Most people don’t want to think about life insurance; it’s something they pay for and hope they never use. But, let’s face it - you just never know when life is going to throw you a curveball. It’s what makes life so incredibly exciting sometimes and so very scary at other times.

Most people don’t want to think about life insurance; it’s something they pay for and hope they never use. But, let’s face it - you just never know when life is going to throw you a curveball. It’s what makes life so incredibly exciting sometimes and so very scary at other times.

Insurance can help you and your family field many of life’s curveballs, but too many people don’t think about insurance until it’s too late. Here are three curveballs that the right insurance can help you and your family handle.

Early Death

Benjamin Franklin said, “In this world nothing can be said to be certain, except death and taxes.” We are all going to die; fortunately, the odds of dying at a young age are pretty slim. In fact, the odds of a 25-year-old American dying is about 1 in 3,000; for a 33-year-old, it’s 1 in 1,500; and for a 42-year-old, it’s 1 in 750. Comforting, right?

What if you have the misfortune of being one of the “1 in”? If you haven’t planned for this curveball, the financial consequences can be devastating to those you leave behind. Younger individuals often have additional debt, such as student loans and mortgages. Many have young children who still have a lifetime of expenses ahead of them. Life insurance can financially protect your loved ones.

Long Life

On the flip side of an early death, is living well into your 90’s or 100’s. Medical advances are allowing people to live longer, healthier lives. According to data compiled by the Social Security Administration:

- A man reaching age 65 today can expect to live, on average, until age 84.

- A woman turning age 65 today can expect to live, on average, until age 86.

And those are just averages. About one out of every four 65-year-olds today will live past age 90, and one out of 10 will live past age 95. Traditionally, most people expected about 15 years of retirement. Today, it can be 20, 30, or even longer. This is awesome, right?

Absolutely - if you’ve prepared for this particular curveball. A permanent life insurance policy can provide much-needed funds to help supplement your retirement income. You can also get a long-term care rider on permanent life insurance that can help cover long-term care costs.

Becoming Disabled

Your chances of becoming disabled are probably higher than you think. According to the Council for Disability awareness:

- Just over 1 in 4 of today's 20 year-olds will become disabled before they retire.

- One in eight workers will be disabled for five years or more during their working careers.

Are you prepared this curveball? Probably not.

• The average group long-term disability claim lasts 34.6 months.

• 5% of working Americans say they could not cover normal living expenses even for a year if their employment income was lost; 38% could not pay their bills for more than 3 months.

The Case for Disability Insurance

Disability insurance is important to help you make ends meet until you’re able to go back to work. Plus, many life insurance policies allow you to add a disability waiver to cover certain expenses if you become disabled, and some permanent life insurance policies have a premium waiver in the event you become disabled.

Insurance Protection for Those Curveballs!

Insurance Protection for Those Curveballs!

American Insuring Group can help protect you and your family from life’s unexpected curveballs. Contact us by email or give us a call at (800) 947-1270 or (610) 775-3848.

Have you ever wondered what factors determine your

Have you ever wondered what factors determine your  Ready to Talk Life Insurance?

Ready to Talk Life Insurance? A new year is a great time for reflection and fresh starts. It’s the perfect time to put the past behind you and look toward the future. Compared to losing those extra 20 pounds, protecting your family in the event of a death is a surprisingly easy New Year’s resolution.

A new year is a great time for reflection and fresh starts. It’s the perfect time to put the past behind you and look toward the future. Compared to losing those extra 20 pounds, protecting your family in the event of a death is a surprisingly easy New Year’s resolution.  Looking to the future by protecting your family with life insurance is one of the easiest and most selfless resolutions you can make. Make it a goal to protect your family with the right life insurance.

Looking to the future by protecting your family with life insurance is one of the easiest and most selfless resolutions you can make. Make it a goal to protect your family with the right life insurance.  Great employees can be the fuel to move your business ahead of the competition. Dedicated employees add more and more value over time as they gain increased knowledge and experience. While everyone likes a company that offers great benefits, the best employees and job candidates are likely to view the quality of the benefits you offer as a compelling reason to join, remain at, or leave your firm.

