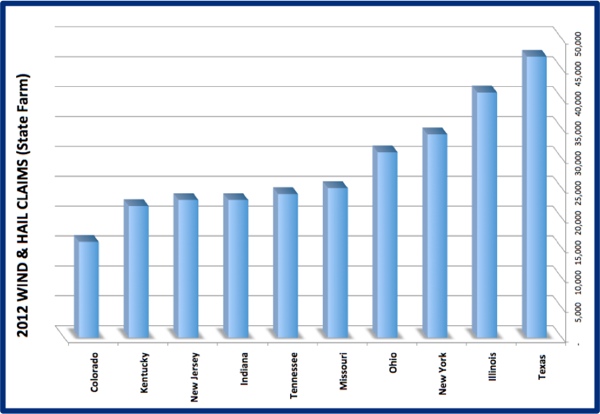

It's Not Just About the Midwest

It's Not Just About the Midwest

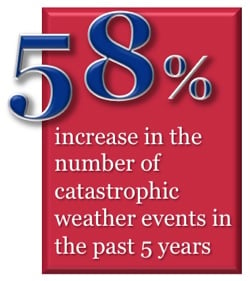

Why the Big Homeowner’s Insurance Cost Increases?

Why the Big Homeowner’s Insurance Cost Increases? Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Are You at Risk?

Are You at Risk?

According to WFMZ-TV: "

According to WFMZ-TV: " October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.

October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.  To receive your free report, courtesy of PuroClean,

To receive your free report, courtesy of PuroClean,  The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie!

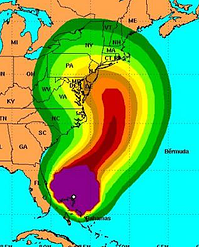

The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie! Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report.

Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report.