If you’re like most Americans, your life is pretty good right now (probably a lot better than you realize), and you see no reason why that should change in the foreseeable future. Now imagine being blindsided by a serious illness that takes away your good health and puts a significant dent in your income.

If you’re like most Americans, your life is pretty good right now (probably a lot better than you realize), and you see no reason why that should change in the foreseeable future. Now imagine being blindsided by a serious illness that takes away your good health and puts a significant dent in your income.

This is not some doomsday scenario; it happens often. And it can leave a trail of financial stress that can impede the healing process.

Dr. Marius Barnard, the famous South African cardiac surgeon, saw first-hand the effects of the financial and emotional stress of serious illnesses on his patients, and in 1983 he came up with the idea of critical illness insurance, a special form of health insurance, as a way to counteract it.

What is Critical Illness Insurance?

If you are ever diagnosed with a life-altering illness that has been pre-specified in your policy, Critical Illness Insurance will provide you with a lump-sum payment that you can use any way you choose.

Although your health insurace plan will identify what is covered, the following illnesses are typically included:

- Heart attack

- Stroke

- Cancer

- Multiple Sclerosis (MS)

- Organ transplants

- Parkinson’s disease

- Alzheimer’s disease

- HIV treatments

- Blindness

The advantages of critical illness insurance

Your health insurance should pay the bulk of your medical expenses, but think about all the things it doesn’t cover—this is the biggest advantage to critical illness insurance. The lump sum payout from your plan can ensure that you don’t have to face any financial disruptions in addition to coping with a serious medical condition.

Consider these five ways that Critical Illness Insurance can be an economic lifesaver:

- You may have to travel for treatment. Depending on your illness, your doctor may recommend an out-of-state hospital with a successful track record in treating your condition. Without savings or a payout from a critical illness insurance plan, you could be forced to run up your credit card for airfares, hotels, and meals. It might take years to pay off these expenses after you recover.

- You’ll need to pay what your health insurance doesn’t. Copays and deductibles are becoming larger as health insurance premiums increase. And there are always other out-of-pocket expenses with which to contend.

- You’ll need to make your mortgage payments. If you’re like most people, you have a life insurance policy that pays off your mortgage if you die. But like any set of statistics will show, if you are younger, you are much more likely to be disabled by an illness than to die. Part of a lump sum payment could be used to make your mortgage payments while you heal. Imagine the peace of mind that would come from knowing that you and your family can continue living in your house even though you can’t work.

- Modify your home or car. Some critical illnesses—MS, for instance—can take away your mobility. Retrofitting your home or car can restore some of it, but it will be expensive (stair lifts alone can cost $5,000). Doorways may need to be widened to accommodate a wheelchair, and ramps will need to replace steps in some areas of the house. A van that allows wheelchair access to the driver’s seat and hand controls could reach $50,000.

- Maintaining your lifestyle. Everyone gets used to a particular way of life. And when a critical illness hampers it, it can cause emotional distress for the whole family. With the payout you’ll receive, a critical illness health insurance plan can eliminate any worries about your lost income during a critical illness.

In Summary:

Your family will have peace of mind, and you can concentrate on getting better if you have properly planned for a critical illness. Knowing that insurance has covered your financial needs after a critical illness diagnosis will remove any financial stress and facilitate your recovery.

We Can Help With Any Health Insurance Need

To learn more about Critical Illness Insurance, or for any health insurance need, contact American Insuring Group online or call us at (800) 947-1270 or (610) 775-3848.

To learn more about Critical Illness Insurance, or for any health insurance need, contact American Insuring Group online or call us at (800) 947-1270 or (610) 775-3848.

We'll research plans from across many competing health insurance providers to find the best insurance policy that meets your needs and your budget.

Call or click today to get started!

Bill is 50-year-old department manager for a mid-sized manufacturer. Even though he has never been seriously ill and has a clean family health history, he was recently told that he has cancer.

