Life Insurance - It's "Booming"!

With the large baby boom generation entering retirement age, retirement planning is getting more and more attention. Interestingly, while marriage is still the leading cause for people to buy life insurance, retirement is also a major motivation. In fact, research from Northwestern Mutual Life, as conducted by Harris Interactive, shows that 25 percent of people buy life insurance products when they enter retirement -- almost as much as the 32 percent of people that buy it after getting married.

With the large baby boom generation entering retirement age, retirement planning is getting more and more attention. Interestingly, while marriage is still the leading cause for people to buy life insurance, retirement is also a major motivation. In fact, research from Northwestern Mutual Life, as conducted by Harris Interactive, shows that 25 percent of people buy life insurance products when they enter retirement -- almost as much as the 32 percent of people that buy it after getting married.

Income and Retirement

On first glance, this may seem a bit counter intuitive. After all, many people buy insurance when they are younger to protect their spouses and family against a loss of income and Northwestern Mutual's research bears this out. As people age, protecting their incomes from work becomes less important as their living expenses drop and income from their retirement portfolio begins to replace wages.

Retirement today is more complicated than in the past. Today, many retired people still work, although they may work reduced hours or switch careers. This can create a need to secure income. In fact, many of the retired people that purchase life insurance cite a desire for income security as a major motivating factor.

Making Money on Life Insurance... Without Having to Die

Purchasing a life policy can do much more than protect income. It can also augment existing income. Products that include an annuity feature provide yearly cash payments that provide retired couples with more money and a more fulfilling lifestyle. Whole life and universal life insurance products can be smart savings vehicles, building value and earning very secure returns while also providing a death benefit like other types of life coverage.

Insuring the Life of a Business

Life insurance coverage is especially valuable as an estate tax planning tool for retired people with businesses or large tangible assets but that also have comparatively small pools of cash, securities or other types of liquid assets. When people in this situation die, their heirs inherit their assets but will have to pay an onerous estate tax on the value of assets transferred to them that exceed any exclusion. Without cash, they would have to sell the asset or business to pay the estate tax liability. To mitigate against this eventuality, some retired asset holder purchase additional life insurance. Upon their passing, the insurance pays a tax-free death benefit which their heirs can use to pay the estate tax, leaving them the ability to retain the assets.

With all of these benefits, it is not surprising that 25 percent of retired couples are purchasing and benefiting from life insurance. As more people discover its benefits, it stands to become even more popular.

Do you need better life insurance coverage?

We can help. Contact us at 800-947-1270 to review your options.

With the end of the year fast approaching, many employees are starting to become anxious. It’s that time of year again, the time when they get to tweak their health insurance benefits. While this may be exciting to some, the responsibility to choose the right health insurance plan can be a source of tension for others.

With the end of the year fast approaching, many employees are starting to become anxious. It’s that time of year again, the time when they get to tweak their health insurance benefits. While this may be exciting to some, the responsibility to choose the right health insurance plan can be a source of tension for others.

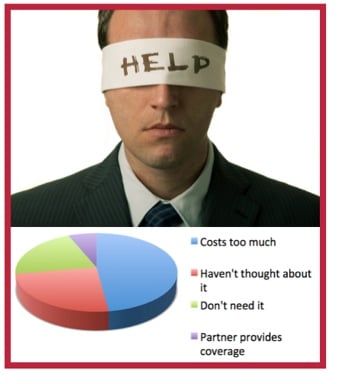

Life insurance coverage might not be the first thing you think of when considering your financial planning. However, it is an extremely important component of that planning. If the unexpected happens, the people you leave behind could be left with the very same financial hardships you’ve been working so hard to prevent, especially if you haven't put the proper life insurance in place. Sadly, as you'll see from the data below, most people fall into one of two categories: uninsured or underinsured.

Life insurance coverage might not be the first thing you think of when considering your financial planning. However, it is an extremely important component of that planning. If the unexpected happens, the people you leave behind could be left with the very same financial hardships you’ve been working so hard to prevent, especially if you haven't put the proper life insurance in place. Sadly, as you'll see from the data below, most people fall into one of two categories: uninsured or underinsured.

For most small businesses, workers compensation insurance costs can eat up a fair percentage of their income. While this type of coverage is essential, especially for riskier professions, there are a few ways to minimize your workers comp insurance expenditures without sacrificing the level of coverage necessary for your enterprise.

For most small businesses, workers compensation insurance costs can eat up a fair percentage of their income. While this type of coverage is essential, especially for riskier professions, there are a few ways to minimize your workers comp insurance expenditures without sacrificing the level of coverage necessary for your enterprise. According to WFMZ-TV: "

According to WFMZ-TV: " Not really. Anyone can apply to insure a commercial vehicle, (for example, a van), but they will find they are restricted when it comes to personal or private use of that vehicle. As long as the vehicle falls under commercial use, like delivering goods or providing a service (say, if the owner is a builder just using the van to get from A to B) then it is much easier to obtain insurance than if the applicant also wanted the vehicle for private use.

Not really. Anyone can apply to insure a commercial vehicle, (for example, a van), but they will find they are restricted when it comes to personal or private use of that vehicle. As long as the vehicle falls under commercial use, like delivering goods or providing a service (say, if the owner is a builder just using the van to get from A to B) then it is much easier to obtain insurance than if the applicant also wanted the vehicle for private use.

Purchasing workers compensation insurance can be a potential minefield for some businesses, who often don’t know where to start and can feel like they’re going in blind without a workers comp specialist to guide them along the way. It can seem like a daunting, upward struggle, especially since some insurance companies and agents won’t even consider writing workers compensation insurance – and they have their reasons - but with the right insurance broker, applicants can get through the process scratch-free.

Purchasing workers compensation insurance can be a potential minefield for some businesses, who often don’t know where to start and can feel like they’re going in blind without a workers comp specialist to guide them along the way. It can seem like a daunting, upward struggle, especially since some insurance companies and agents won’t even consider writing workers compensation insurance – and they have their reasons - but with the right insurance broker, applicants can get through the process scratch-free.

A section of The Affordable Care Act requires health insurance providers to spend at least 80 percent of dollars they receive from premiums on patient care, or be forced to send a rebate to patients. This may seem like a good deal for patients, but health economists say the provision can only lead to more expensive insurance.

A section of The Affordable Care Act requires health insurance providers to spend at least 80 percent of dollars they receive from premiums on patient care, or be forced to send a rebate to patients. This may seem like a good deal for patients, but health economists say the provision can only lead to more expensive insurance.

When looking into insuring a company car, van, or pickup, you will find commercial vehicle insurance and regular auto insurance are entirely different animals. But although the products available differ greatly, the basic principles apply when it comes to finding the best policy for a particular small business – be it auto insurance for a private, or commercial vehicle.

When looking into insuring a company car, van, or pickup, you will find commercial vehicle insurance and regular auto insurance are entirely different animals. But although the products available differ greatly, the basic principles apply when it comes to finding the best policy for a particular small business – be it auto insurance for a private, or commercial vehicle.

Many businesses are dependent on their stock; without inventory, there can be no sales, and without sales, there is no income, so insuring one's inventory can be critically important. Depending on the type of business, a wide array of products and quality stock could be at risk from unforeseen disasters such as fires or flooding. So, it makes good sense to take out a commercial property insurance policy covering the entire range of your inventory.

Many businesses are dependent on their stock; without inventory, there can be no sales, and without sales, there is no income, so insuring one's inventory can be critically important. Depending on the type of business, a wide array of products and quality stock could be at risk from unforeseen disasters such as fires or flooding. So, it makes good sense to take out a commercial property insurance policy covering the entire range of your inventory.