A new year is a great time for reflection and fresh starts. It’s the perfect time to put the past behind you and look toward the future. Compared to losing those extra 20 pounds, protecting your family in the event of a death is a surprisingly easy New Year’s resolution.

A new year is a great time for reflection and fresh starts. It’s the perfect time to put the past behind you and look toward the future. Compared to losing those extra 20 pounds, protecting your family in the event of a death is a surprisingly easy New Year’s resolution.

Although most people don’t want to think about their own death or the death of a loved one, preparing for the event is one of the most selfless acts you can do for your family.

Life Insurance for the Primary Breadwinner

The first thing you want to do, if you haven’t already, is ensure that the primary breadwinner in the family is covered. Nothing can replace a spouse or a parent, but the financial consequences of that loss are another matter. Life insurance can protect the surviving family members from the loss of future income and the expenses that occur as a result of a death. Most people understand the importance of life insurance for the primary breadwinner, but there are other considerations as well.

Life Insurance for your Spouse

Very few families today can survive on one income, so even if a spouse makes less than the primary breadwinner, you should take a look at what the loss of that income would mean to your family. Could you survive financially if you lost that second income? Or, let’s say that spouse doesn’t produce a monetary income, but he or she is the primary caregiver of children or aging parents. What would it take, financially, to replace that care? No, life insurance can never replace the love of that caregiver, but it can give the survivors some peace of mind that their essential needs will be taken care of.

Life Insurance for your Children

Finally, the death of a child is probably the worst thing that can happen to anyone, and it’s every parent’s worst nightmare. It’s something no parent wants to even consider, but in the event that something should happen, life insurance can at least alleviate the financial burden of a child’s death. Many people believe that purchasing life insurance for children is a giant waste of money. Your children probably aren’t bringing home a paycheck that you rely on to pay the bills, but there are other factors to consider.

- The average cost of a traditional funeral is almost $6,600, according to the National Funeral Directors Association. Cemetery services, including the gravesite and vault or liner, can cost an additional $3,000. A life insurance policy on your child allows parents to grieve without the burden of worrying about how they will pay for the funeral.

- Medical bills left from a prolonged sickness and/or emergency room visits can accumulate and become a burden to a family mourning the loss of a child. A National Institute of Health (NIH)-funded study found the average cost for an ER visit was more than $2,000. In 2012, 11 of the 12 FDA-approved drugs for cancer were priced above $100,000 for a year of treatment.

- Your child may develop a condition later in life that will preclude them from purchasing life insurance in the future. Protecting your child early in life can ensure they have protection in the future.

Protect Your Family with the Right Life Insurance

Looking to the future by protecting your family with life insurance is one of the easiest and most selfless resolutions you can make. Make it a goal to protect your family with the right life insurance. Contact us at American Insuring Group at (800) 947-1270 or (610) 775-3848 to learn more about affordable life insurance policies available for your entire family.

Looking to the future by protecting your family with life insurance is one of the easiest and most selfless resolutions you can make. Make it a goal to protect your family with the right life insurance. Contact us at American Insuring Group at (800) 947-1270 or (610) 775-3848 to learn more about affordable life insurance policies available for your entire family.

Great employees can be the fuel to move your business ahead of the competition. Dedicated employees add more and more value over time as they gain increased knowledge and experience. While everyone likes a company that offers great benefits, the best employees and job candidates are likely to view the quality of the benefits you offer as a compelling reason to join, remain at, or leave your firm.

Great employees can be the fuel to move your business ahead of the competition. Dedicated employees add more and more value over time as they gain increased knowledge and experience. While everyone likes a company that offers great benefits, the best employees and job candidates are likely to view the quality of the benefits you offer as a compelling reason to join, remain at, or leave your firm.

