Life insurance coverage might not be the first thing you think of when considering your financial planning. However, it is an extremely important component of that planning. If the unexpected happens, the people you leave behind could be left with the very same financial hardships you’ve been working so hard to prevent, especially if you haven't put the proper life insurance in place. Sadly, as you'll see from the data below, most people fall into one of two categories: uninsured or underinsured.

Life insurance coverage might not be the first thing you think of when considering your financial planning. However, it is an extremely important component of that planning. If the unexpected happens, the people you leave behind could be left with the very same financial hardships you’ve been working so hard to prevent, especially if you haven't put the proper life insurance in place. Sadly, as you'll see from the data below, most people fall into one of two categories: uninsured or underinsured.

Survey: 39% Have No Life Insurance

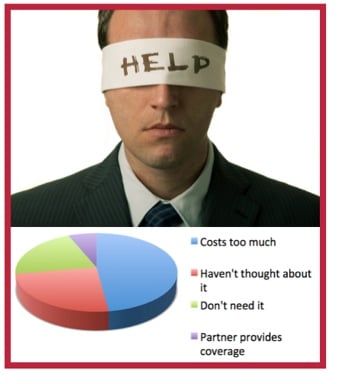

If life insurance hasn’t made it to your priority list, you aren’t alone. An August 2012 survey from Harris Interactive found that 39% of respondents had no coverage. Most people thought it would cost them too much, but many hadn’t even considered whether they need it. In short:

Of the 39% with no coverage:

- Costs too much: 45%

- Haven’t thought about it: 23%

- Don’t think they need it: 20%

- Partner provides coverage: 6%

61% with Life Insurance are Open to Risk

People who had life insurance coverage had not eliminated their risk, either, though. How much coverage is needed is based on many variables. There are the immediate expenses, of course, such as funeral expenses. Then there are longer-term considerations, such as mortgages, college expenses, and inflation.

The survey found that 61% of respondents had too little coverage based on a rule of thumb that a million dollar policy would be sufficient to cover a median household income of $50,000. Most of these respondents hadn’t really considered how much life insurance would be needed to take care of those left behind when all the variables are considered.

Of the 61% with too little coverage based on their income:

- $100,000 of coverage or less: 53%

- $100,000 to $250,000: 20%

- $250,000 to $1,000,000: 15%

- $1,000,000 or above: 2%

(You can see an infographic of this data here.)

As you can see, most Americans are woefully unprepared or under-prepared when it comes to life insurance. But it really doesn’t have to be this way since these policies can be very affordable and flexible.

To protect the work you’ve done in life, and protect those you leave behind, talk with an insurance adviser about your specific situation. They can help you consider all the variables and calculate what amount of life insurance you should incorporate into your financial planning.

Need Help Understanding Your Life Insurance Options?

If you'd like help reviewing your life insurance coverage, please contact us today for a free, no-hassle consultation.

Who Can You Trust?

Who Can You Trust? That’s where your friends at American Insuring Group near Reading, PA can help. Our professional agents are committed to helping you understand what life insurance coverage you need for your spouse and family, and to finding an affordable life insurance policy that is well suited to your needs.

That’s where your friends at American Insuring Group near Reading, PA can help. Our professional agents are committed to helping you understand what life insurance coverage you need for your spouse and family, and to finding an affordable life insurance policy that is well suited to your needs. Back in the good old days, getting

Back in the good old days, getting  So why not just buy "Cheap Life Insurance" from those companies that constantly bombard you with ads for low cost life insurance? Why not call 1-800-Low-Cost-Life-Insurance and have them write the coverage you think you need? The reason is your family is too important for that! You need an Independent broker who represents many competing life insurance companies who offer many different types of life insurance policies for many different situations. More choices help ensure you get the best deal, and one that best meets your unique needs.

So why not just buy "Cheap Life Insurance" from those companies that constantly bombard you with ads for low cost life insurance? Why not call 1-800-Low-Cost-Life-Insurance and have them write the coverage you think you need? The reason is your family is too important for that! You need an Independent broker who represents many competing life insurance companies who offer many different types of life insurance policies for many different situations. More choices help ensure you get the best deal, and one that best meets your unique needs.