How Much Commercial Insurance Protection Do You Need?

If you’re considering starting or have already established a business, you may be wondering, “Do I really need any special liability insurance for my business?” Establishing and growing a business is hard work. It’s an investment of time and money, and it’s important to protect that hard work against unforeseen circumstances. Even though we may not want to think about it, like Forrest Gump said, “stuff” happens. Even if you work from home and think your home owner’s insurance covers you or if you’ve filed as an LLC to protect your assets, your business may not be as safe from catastrophic loss and possible bankruptcy as you think.

If you’re considering starting or have already established a business, you may be wondering, “Do I really need any special liability insurance for my business?” Establishing and growing a business is hard work. It’s an investment of time and money, and it’s important to protect that hard work against unforeseen circumstances. Even though we may not want to think about it, like Forrest Gump said, “stuff” happens. Even if you work from home and think your home owner’s insurance covers you or if you’ve filed as an LLC to protect your assets, your business may not be as safe from catastrophic loss and possible bankruptcy as you think.

Business Insurance When You're Unable to Work

What if you become sick and can’t work? What if one of your customers sues you? What if a fire forces you to shut your business down for a period of time? Have you thought about how you will protect your finances, your business, and your employees? The right insurance can help protect these very important assets. Here are four major categories of business insurance protection you, as a business owner, need to consider.

Business Liability Insurance (A.k.a. Commercial General Business Liability)

Liability insurance helps protect your company if someone gets hurt on your property or if you or an employee causes property damage or injury. Liability insurance also protects you as a tenant if you cause damage to a property you rent, and it covers claims of false or misleading advertising, including libel, slander, and copyright infringement. This insurance helps cover medical and legal defense costs and settlements if you are successfully sued.

Many small business owners can’t imagine ever being sued, but the fact is that we live in a very litigious society. Liability insurance is a wise and affordable investment for any business. It can be purchased individually or included as part of a Business Owner’s Policy (BOP) that combines liability and property insurance into one policy. It’s a good idea to make sure you have enough liability coverage if you have a BOP.

Umbrella Liability Insurance

Umbrella liability insurance is designed to protect your business against catastrophic losses that exceed the limits of other policies or for losses not covered by other policies. Think of it as an upgrade to your existing business, homeowners, and auto insurance that goes above and beyond.

Business Interruption Insurance

Business interruption insurance helps protect against financial loss in the event that your business is prevented from generating revenue. It helps pay for operating costs (such as rent, utilities, and payroll) and lost profits if your business is forced to shut down for an extended period of time, such as during a natural disaster that either forces your business to close or requires repairs to be made to the property before business can resume. Business interruption insurance can be added to your property insurance policy or purchased as part of a BOP.

Overhead Insurance

Overhead insurance is designed to protect the operations of your business if you suffer from a major accident or illness and become unable to work. Overhead insurance helps cover business expenses such as salaries, utilities, interest payments, insurance premiums, and rental payments.

Putting Together a Business Insurance Plan

You’ve worked hard to make your business a success. Don’t let someone or something take it all away from you. Take the necessary steps to protect it with the right business insurance.

Free Report: 7 Things You Must Know to Protect Your Businesss

For more information, click here for our report, 7 Things You Must Know to Protect Your Business.

Need help in figuring out the right level of insurance to properly protect your business? Call us today at (800) 947-1270 or (610) 775-3848 or Contact Us by email. We're independent agents representing over 25 brands of insurance. We'll find the right coverage at the right price to meet your needs.

It's obvious that having the right commercial property insurance is key to protecting your business against unforeseen risks. But have you taken practical steps to reduce the potential impact of storms, floods, earthquakes, or other natural disasters beyond obtaining insurance?

It's obvious that having the right commercial property insurance is key to protecting your business against unforeseen risks. But have you taken practical steps to reduce the potential impact of storms, floods, earthquakes, or other natural disasters beyond obtaining insurance?

Dirty Harry Was Right About Disability Insurance

Dirty Harry Was Right About Disability Insurance

The

The

Too Busy to Assess Your Risk?

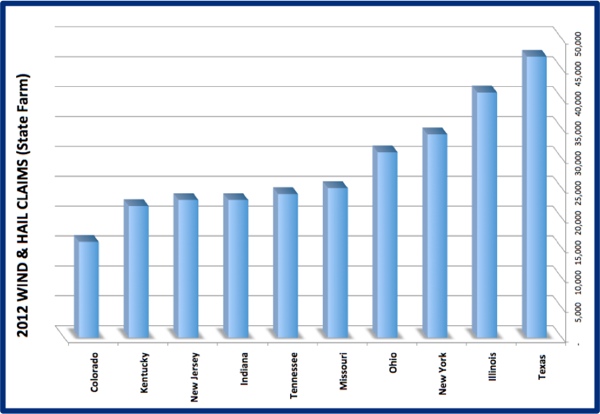

Too Busy to Assess Your Risk? Hurricane Sandy was one of the most destructive and deadliest hurricanes in United States history. Twenty-four American states and seven other countries were affected. Coastal towns once pulsing with beachcombers by day and clubbers by night were submerged within hours. Businesses were out of operation for much longer than ever anticipated and the damages sustained were astronomical.

Hurricane Sandy was one of the most destructive and deadliest hurricanes in United States history. Twenty-four American states and seven other countries were affected. Coastal towns once pulsing with beachcombers by day and clubbers by night were submerged within hours. Businesses were out of operation for much longer than ever anticipated and the damages sustained were astronomical. It's Not Just About the Midwest

It's Not Just About the Midwest

Although each insurance company has different guidelines for determining to what extent your personal vehicle may be insured when used for commercial purposes, it is nonetheless risky to assume your personal vehicle will be properly covered, if it is covered at all. Rather than taking chances, consult an independent insurance agent to learn the details of your coverage, and to select the best insurance company and policy to meet your commercial insurance needs.

Although each insurance company has different guidelines for determining to what extent your personal vehicle may be insured when used for commercial purposes, it is nonetheless risky to assume your personal vehicle will be properly covered, if it is covered at all. Rather than taking chances, consult an independent insurance agent to learn the details of your coverage, and to select the best insurance company and policy to meet your commercial insurance needs.

As the owner of a commercial building, any permanent upgrades made to your property by a tenant become your property, not the tenant’s property. This may seem obvious, but consider the impact should damage be done to such improvements during the tenant’s leasing period. Whose insurance will pay for the repair or replacement cost? Will either insurance policy pay? Will both pay? Can you live with the uncertainty of not knowing?

As the owner of a commercial building, any permanent upgrades made to your property by a tenant become your property, not the tenant’s property. This may seem obvious, but consider the impact should damage be done to such improvements during the tenant’s leasing period. Whose insurance will pay for the repair or replacement cost? Will either insurance policy pay? Will both pay? Can you live with the uncertainty of not knowing?