There’s a good chance you’ve heard that long-term care insurance should be a part of everyone’s financial planning.

There’s a good chance you’ve heard that long-term care insurance should be a part of everyone’s financial planning.

A long-term care insurance policy helps pay for the care you need when you become unable to care for yourself. It can protect your family's financial future and your investments and savings, and is therefore an important element in a well designed health insurance strategy.

What long-term care insurance covers

Long-term insurance benefits pay for services that include personal care such as bathing, dressing, eating, using the bathroom, moving around, or getting in or out of a bed or a chair. The help could be administered at your home or a variety of other facilities.

Long-term insurance rates vary depending on individual factors:

• How old you are when you apply for it

• The maximum amount that the policy will cover per day

• The highest number of days, months, or years that the policy will provide benefits

• The lifetime maximum amount

• Any options that you choose (increasing benefits with inflation, for instance)

Since most long-term policies require medical underwriting, you may not even qualify for the protection if you are in bad health. Sometimes, however, you can get group coverage that requires no underwriting, or you might be able to purchase an individual policy with limited coverage or at higher rates.

Good news from the IRS on long-term care insurance

The Internal Revenue Service (IRS) has announced that it is increasing the amount taxpayers can deduct from their 2016 income for long-term care insurance premiums.

Premiums for qualified long-term care insurance policies are tax deductible to the extent that they, along with other unreimbursed medical expenses, exceed 10 percent of the insured's adjusted gross income, or 7.5 percent for taxpayers 65 and older (through 2016).

The premiums, which are the amount a policyholder pays the insurance company, are deductible for the taxpayer, spouse, and other dependents. Self-employed individuals take note: Your rules are different. You can take the amount of the premium as a deduction just as long as you made a net profit. And your medical expenses do not have to exceed a certain percentage of your income.

One caveat, depending on the taxpayer’s age, there is a limit on how much of the premium may be deducted. The IRS does not consider any premium amounts for the year that are above these limits to be a medical expense.

Here are the deductibility limits for 2016:

Age before the end of the year

40 or less: $390

41 to 50: $730

51 to 60: $1,460

61 to 70: $3,900

71 and up: $4,870

How to receive the long-term care insurance tax deduction:

You must itemize your deductions on your federal return to receive the long-term care insurance tax deduction. Your long term care insurance premiums are added in to your other unreimbursed medical expenses. To get a tax deduction, you must have unreimbursed medical expenses that exceed 10% (7.5% for 65 and older) of your adjusted gross income. If so, you may deduct up to the age-based limits shown above.

We can help you select the right long-term care insurance

It’s never a bad time to review your financial plan, and with the IRS giving you an added incentive, you should take the time to consider long-term care insurance as part of your plan for 2017.

It’s never a bad time to review your financial plan, and with the IRS giving you an added incentive, you should take the time to consider long-term care insurance as part of your plan for 2017.

Contact American Insuring Group online, or call us at (800) 947-1270 or (610) 775-3848, and get all the details on this essential coverage.

If you’re like most Americans, your life is pretty good right now (probably a lot better than you realize), and you see no reason why that should change in the foreseeable future. Now imagine being blindsided by a serious illness that takes away your good health and puts a significant dent in your income.

If you’re like most Americans, your life is pretty good right now (probably a lot better than you realize), and you see no reason why that should change in the foreseeable future. Now imagine being blindsided by a serious illness that takes away your good health and puts a significant dent in your income. To learn more about Critical Illness Insurance, or for any health insurance need,

To learn more about Critical Illness Insurance, or for any health insurance need,  Most medical statistics that you read or hear about are not designed to brighten your day.

Most medical statistics that you read or hear about are not designed to brighten your day. Seek professional assistance before planning for your long-term care. There are a variety of policies from which to choose, from traditional long-term care insurance to hybrid plans that will return your premium should you not need care. There are also decisions to be made within each policy type that may require expert advice.

Seek professional assistance before planning for your long-term care. There are a variety of policies from which to choose, from traditional long-term care insurance to hybrid plans that will return your premium should you not need care. There are also decisions to be made within each policy type that may require expert advice. Need something to jolt you awake faster than your morning espresso? Try these government statistics: About 70 percent of people over age 65 will need some type of long-term care during their lifetime, and more than 40 percent will need care in a nursing home at some point.

Need something to jolt you awake faster than your morning espresso? Try these government statistics: About 70 percent of people over age 65 will need some type of long-term care during their lifetime, and more than 40 percent will need care in a nursing home at some point. Bill is 50-year-old department manager for a mid-sized manufacturer. Even though he has never been seriously ill and has a clean family health history, he was recently told that he has cancer.

Bill is 50-year-old department manager for a mid-sized manufacturer. Even though he has never been seriously ill and has a clean family health history, he was recently told that he has cancer. Get the Right Disability Insurance Coverage

Get the Right Disability Insurance Coverage Do you live under a rock? No? Then it’s pretty safe to say that you’ve heard about the Affordable Care Act (ACA) – Also known as Obamacare - that was signed into law in March 2010.

Do you live under a rock? No? Then it’s pretty safe to say that you’ve heard about the Affordable Care Act (ACA) – Also known as Obamacare - that was signed into law in March 2010.  Get Help - Find the Right Health Insurance for Your Small Business

Get Help - Find the Right Health Insurance for Your Small Business

Our world is changing. The “typical” family has changed and people are living much longer due to advances in medicine. These two ingredients have created a new generation – known as the Sandwich Generation. Gone are the days when a “typical” family consisted of a working husband, a stay-at-home wife and a couple of children.

Our world is changing. The “typical” family has changed and people are living much longer due to advances in medicine. These two ingredients have created a new generation – known as the Sandwich Generation. Gone are the days when a “typical” family consisted of a working husband, a stay-at-home wife and a couple of children.

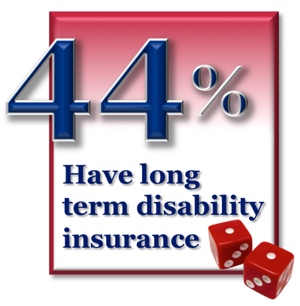

Let's Get Honest About Disability Insurance

Let's Get Honest About Disability Insurance The average long-term disability claim is 34.6 months (just shy of 3 years!). If you rely on your paycheck (and who doesn't?) you should have disability insurance.

The average long-term disability claim is 34.6 months (just shy of 3 years!). If you rely on your paycheck (and who doesn't?) you should have disability insurance.  How Will the Affordable Care Act Affect Small Business Health Insurance Costs?

How Will the Affordable Care Act Affect Small Business Health Insurance Costs?

Do you believe that your employees are one of your most valuable assets? Do you think of your employees as an investment rather than an expense?

Do you believe that your employees are one of your most valuable assets? Do you think of your employees as an investment rather than an expense?  Contact American Insuring Group

Contact American Insuring Group