The storm was ferocious. Luckily, your buildings were spared damage from the high winds and heavy rains; however, a few miles away the storm brought down power lines that supply your business with electricity. While there is no physical damage to your property, you’re still out of business without power. Does your business insurance cover this? Do you have utility service interruption insurance?

The storm was ferocious. Luckily, your buildings were spared damage from the high winds and heavy rains; however, a few miles away the storm brought down power lines that supply your business with electricity. While there is no physical damage to your property, you’re still out of business without power. Does your business insurance cover this? Do you have utility service interruption insurance?

Commercial Property Policies Exclude Utility Service Outages

You have a standard loss of business income insurance policy, and you may think that you are protected in the event of an outage. Unfortunately, most policies do not cover utility interruptions that originate away from your premises. While utility service exclusions may vary from one policy to another, they usually include the following:

- Power supply services--electricity, gas and steam

- Water supply services

- Communications supply services--telephone, radio, microwave or television

Losing these services for an extended period can be financially devastating. To protect your business from any of these utility outages, you will need to purchase an endorsement that extends your insurance coverage to include utility services interruptions.

Utility Service Interruption Insurance Closes the Gaps

Storms are not the only threat to your business. A vehicle can snap off a utility pole, a fire can start several blocks away, or a tornado can touch down unexpectedly. None of these has caused damage to your facility, yet your business is on hold because one or more utilities that are vital to your operation have been interrupted.

Utility service interruption coverage is an endorsement that covers your losses due to lack of incoming electricity--or similar utility services--caused by damage to property away from your premises. (For instance, the utility generating station may have been damaged or transmission lines could be down.)

These endorsements vary widely as to what utility services are included and whether both Direct Damage and Time Element losses are covered. The following details explain these coverages:

Direct Damage Coverage

- If a power surge occurs during power restoration, this coverage pays to repair or replace any items that have been damaged by the surge

- You must have Personal Property insurance to purchase Direct Damage coverage. It is an extension of your Personal Property coverage

- The deductible that applies to your Personal Property coverage will also apply to Direct Damage

Time Element Coverage

- Time Element coverage extends standard business interruption coverage to include utility services interruptions

- Time Element pays your profit plus continuing expenses, up to the limit you have chosen or until the utility comes back into service, whichever comes first

- You must have Loss of Business Income coverage to buy the Time Element extension

- The utility must be out due to a covered cause of loss

- If you have a deductible or waiting period on Loss of Business Income, it will be the same on your Time Element endorsement

Consider the Exposures to Your Business

The first step is to evaluate the exposures facing your company. Will the loss of power for hours or days adversely impact your operations and profits? If you determine that it will, your next step is to determine how your current insurance program would apply. This involves reviewing the policy language, evaluating the coverage and taking the appropriate action to change the policies or add endorsements.

A word of caution: many power outages are caused by downed transmission and distribution lines. These endorsements do not automatically extend coverage for loss caused by or resulting from the damaged lines. This coverage is available, but it must be specifically requested and added by endorsement.

We Can Help You Get the Right Utility Services Interruption Insurance Policy

The experienced agents at American Insuring Group can help you determine if Utility Services Interruption Insurance is a good idea for your business.

The experienced agents at American Insuring Group can help you determine if Utility Services Interruption Insurance is a good idea for your business.

Click here to contact us or give us a call at (800) 947-1270 or (610) 775-3848. Our independent agents will compare insurance policies among many competing providers to find you the right insurance at the right price. Call or click today!

Every small business should conduct a risk management assessment prior to reassessing their

Every small business should conduct a risk management assessment prior to reassessing their

You’re about to become an employer. Maybe you’ve been in business for a while, but now you’re ready to hire your first employee. You’re excited; this means your business is growing. Or, maybe you’re just starting a business and you need employees to help run that business.

You’re about to become an employer. Maybe you’ve been in business for a while, but now you’re ready to hire your first employee. You’re excited; this means your business is growing. Or, maybe you’re just starting a business and you need employees to help run that business.

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA).

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA). In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an

In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an  For more information about drone insurance and other commercial insurance needs,

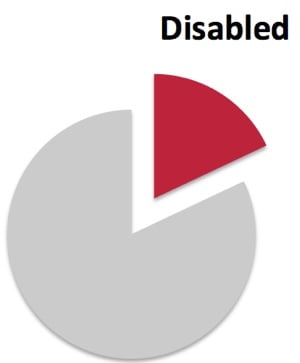

For more information about drone insurance and other commercial insurance needs,  More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.

More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.  Every employer is responsible for insuring a safe working environment for his or her employees. If you’re in construction, workplace safety should move to the top of your priorities because more than 20% of the work-related fatalities in 2013 occurred in the construction industry.

Every employer is responsible for insuring a safe working environment for his or her employees. If you’re in construction, workplace safety should move to the top of your priorities because more than 20% of the work-related fatalities in 2013 occurred in the construction industry.

Let’s say you own a restaurant. One night, a group of friends enjoy dinner and a few drinks at your restaurant. They decide to go to a club where they dance and consume more alcohol. Then, they go to a corner pub to wind down with a few more drinks. On the way home, one of those friends causes an accident that injures or – God forbid – kills someone in the process.

Let’s say you own a restaurant. One night, a group of friends enjoy dinner and a few drinks at your restaurant. They decide to go to a club where they dance and consume more alcohol. Then, they go to a corner pub to wind down with a few more drinks. On the way home, one of those friends causes an accident that injures or – God forbid – kills someone in the process.

What About Dishonest Worker's Comp Claims?

What About Dishonest Worker's Comp Claims? On March 25, 1911, the US witnessed one of the deadliest industrial disasters in American history – the Triangle Shirtwaist Factory Fire in New York City. The fire resulted in the deaths of 146 garment workers – 123 women and 23 men – who were working on the eighth, ninth, and tenth floors. Some died from the fire, but many were killed by smoke inhalation or falling or jumping to their deaths.

On March 25, 1911, the US witnessed one of the deadliest industrial disasters in American history – the Triangle Shirtwaist Factory Fire in New York City. The fire resulted in the deaths of 146 garment workers – 123 women and 23 men – who were working on the eighth, ninth, and tenth floors. Some died from the fire, but many were killed by smoke inhalation or falling or jumping to their deaths.