Have you recently started a new business, or perhaps suddenly come to the realization that your personal vehicle insurance may not fully protect you when using your car, van, or truck for business purposes?

Commercial Vehicle Insurance Coverage Differs by Company

Although each insurance company has different guidelines for determining to what extent your personal vehicle may be insured when used for commercial purposes, it is nonetheless risky to assume your personal vehicle will be properly covered, if it is covered at all. Rather than taking chances, consult an independent insurance agent to learn the details of your coverage, and to select the best insurance company and policy to meet your commercial insurance needs.

Although each insurance company has different guidelines for determining to what extent your personal vehicle may be insured when used for commercial purposes, it is nonetheless risky to assume your personal vehicle will be properly covered, if it is covered at all. Rather than taking chances, consult an independent insurance agent to learn the details of your coverage, and to select the best insurance company and policy to meet your commercial insurance needs.

How to Know if Your Vehicle Use is Commercial or Personal

The most obvious indicator that you are using your vehicle for business purposes occurs when you are using your car, van, truck, or other vehicle to transport merchandise or people, or to perform services for a fee.

For example, if you are using your vehicle to:

- Deliver flowers or restaurant food, such as pizza or other food items

- Perform landscaping services, such as delivering workers and/or materials

- Perform snow removal services

- Tow a trailer used for business purposes

- Travel to customers for sales calls or to perform consulting services

Who is Covered Under a Commercial Vehicle Insurance Policy?

Unlike a personal policy, commercial vehicle policies allow you to cover any of your employees when your vehicle is used for business purposes. If your vehicle is driven by employees, that’s a sure sign that you need a commercial policy. Likewise, if your vehicle is owned under a corporate partnership, or used to haul heavy equipment, or to make deliveries requiring federal or state filings, then you definitely need commercial vehicle insurance protection.

Amount of Vehicle Insurance You Need for Business vs. Personal Use

Commercial vehicle insurance policies generally provide greater protection than personal policies, with higher liability limits. However, it’s very important to make sure you are fully protected for both business and personal use if your vehicle is used for both.

Don’t Take Chances!

By now we hope you are thoroughly convinced that it is not worth taking chances with your commercial vehicle insurance coverage. Whether you hail from a larger city like Philadelphia or Allentown, or smaller areas like Reading or Lancaster, you need the right insurance protection. Please don't take chances with your future.

To learn more about commercial insurance for your car, van, truck, or commercial fleet, click here. Or, contact us online. You may also reach us at (610) 775-3848. We’re independent insurance agents who stand ready to help you find the insurance protection that’s right for you, your budget, and your business.

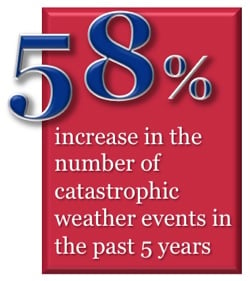

Why the Big Homeowner’s Insurance Cost Increases?

Why the Big Homeowner’s Insurance Cost Increases? Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

As the owner of a commercial building, any permanent upgrades made to your property by a tenant become your property, not the tenant’s property. This may seem obvious, but consider the impact should damage be done to such improvements during the tenant’s leasing period. Whose insurance will pay for the repair or replacement cost? Will either insurance policy pay? Will both pay? Can you live with the uncertainty of not knowing?

As the owner of a commercial building, any permanent upgrades made to your property by a tenant become your property, not the tenant’s property. This may seem obvious, but consider the impact should damage be done to such improvements during the tenant’s leasing period. Whose insurance will pay for the repair or replacement cost? Will either insurance policy pay? Will both pay? Can you live with the uncertainty of not knowing? Providing workers compensation insurance for employees can be a significant expense, especially in industries prone to serious injuries, such as those requiring heavy or potentially dangerous machinery. While some employers may be tempted to misclassify workers as independent contractors rather than as employees in order to avoid worker’s comp insurance and other costs, the penalties for misclassifying employees as independent contractors can be severe.

Providing workers compensation insurance for employees can be a significant expense, especially in industries prone to serious injuries, such as those requiring heavy or potentially dangerous machinery. While some employers may be tempted to misclassify workers as independent contractors rather than as employees in order to avoid worker’s comp insurance and other costs, the penalties for misclassifying employees as independent contractors can be severe.

Having the proper business insurance can be vital to growing your company and protecting your future. While every business varies in terms of exposure to risk and the related cost of coverage, knowing the 5 key cost drivers can help you reduce your insurance costs, whether you are in a mid-sized city like Reading or Allentown, a smaller city like York or Lancaster, or a large city like Philadelphia, especially if you consider costs before launching your business.

Having the proper business insurance can be vital to growing your company and protecting your future. While every business varies in terms of exposure to risk and the related cost of coverage, knowing the 5 key cost drivers can help you reduce your insurance costs, whether you are in a mid-sized city like Reading or Allentown, a smaller city like York or Lancaster, or a large city like Philadelphia, especially if you consider costs before launching your business. Ah, but think of it this way: wouldn’t it be great to have the peace of mind of knowing that you are financially covered against many of the uncertainties life can throw at you? Isn’t that better than the nagging feeling that you may be unprotected against some unknown liability for which you failed to get the needed business insurance protection?

Ah, but think of it this way: wouldn’t it be great to have the peace of mind of knowing that you are financially covered against many of the uncertainties life can throw at you? Isn’t that better than the nagging feeling that you may be unprotected against some unknown liability for which you failed to get the needed business insurance protection?

Are You at Risk?

Are You at Risk?

5 Easy Steps to Better Public Liability Insurance Protection & Greater Savings:

5 Easy Steps to Better Public Liability Insurance Protection & Greater Savings:

An affordable policy can help you save money without straining your budget. Here are seven tips to help you pay less for insurance:

An affordable policy can help you save money without straining your budget. Here are seven tips to help you pay less for insurance: