The EOC looks at nearly 90,000 Employment Practices Liability Insurance (EPLI) claims every year, and the average cost of each case is $450,000.

If you own a restaurant, you’ve probably worked hard to build strong relationships with your staff and create an environment conducive to teamwork. If you’re lucky, you’ve found the magical formula that balances friendliness with professionalism, and you’re proudly watching as your well-oiled team creates and delivers delicious food to your customers. You and your staff may even feel like a big happy family.

If you own a restaurant, you’ve probably worked hard to build strong relationships with your staff and create an environment conducive to teamwork. If you’re lucky, you’ve found the magical formula that balances friendliness with professionalism, and you’re proudly watching as your well-oiled team creates and delivers delicious food to your customers. You and your staff may even feel like a big happy family.

But even happy families disagree and face irreconcilable differences. It happens all the time. Sometimes they can work through it, and sometimes they can’t. The same is true for employees.

Employment Issues Are 30% of Civil Litigations

The Equal Opportunity Commission (EOC) reports that employment issues make up 30% of all civil litigations in the U.S., which makes the likelihood of an employment claim against an employer higher than a property or general liability claim. And employment practices liability risks can begin the moment you interview someone.

Employment litigation claims can have a severe financial impact on a restaurant, even forcing them out of business if they do not have adequate insurance. According to the Society for Human Resource Management, 67% of all employment cases that go to litigation result in a judgment for the plaintiff.

Larger companies tend to protect themselves against employment claims with employee policies and procedures and EPLI, but many small restaurant owners do not, and 41% of all EPLI claims are made against employers with only 15 to 100 employees.

Common EPLI Issues For Restaurants

Common issues for which a good EPLI policy can help protect your restaurant include:

- Sexual harassment

- Discrimination in hiring practices

- Wrongful termination

- Defamation of character

- Emotional distress

- Invasion of privacy

- Failure to promote

How to Protect Your Restaurant From Employment Practices Liability Risk

- Research employment laws that apply to your business.

- Create an employee handbook with detailed policies and procedures that guide you through hiring, disciplining, and terminating employees. Include policies and procedures regarding attendance, discipline, and complaints; an employment-at-will statement and an equal employment opportunity statement.

- Create job descriptions for each position that clearly defines the skills and performance expected from someone hired for that position.

- Include an equal employment opportunity statement and an employee-at-will statement on your job

- Conduct background checks on candidates.

- Conduct and document periodic performance reviews of all employees.

- Create a zero-tolerance policy regarding discrimination, substance abuse, and harassment.

- Conduct an insurance review with your insurance agent to ensure that you have adequate EPLI

What You Should Know About Employment Practices Liability Insurance

The cost of EPLI coverage is determined by factors such as the number of employees you have, the percentage of employee turnover, and if you have established practices and procedures in place. EPLI may be offered as an endorsement to your Business Owner’s Policy, General Liability Policy, or as a stand-alone policy. It usually covers the cost of defending your restaurant against the charges and any damages you are ordered to pay.

Contact Us for a Free Insurance Review

Don't take chances with your restaurant business - you've worked too hard to get to where you are today. Be sure you are properly covered for every liability.

Don't take chances with your restaurant business - you've worked too hard to get to where you are today. Be sure you are properly covered for every liability.

For a FREE REVIEW of your liability insurance, contact American Insuring Group online or call us (800) 947-1270 or (610) 775-3848.

As a small business owner who allows customers and visitors on your property, you assume the responsibility of providing a reasonably safe environment for them. This responsibility includes warning them about any concealed dangerous conditions. In states with “concealed carry” laws, you might need to post warnings that your sales clerks are armed.