Life insurance. It's one of those decisions that can be so easy to ignore, a can we like to kick down the road, whether that road hails from Philadelphia, Reading, Allentown, Lancaster or beyond. If you've been procrastinating about resolving your life insurance needs, then this article is for you. Let's think this through and get that monkey off your back, shall we?

Life insurance. It's one of those decisions that can be so easy to ignore, a can we like to kick down the road, whether that road hails from Philadelphia, Reading, Allentown, Lancaster or beyond. If you've been procrastinating about resolving your life insurance needs, then this article is for you. Let's think this through and get that monkey off your back, shall we? Contact Us

Contact Us An affordable policy can help you save money without straining your budget. Here are seven tips to help you pay less for insurance:

An affordable policy can help you save money without straining your budget. Here are seven tips to help you pay less for insurance:

With the large baby boom generation entering retirement age, retirement planning is getting more and more attention. Interestingly, while marriage is still the leading cause for people to buy life insurance, retirement is also a major motivation. In fact, research from Northwestern Mutual Life, as conducted by Harris Interactive, shows that 25 percent of people buy life insurance products when they enter retirement -- almost as much as the 32 percent of people that buy it after getting married.

With the large baby boom generation entering retirement age, retirement planning is getting more and more attention. Interestingly, while marriage is still the leading cause for people to buy life insurance, retirement is also a major motivation. In fact, research from Northwestern Mutual Life, as conducted by Harris Interactive, shows that 25 percent of people buy life insurance products when they enter retirement -- almost as much as the 32 percent of people that buy it after getting married.

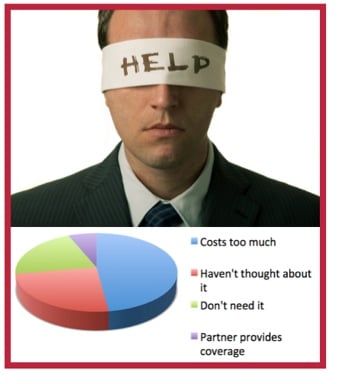

Life insurance coverage might not be the first thing you think of when considering your financial planning. However, it is an extremely important component of that planning. If the unexpected happens, the people you leave behind could be left with the very same financial hardships you’ve been working so hard to prevent, especially if you haven't put the proper life insurance in place. Sadly, as you'll see from the data below, most people fall into one of two categories: uninsured or underinsured.

Life insurance coverage might not be the first thing you think of when considering your financial planning. However, it is an extremely important component of that planning. If the unexpected happens, the people you leave behind could be left with the very same financial hardships you’ve been working so hard to prevent, especially if you haven't put the proper life insurance in place. Sadly, as you'll see from the data below, most people fall into one of two categories: uninsured or underinsured.

Who Can You Trust?

Who Can You Trust? That’s where your friends at American Insuring Group near Reading, PA can help. Our professional agents are committed to helping you understand what life insurance coverage you need for your spouse and family, and to finding an affordable life insurance policy that is well suited to your needs.

That’s where your friends at American Insuring Group near Reading, PA can help. Our professional agents are committed to helping you understand what life insurance coverage you need for your spouse and family, and to finding an affordable life insurance policy that is well suited to your needs. Back in the good old days, getting

Back in the good old days, getting  So why not just buy "Cheap Life Insurance" from those companies that constantly bombard you with ads for low cost life insurance? Why not call 1-800-Low-Cost-Life-Insurance and have them write the coverage you think you need? The reason is your family is too important for that! You need an Independent broker who represents many competing life insurance companies who offer many different types of life insurance policies for many different situations. More choices help ensure you get the best deal, and one that best meets your unique needs.

So why not just buy "Cheap Life Insurance" from those companies that constantly bombard you with ads for low cost life insurance? Why not call 1-800-Low-Cost-Life-Insurance and have them write the coverage you think you need? The reason is your family is too important for that! You need an Independent broker who represents many competing life insurance companies who offer many different types of life insurance policies for many different situations. More choices help ensure you get the best deal, and one that best meets your unique needs.