There is a lot of uncertainty these days regarding what is required under the Affordable Care Act, also known as ObamaCare. Businesses and individuals alike are concerned they may be penalized or miss out on important information needed to keep their health insurance in tact and affordable.

There is a lot of uncertainty these days regarding what is required under the Affordable Care Act, also known as ObamaCare. Businesses and individuals alike are concerned they may be penalized or miss out on important information needed to keep their health insurance in tact and affordable.

With that in mind, here are 10 things you should know:

- As of January 1st 2014, every person must be insured under a Qualified Health Insurance Plan.

- If Employer Coverage is not offered, it is the responsibility of the Individual to purchase insurance independent of their Employer.

- If a person is not insured in 2014, they will be faced with an Individual Tax penalty equal to $95/person or 1% of your taxable income…whichever is greater!

- The Initial Open Enrollment period ends March 31st, 2014.

- Health plans sold after January 1, 2014 must include a list of 10 Essential Health Benefits such as Maternity coverage, Mental Health coverage, Prescription coverage, Pediatric Dental coverage, etc.

- Health Plans will fall into 4 Metal Levels (Platinum, Gold, Silver, Bronze) and also include a catastrophic coverage option for those under 30 or for those meeting specific hardship guidelines.

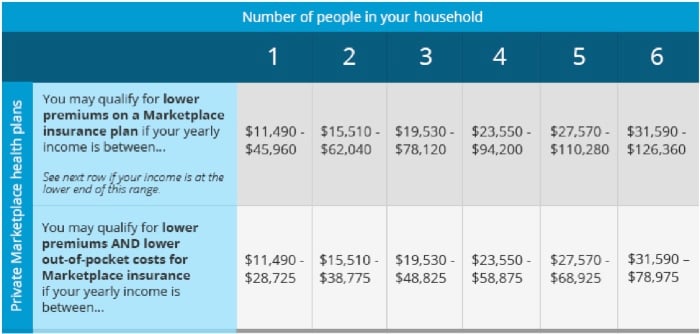

- There is premium assistance for people making between 100-400% of the Federal Poverty Level.

- In addition to premium assistance, there are cost sharing subsidies (reduction in deductibles and out-of-pocket expenses) for those between 100-250% of the Federal Poverty Level.

- The only way to claim the Premium Subsidy (Advance Premium Tax Credit) and the Cost Sharing Subsidies is to apply with the Federally Facilitated Marketplace (FFM).

- Because the FFM is temperamental, the best way to apply and evaluate your coverage options is to contact a CERTIFIED Licensed Producer for assistance.

Looking for help in obtaining the right health insurance coverage for your employees or family?

Looking for help in obtaining the right health insurance coverage for your employees or family?

Contact us today at American Insuring Group or request a free health insurance quote.

Do you want to become a burden to your family? Of course not.

Do you want to become a burden to your family? Of course not. If you want to ensure that you can live independently and not become a burden to your family and friends in the event that you need care over a long period of time, give us a call at

If you want to ensure that you can live independently and not become a burden to your family and friends in the event that you need care over a long period of time, give us a call at  According to a May 2013 report by the non-profit Council for Disability Awareness (CDA), there is a sharp mismatch between the high value employees place on their ability to earn a living vs. their financial preparedness to handle a disability that would threaten their income as evidenced by having adequate levels of disability insurance.

According to a May 2013 report by the non-profit Council for Disability Awareness (CDA), there is a sharp mismatch between the high value employees place on their ability to earn a living vs. their financial preparedness to handle a disability that would threaten their income as evidenced by having adequate levels of disability insurance. With the end of the year fast approaching, many employees are starting to become anxious. It’s that time of year again, the time when they get to tweak their health insurance benefits. While this may be exciting to some, the responsibility to choose the right health insurance plan can be a source of tension for others.

With the end of the year fast approaching, many employees are starting to become anxious. It’s that time of year again, the time when they get to tweak their health insurance benefits. While this may be exciting to some, the responsibility to choose the right health insurance plan can be a source of tension for others.

A section of The Affordable Care Act requires health insurance providers to spend at least 80 percent of dollars they receive from premiums on patient care, or be forced to send a rebate to patients. This may seem like a good deal for patients, but health economists say the provision can only lead to more expensive insurance.

A section of The Affordable Care Act requires health insurance providers to spend at least 80 percent of dollars they receive from premiums on patient care, or be forced to send a rebate to patients. This may seem like a good deal for patients, but health economists say the provision can only lead to more expensive insurance.