It's obvious that having the right commercial property insurance is key to protecting your business against unforeseen risks. But have you taken practical steps to reduce the potential impact of storms, floods, earthquakes, or other natural disasters beyond obtaining insurance?

It's obvious that having the right commercial property insurance is key to protecting your business against unforeseen risks. But have you taken practical steps to reduce the potential impact of storms, floods, earthquakes, or other natural disasters beyond obtaining insurance?

By combining the right property insurance with responsible disaster planning you greatly increase your odds of weathering a disaster with minimal loss to your business.

While reducing your business exposure to major disruptions from natural disasters takes careful planning, it is not necessarily expensive. Having solid plans can make the difference between days vs. weeks of serious business disruption and loss of income.

Here are some tips to help your business recover more quickly from a natural disaster:

Perform a Risk/Impact Analysis & Create a To-Do List

Begin by creating a list of natural disasters that could impact your business. Rank them from high to low in terms of likelihood, and then separately by the amount of impact (harm) they could have on your business. Next, identify what can be done to address the more likely ones first. Of the more likely ones, address them in order of the potential harm they could cause your business.

Example:

If your business is in a flood plain or low lying area then your exposure to flood or water damage will be greater than if you are located on high ground. If a flood were to occur, how much damage could be caused? How long would it take to recover? Do you have expensive electronic equipment on the first floor or basement? Could it be moved to the second floor? Could you alter the landscape in such a way as to divert water away from your building so as to avert damage?

Example:

Are you in an area susceptible to damaging high winds, hurricanes, or tornadoes? Could a heavy snowfall of a foot or more cause damage or leaks to your roof that could ruin equipment or force portions of your office or factory to become unusable for a period of time?

Create a Disaster Emergency Plan

Your emergency plan may not have to be elaborate. Even a simple, well-thought-out plan can be of tremendous benefit when needed. Be sure that your employees know their part in the plan, and have easy access to the documentation (I.e., to the portion of the documentation that applies to them or to their department). Among other details, your plan should include:

- An evacuation plan and designated meeting location.

- A list of cell and home phone numbers of managers and key employees.

- A description of who is responsible for taking various actions, including identifying the point person(s) responsible for contacting the media, emergency personnel, key customers and suppliers, department heads, and employees.

- A data recovery plan (consider backing up all data on the cloud daily so it can be accessed remotely even if your internal computer system is destroyed). Identify and rank the key types of data in terms of importance to your business continuity.

- A description of how the business will perform certain key functions off site, including things that could be outsourced. Break it down by department (customer service, accounts payable, accounts receivable, production planning, manufacturing, distribution, I.T., etc.).

After you have completed the basic plan above, or at least an outline, consider contacting a disaster recovery specialist who can identify weaknesses in your plan, and suggest appropriate remedies.

Perform a Commercial Property Insurance Review

Your independent insurance agent can perform an insurance vulnerability analysis for all types of insurance coverage across your business that may be needed in the event of a natural disaster. This includes basic property insurance, business interruption insurance, spoilage insurance, inventory insurance, and other forms of expanded insurance coverage. Your level of coverage should not only be adequate for your current level of business, but also for the projected level of business to cover you properly until the date of the next scheduled insurance review (annual or otherwise).

Contact Us - We're Commercial Insurance Experts You Can Trust

When it comes to commercial property insurance and other types of business insurance, you can't do better than the independent agents at American Insuring Group. As independent agents, we work for you, not an insurance company. We'll identify the right combination of business insurance policies from many insurance carriers, and put together a plan that fits your needs and budget. See why more business owners in Philadelphia, Reading, Lancaster, York, Harrisburg, Allentown, Pittsburgh, Erie and beyond rely on us for all their commercial insurance needs.

Contact us today: (800) 977-1270 or (610) 775-3848

Dirty Harry Was Right About Disability Insurance

Dirty Harry Was Right About Disability Insurance

Life insurance. It's one of those decisions that can be so easy to ignore, a can we like to kick down the road, whether that road hails from Philadelphia, Reading, Allentown, Lancaster or beyond. If you've been procrastinating about resolving your life insurance needs, then this article is for you. Let's think this through and get that monkey off your back, shall we?

Life insurance. It's one of those decisions that can be so easy to ignore, a can we like to kick down the road, whether that road hails from Philadelphia, Reading, Allentown, Lancaster or beyond. If you've been procrastinating about resolving your life insurance needs, then this article is for you. Let's think this through and get that monkey off your back, shall we? Contact Us

Contact Us The

The

Too Busy to Assess Your Risk?

Too Busy to Assess Your Risk? Hurricane Sandy was one of the most destructive and deadliest hurricanes in United States history. Twenty-four American states and seven other countries were affected. Coastal towns once pulsing with beachcombers by day and clubbers by night were submerged within hours. Businesses were out of operation for much longer than ever anticipated and the damages sustained were astronomical.

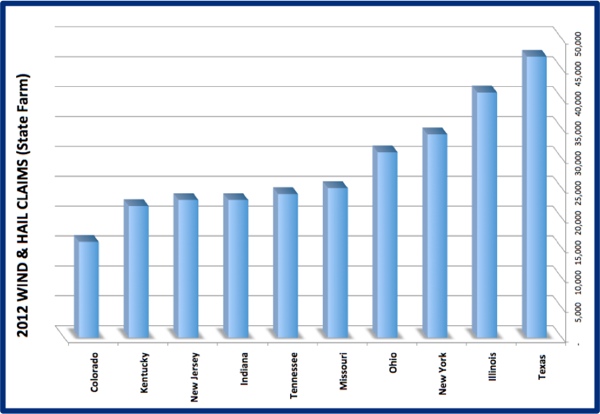

Hurricane Sandy was one of the most destructive and deadliest hurricanes in United States history. Twenty-four American states and seven other countries were affected. Coastal towns once pulsing with beachcombers by day and clubbers by night were submerged within hours. Businesses were out of operation for much longer than ever anticipated and the damages sustained were astronomical. It's Not Just About the Midwest

It's Not Just About the Midwest

According to a May 2013 report by the non-profit Council for Disability Awareness (CDA), there is a sharp mismatch between the high value employees place on their ability to earn a living vs. their financial preparedness to handle a disability that would threaten their income as evidenced by having adequate levels of disability insurance.

According to a May 2013 report by the non-profit Council for Disability Awareness (CDA), there is a sharp mismatch between the high value employees place on their ability to earn a living vs. their financial preparedness to handle a disability that would threaten their income as evidenced by having adequate levels of disability insurance. GAP insurance may be a wise choice in cases where a low down payment has been made, and on high-interest loans of 60 months or more. It is often offered by finance companies at time of purchase, and by auto insurance companies. This loan scenario frequently applies to vehicle purchases, which is why the term “GAP insurance” most often refers to added insurance protection for a vehicle.

GAP insurance may be a wise choice in cases where a low down payment has been made, and on high-interest loans of 60 months or more. It is often offered by finance companies at time of purchase, and by auto insurance companies. This loan scenario frequently applies to vehicle purchases, which is why the term “GAP insurance” most often refers to added insurance protection for a vehicle.