Great employees can be the fuel to move your business ahead of the competition. Dedicated employees add more and more value over time as they gain increased knowledge and experience. While everyone likes a company that offers great benefits, the best employees and job candidates are likely to view the quality of the benefits you offer as a compelling reason to join, remain at, or leave your firm.

Life insurance. It's one of those decisions that can be so easy to ignore, a can we like to kick down the road, whether that road hails from Philadelphia, Reading, Allentown, Lancaster or beyond. If you've been procrastinating about resolving your life insurance needs, then this article is for you. Let's think this through and get that monkey off your back, shall we?

Life insurance. It's one of those decisions that can be so easy to ignore, a can we like to kick down the road, whether that road hails from Philadelphia, Reading, Allentown, Lancaster or beyond. If you've been procrastinating about resolving your life insurance needs, then this article is for you. Let's think this through and get that monkey off your back, shall we? Contact Us

Contact Us An affordable policy can help you save money without straining your budget. Here are seven tips to help you pay less for insurance:

An affordable policy can help you save money without straining your budget. Here are seven tips to help you pay less for insurance:

With the large baby boom generation entering retirement age, retirement planning is getting more and more attention. Interestingly, while marriage is still the leading cause for people to buy life insurance, retirement is also a major motivation. In fact, research from Northwestern Mutual Life, as conducted by Harris Interactive, shows that 25 percent of people buy life insurance products when they enter retirement -- almost as much as the 32 percent of people that buy it after getting married.

With the large baby boom generation entering retirement age, retirement planning is getting more and more attention. Interestingly, while marriage is still the leading cause for people to buy life insurance, retirement is also a major motivation. In fact, research from Northwestern Mutual Life, as conducted by Harris Interactive, shows that 25 percent of people buy life insurance products when they enter retirement -- almost as much as the 32 percent of people that buy it after getting married.

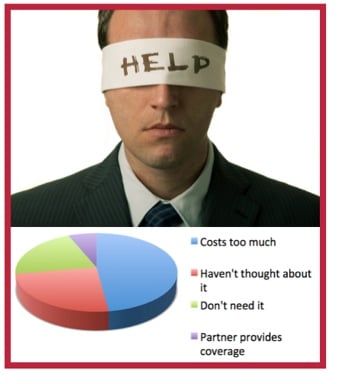

Life insurance coverage might not be the first thing you think of when considering your financial planning. However, it is an extremely important component of that planning. If the unexpected happens, the people you leave behind could be left with the very same financial hardships you’ve been working so hard to prevent, especially if you haven't put the proper life insurance in place. Sadly, as you'll see from the data below, most people fall into one of two categories: uninsured or underinsured.

Life insurance coverage might not be the first thing you think of when considering your financial planning. However, it is an extremely important component of that planning. If the unexpected happens, the people you leave behind could be left with the very same financial hardships you’ve been working so hard to prevent, especially if you haven't put the proper life insurance in place. Sadly, as you'll see from the data below, most people fall into one of two categories: uninsured or underinsured.

Who Can You Trust?

Who Can You Trust? That’s where your friends at American Insuring Group near Reading, PA can help. Our professional agents are committed to helping you understand what life insurance coverage you need for your spouse and family, and to finding an affordable life insurance policy that is well suited to your needs.

That’s where your friends at American Insuring Group near Reading, PA can help. Our professional agents are committed to helping you understand what life insurance coverage you need for your spouse and family, and to finding an affordable life insurance policy that is well suited to your needs. Back in the good old days, getting

Back in the good old days, getting  So why not just buy "Cheap Life Insurance" from those companies that constantly bombard you with ads for low cost life insurance? Why not call 1-800-Low-Cost-Life-Insurance and have them write the coverage you think you need? The reason is your family is too important for that! You need an Independent broker who represents many competing life insurance companies who offer many different types of life insurance policies for many different situations. More choices help ensure you get the best deal, and one that best meets your unique needs.

So why not just buy "Cheap Life Insurance" from those companies that constantly bombard you with ads for low cost life insurance? Why not call 1-800-Low-Cost-Life-Insurance and have them write the coverage you think you need? The reason is your family is too important for that! You need an Independent broker who represents many competing life insurance companies who offer many different types of life insurance policies for many different situations. More choices help ensure you get the best deal, and one that best meets your unique needs.