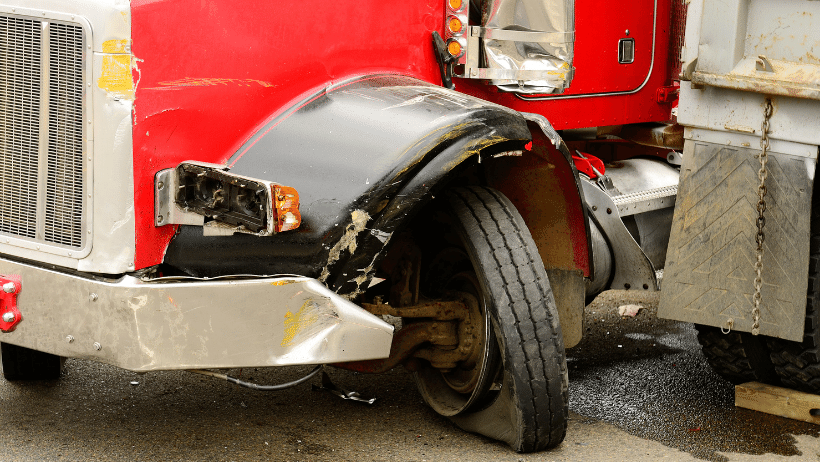

The key to lowering Commercial Truck Insurance costs is to incur fewer claims, and the key to fewer claims is safer drivers. According to the National Safety Council (NSC), 4,842 large trucks were involved in fatal accidents last year (a 33% increase since 2011), and 107,000 large trucks were involved in accidents resulting in an injury.

The key to lowering Commercial Truck Insurance costs is to incur fewer claims, and the key to fewer claims is safer drivers. According to the National Safety Council (NSC), 4,842 large trucks were involved in fatal accidents last year (a 33% increase since 2011), and 107,000 large trucks were involved in accidents resulting in an injury.

We understand that sometimes accidents are unavoidable. However, in crashes where a large truck was the leading cause of an accident, 87% were caused by the driver, while 10% were due to the vehicle and 3% to the environment, according to the Federal Motor Carrier Safety Administration (FMCSA) "Large Truck Crash Causation Study."

If you are a driver, it is your responsibility to understand how you can minimize the risk of an accident for your own well-being and the well-being of other people on the road. If you are a fleet manager, it is your responsibility to provide proper training, create and enforce a driver safety policy, and make fleet maintenance a priority for the well-being of your drivers and your business.

Here are 30 safety tips for truck drivers:

- Take care of your health by eating, exercising, and getting enough sleep.

- Avoid drugs and alcohol

- Wear comfortable clothing

- Plan your route based on weather, road conditions, traffic patterns, construction, etc.

- Monitor the weather and adjust as needed

- Perform a thorough pre-trip inspection

- Perform a thorough post-trip inspection and record or report any issues

- Adjust the steering wheel, seat, mirrors, etc. to maximize comfort

- Know where everything is in your truck's interior

- Take regular breaks and move around

- Wear your seatbelt – According to the CDC, "Buckling up is both effective and required by federal regulations. But 1 in 6 drivers of large trucks don't use their seat belts (2013). More than 1 in 3 truck drivers who died in crashes in 2012 were not wearing seat belts. Buckling up could have prevented up to 40% of these deaths."

- Don't use your cell phone while driving

- Stay alert at all times and especially in school and work zones

- Be aware of speed limits and stay within those limits (they're there for a reason)

- Maintain proper stopping distance

- Know when you're tired

- Check your mirrors every 8-10 seconds to know when vehicles are entering your blind spot.

- Scan ahead to identify traffic issues, work zones, etc.

- Make wide turns carefully

- Use your turn signals to give other drivers notice of your intent

- Stay focused and avoid distractions

- Maintain your vehicle

- When in work zones, slow down, maintain extra following space, obey signs, scan for changing traffic patterns, and be prepared to stop

- Practice defensive driving

- Slow down for curves and turns

- Don't be afraid to ask for help

- Park safely

- Stay centered in your lane

- Be careful when getting in and out of your truck – never jump from the cab to the ground and use three points of contact

- Be careful when handling cargo by ensuring the load is stable, don't handle cargo in poor visibility, use lifting equipment properly, etc.

Save More on Truck Insurance Today!

One of the easiest ways to save on truck insurance is to work with an independent insurance agent who specializes in truck insurance and understands your unique needs, like the agents at American Insuring Group. As independent agents, we compare the cost of your coverage among many insurance companies to ensure you pay the lowest premiums for quality insurance protection.

Call us at (800) 947-1270 or (610) 775-3848, or connect with us online!

If you want to reduce

If you want to reduce

Commercial Truck Insurance

Commercial Truck Insurance Most people wouldn’t think that Daylight Savings would affect

Most people wouldn’t think that Daylight Savings would affect

We're all about saving you money on your

We're all about saving you money on your  Safer drivers mean fewer accidents, and fewer accidents mean lower

Safer drivers mean fewer accidents, and fewer accidents mean lower  Whether you are a new restaurant owner or have been in business for decades,

Whether you are a new restaurant owner or have been in business for decades,  If you get hired as a subcontractor, don’t assume that the general contractor’s Contractors Insurance covers you. As a subcontractor, you are NOT considered an employee of that contractor, and

If you get hired as a subcontractor, don’t assume that the general contractor’s Contractors Insurance covers you. As a subcontractor, you are NOT considered an employee of that contractor, and