As a small business owner who allows customers and visitors on your property, you assume the responsibility of providing a reasonably safe environment for them. This responsibility includes warning them about any concealed dangerous conditions. In states with “concealed carry” laws, you might need to post warnings that your sales clerks are armed. To learn more about Commercial General Liability Insurance,

To learn more about Commercial General Liability Insurance,  Attention: restoration contractors! You may have lucrative opportunities from an unlikely source—mold. Yes, the fungus that grows in moisture-laden areas of many old homes has created a demand for professional mold remediation services. Done right, you can grow your mold remediation business while controlling your

Attention: restoration contractors! You may have lucrative opportunities from an unlikely source—mold. Yes, the fungus that grows in moisture-laden areas of many old homes has created a demand for professional mold remediation services. Done right, you can grow your mold remediation business while controlling your  To learn more about Commercial General Liability and Contractors Pollution Liability insurance, or for any business insurance need,

To learn more about Commercial General Liability and Contractors Pollution Liability insurance, or for any business insurance need,  In 1992, 79-year old Stella Liebeck filed a lawsuit against McDonald’s for serving coffee that was too hot. In a product liability case that became known as the “McDonald’s Coffee Case,” the Albuquerque woman sued for injuries she had received after spilling coffee on herself. The basis of the lawsuit centered on insufficient warnings on the cups. After a trial and appeals, the parties settled out of court for an amount of less than $600,000.

In 1992, 79-year old Stella Liebeck filed a lawsuit against McDonald’s for serving coffee that was too hot. In a product liability case that became known as the “McDonald’s Coffee Case,” the Albuquerque woman sued for injuries she had received after spilling coffee on herself. The basis of the lawsuit centered on insufficient warnings on the cups. After a trial and appeals, the parties settled out of court for an amount of less than $600,000. Get the Right Product Liability Insurance

Get the Right Product Liability Insurance  Litigation is like lightening; it can never be accurately predicted. So, the best defense against both is to avoid them altogether. While it’s possible to seek shelter and stay out of harm’s way during a storm, avoiding a professional liability lawsuit can be much more complicated.

Litigation is like lightening; it can never be accurately predicted. So, the best defense against both is to avoid them altogether. While it’s possible to seek shelter and stay out of harm’s way during a storm, avoiding a professional liability lawsuit can be much more complicated. To learn more about Professional Liability Insurance, which helps you pay for the cost of lawsuits and other expenses for which you are legally responsible, and for all your

To learn more about Professional Liability Insurance, which helps you pay for the cost of lawsuits and other expenses for which you are legally responsible, and for all your  Experienced small-business owners know that it’s wise to expect the unexpected. Bad things often happen without warning.

Experienced small-business owners know that it’s wise to expect the unexpected. Bad things often happen without warning. To learn more about business liability and commercial property insurance from our independent agents,

To learn more about business liability and commercial property insurance from our independent agents,  All businesses are at risk for some type of damage, liability or loss, and need to ensure that they have the right commercial insurance to protect themselves, their business, and their employees from those risks.

All businesses are at risk for some type of damage, liability or loss, and need to ensure that they have the right commercial insurance to protect themselves, their business, and their employees from those risks.

If you own a child care business, you’re probably familiar with the specific rules you must follow and specific certifications you must obtain in order to legally operate your business. In Pennsylvania, child care and early learning providers operating a program for four or more unrelated children must be certified by the Pennsylvania Department of Human Services.

If you own a child care business, you’re probably familiar with the specific rules you must follow and specific certifications you must obtain in order to legally operate your business. In Pennsylvania, child care and early learning providers operating a program for four or more unrelated children must be certified by the Pennsylvania Department of Human Services. To learn more about protecting your business and your customers (both big and small) with the proper commercial liability insurance, give us a call at

To learn more about protecting your business and your customers (both big and small) with the proper commercial liability insurance, give us a call at  Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA).

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA). In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an

In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an  For more information about drone insurance and other commercial insurance needs,

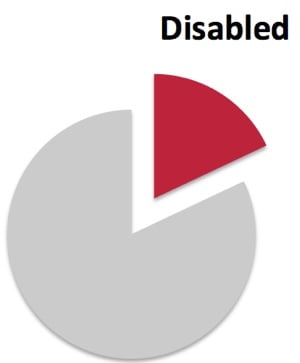

For more information about drone insurance and other commercial insurance needs,  More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.

More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.