The rules and restrictions put in place by Gov. Tom Wolf, during the COVID-19 pandemic, forced many restaurants to get a little creative. At first, only take-out and curbside pickup were allowed, and then in early June, restaurants were given the okay for outdoor seating.

The rules and restrictions put in place by Gov. Tom Wolf, during the COVID-19 pandemic, forced many restaurants to get a little creative. At first, only take-out and curbside pickup were allowed, and then in early June, restaurants were given the okay for outdoor seating.

Many restaurants that hadn't offered outside seating before the pandemic, quickly adapted. And even as we moved into the green phase and some of the restrictions on indoor dining were lifted, many diners continued to feel safer eating outside.

Even without the fear of COVID-19, many people enjoy outdoor dining. Still, restaurants need to remember that outdoor dining presents a few challenges, including risks that could affect the cost of Restaurant Insurance.

Here are tips to ensure the safety of your customers and staff:

Food Safety

Food safety should always be a priority for restaurants, but as the temperatures rise, it becomes even more crucial. According to the US Department of Agriculture Food Safety and Inspection Service (USDA FSIS), there is a "Danger Zone" – temperatures 40 to 140 degrees F - where bacteria can grow more rapidly.

If you are in the "danger zone" (which will often occur with outdoor dining in the summer), don't leave food out of the refrigerator for more than two hours, and if temperatures are above 90 degrees, that time goes down to one hour. Cold foods should be kept at 40 degrees F, or colder and hot foods should be kept at an internal temp of 40 degrees F or higher.

Weather

Bad weather can be just a nuisance or an actual danger to outdoor diners and restaurant staff.

Restaurant managers can keep an eye on the weather and be more prepared for bad weather by uploading a weather app to their phone.

A roof, partial enclosure, or even table umbrellas can help keep diners dry and protected from the hot sun. Other ways to keep diners cool are fans or mist sprayers. Also, make sure your staff provides cold water to customers on particularly hot days.

As the weather begins to cool, you can extend your outdoor dining time with patio heaters to keep diners warm on chilly fall evenings.

Bugs

Bugs are just a part of summer living, but that doesn't make them any more tolerable when your customers are trying to enjoy their meals al fresco! Consider adding mosquito-repelling plants (such as lemongrass or scented geraniums) or a commercial bug zapper or bug light. Do NOT spray insect repellent around food or customers.

Smoking

According to the PA Department of Health, smoking is not banned for "structures such as a deck or patio that is not enclosed by walls and a ceiling." You should still have a policy in place, especially if you decide to extend the ban to outdoor spaces at your restaurant.

Pets

Americans are obsessed with their pets, and many would love to bring their dogs along with them when they eat outside. While many states (17, according to Michigan State University's Animal Legal and Historical Center) are beginning to allow pets into outdoor areas of restaurants, Pennsylvania is currently not one of them – unless it is a service animal protected under the American with Disabilities Act. The reasons for this restriction given by many experts are health (diseases and parasites), safety (biting), and aesthetics (barking).

Lower Your Restaurant Insurance Costs

Keeping diners and staff safe helps keep the costs of Restaurant Insurance in check. Another way to keep those costs down is to work with an independent agent (like those at American Insuring Group) who can compare the cost of your insurance with several carriers to ensure you get the best price. Give us a call today at (800) 947-1270 or (610) 775-3848 or connect with us online.

Third-party food delivery got a serious boost when Pennsylvania Governor Tom Wolf ordered all restaurants and bars to close their dine-in facilities to help stop the spread of COVID-19, while still permitting carry-out, delivery, and drive-through food and beverage service. Many restaurants began offering food delivery through apps such as Grubhub and UberEats.

Third-party food delivery got a serious boost when Pennsylvania Governor Tom Wolf ordered all restaurants and bars to close their dine-in facilities to help stop the spread of COVID-19, while still permitting carry-out, delivery, and drive-through food and beverage service. Many restaurants began offering food delivery through apps such as Grubhub and UberEats.  As a restaurant owner, your number one priority should be ensuring the safety of the food you serve. Beyond the human element of food safety, foodborne illness can result in negative publicity, huge fines, possible jail time, lawsuits, and higher

As a restaurant owner, your number one priority should be ensuring the safety of the food you serve. Beyond the human element of food safety, foodborne illness can result in negative publicity, huge fines, possible jail time, lawsuits, and higher  There is no denying that we live in a litigious society, and restaurants are not immune to lawsuits. In fact, the very nature of the business often makes them more vulnerable to lawsuits. Don’t believe us?

There is no denying that we live in a litigious society, and restaurants are not immune to lawsuits. In fact, the very nature of the business often makes them more vulnerable to lawsuits. Don’t believe us? Restaurant Insurance

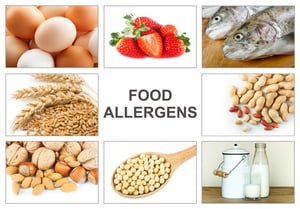

Restaurant Insurance Are food allergies affecting the cost of your restaurant liability insurance? Maybe.

Are food allergies affecting the cost of your restaurant liability insurance? Maybe.  Imagine… One of your servers loses his grip on a hot cup of coffee and it lands on a patron’s lap. Or a woman slips on a wet spot in your restroom and breaks her ankle in two places.

Imagine… One of your servers loses his grip on a hot cup of coffee and it lands on a patron’s lap. Or a woman slips on a wet spot in your restroom and breaks her ankle in two places. No matter how well prepared you think you are, your food service business is not immune to accidents. A Restaurant General Liability policy is a must to protect you against the unpredictability of mishaps, oversights, and lawsuits.

No matter how well prepared you think you are, your food service business is not immune to accidents. A Restaurant General Liability policy is a must to protect you against the unpredictability of mishaps, oversights, and lawsuits.