Bill is 50-year-old department manager for a mid-sized manufacturer. Even though he has never been seriously ill and has a clean family health history, he was recently told that he has cancer. Get the Right Disability Insurance Coverage

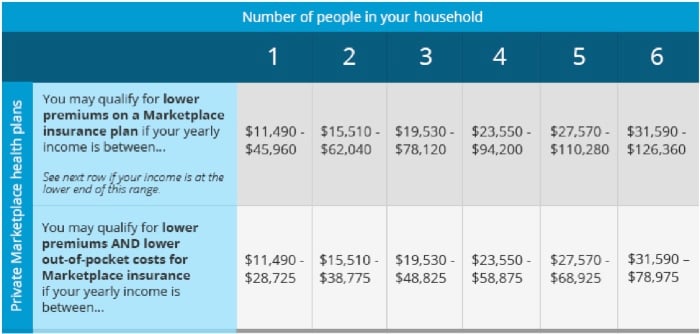

Get the Right Disability Insurance Coverage Do you live under a rock? No? Then it’s pretty safe to say that you’ve heard about the Affordable Care Act (ACA) – Also known as Obamacare - that was signed into law in March 2010.

Do you live under a rock? No? Then it’s pretty safe to say that you’ve heard about the Affordable Care Act (ACA) – Also known as Obamacare - that was signed into law in March 2010.  Get Help - Find the Right Health Insurance for Your Small Business

Get Help - Find the Right Health Insurance for Your Small Business

Our world is changing. The “typical” family has changed and people are living much longer due to advances in medicine. These two ingredients have created a new generation – known as the Sandwich Generation. Gone are the days when a “typical” family consisted of a working husband, a stay-at-home wife and a couple of children.

Our world is changing. The “typical” family has changed and people are living much longer due to advances in medicine. These two ingredients have created a new generation – known as the Sandwich Generation. Gone are the days when a “typical” family consisted of a working husband, a stay-at-home wife and a couple of children.

Let's Get Honest About Disability Insurance

Let's Get Honest About Disability Insurance The average long-term disability claim is 34.6 months (just shy of 3 years!). If you rely on your paycheck (and who doesn't?) you should have disability insurance.

The average long-term disability claim is 34.6 months (just shy of 3 years!). If you rely on your paycheck (and who doesn't?) you should have disability insurance.  How Will the Affordable Care Act Affect Small Business Health Insurance Costs?

How Will the Affordable Care Act Affect Small Business Health Insurance Costs?

Do you believe that your employees are one of your most valuable assets? Do you think of your employees as an investment rather than an expense?

Do you believe that your employees are one of your most valuable assets? Do you think of your employees as an investment rather than an expense?  Contact American Insuring Group

Contact American Insuring Group There is a lot of uncertainty these days regarding what is required under the Affordable Care Act, also known as ObamaCare. Businesses and individuals alike are concerned they may be penalized or miss out on important information needed to keep their

There is a lot of uncertainty these days regarding what is required under the Affordable Care Act, also known as ObamaCare. Businesses and individuals alike are concerned they may be penalized or miss out on important information needed to keep their

Do you want to become a burden to your family? Of course not.

Do you want to become a burden to your family? Of course not. If you want to ensure that you can live independently and not become a burden to your family and friends in the event that you need care over a long period of time, give us a call at

If you want to ensure that you can live independently and not become a burden to your family and friends in the event that you need care over a long period of time, give us a call at  According to a May 2013 report by the non-profit Council for Disability Awareness (CDA), there is a sharp mismatch between the high value employees place on their ability to earn a living vs. their financial preparedness to handle a disability that would threaten their income as evidenced by having adequate levels of disability insurance.

According to a May 2013 report by the non-profit Council for Disability Awareness (CDA), there is a sharp mismatch between the high value employees place on their ability to earn a living vs. their financial preparedness to handle a disability that would threaten their income as evidenced by having adequate levels of disability insurance.