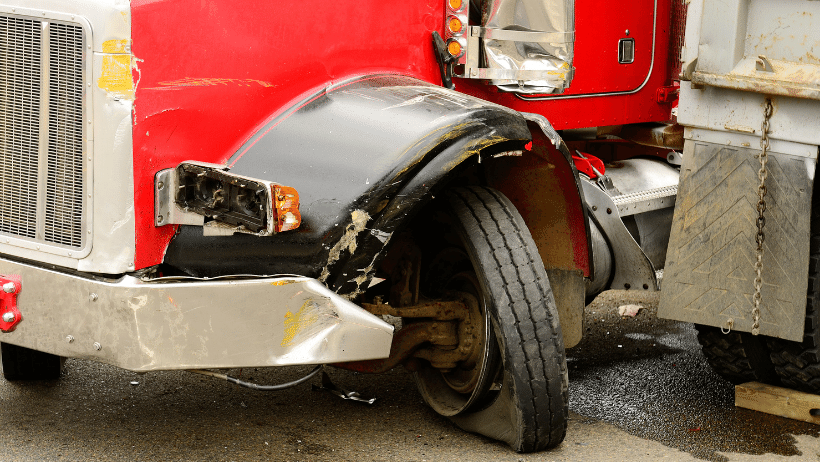

The more accidents you have, the higher your operating and Truck Insurance costs; therefore, it makes sense to avoid accidents whenever possible. Large trucks are bigger and heavier than passenger vehicles and can cause more severe injuries and damage in an accident. In 2020, there were approximately 415,000 accidents involving large trucks, 4,444 were fatal crashes, and 101,000 were injury crashes, according to the Federal Motor Carrier Safety Administration (FMCSA).

Many accidents are the result of skidding - when tires lose their grip or traction on the road – and understanding the leading causes of skidding can help drivers minimize the risk of skidding. Skids are typically caused by one of the following:

- Over-Braking – slamming on the brakes, which locks the wheels (the most common cause of skids)

- Over-Steering – turning the steering wheel more sharply than the truck can turn

- Driving Too Fast – Driving too fast based on the road conditions

- Over-Accelerating – Applying too much pedal pressure too quickly

4 Tips to Avoid Skidding in Commercial Trucks

Brake Correctly

It’s no surprise that over-braking is the most common cause of skids. If the car in front of you suddenly stops or something darts in front of you, the first instinct for most people is to slam on the brake pedal. Unfortunately, this can cause one or more of the duals or the steering axle brakes to lock up. If this happens, you can end up skidding or sliding sideways.

Instead of slamming on the brake, gently ease pressure on the pedal. Once you’ve reduced your speed, feather the brake by applying light pressure and adjusting the pressure level as needed.

Feathering allows air to get in between the brakes and the drum and helps cool the system. It does what anti-locking (ABS) is supposed to do. Unfortunately, exposure to the weather can cause erosion to the ABS, which often means it is not working as it should.

Feathering is particularly crucial on slippery roads and steep hills. Here’s a video that shows how to feather the brake pedal.

Use the Jake Brake

“As a big rig is working, the air is forced into the engine cylinders as it enters the intake valve. This causes the air to compress, which converts it into energy that can be distributed. Usually, the pistons take that energy and guide it to the rest of the vehicle to produce power,” Matheson explains. “However, when a Jake Brake is activated, that air is pushed out the exhaust valves instead of being used to power the crankshaft and down-stroke. This results in a drag on the crankshaft, slowing the vehicle without any extra friction on the service brakes.”

Matheson also states, “Because of how a Jake Brake works, drivers should avoid using them when on slippery road surfaces”; however, many experienced drivers find keeping the Jake Brake switch on the lowest position when driving on slippery road surfaces helpful.

Keep in mind that some areas have prohibited their use due to the noise Jake Brakes makes.

Allow Enough Stopping Distance

One way to avoid the need for quick stopping is to allow enough stopping distance. The condition of the road, how fast you’re going, and the weight and height of your haul can all affect how much stopping distance is required. However, trucks will always need more stopping distance than passenger cars.

For Example, the Utah Department of Transportation (UTDOT) states, “A passenger vehicle weighing 4,000 pounds, traveling under ideal conditions at a speed of 65 miles per hour would take 316 feet to stop (nearly the length of a football field). In comparison, a fully loaded tractor-trailer weighing 80,000 pounds traveling under ideal conditions at a speed of 65 miles per hour will take 525 feet to stop (almost the length of two football fields).”

Mind Your Speed

We understand many truck drivers are under pressure to meet tight deadlines, but safety should always be a priority. The faster you are traveling, the longer it will take to stop your truck, so mind your speed – especially on wet or slippery roads or steep hills or if you are an inexperienced driver.

Driving at the posted speed limit may not always be safe. Depending on the conditions, going below the speed limit may be wise. ‘In many areas, law enforcement can cite you for speeding if your speed was inappropriate for the road conditions, even if it was lower than the posted speed limit,” DSW states. “It’s better to be safe than sorry and to use your best judgment to determine a safe speed.”

How to Pay Less for Truck Insurance

Avoiding skids is one way to lower Truck Insurance costs. Another way is to call American Insuring Group at (800) 947-1270 or (610) 775-3848 or connect with us online. Our independent agents will compare the cost of your insurance among competing insurance companies so you will pay less for all of your commercial insurance needs.

A seat belt safety program is a must if you want to keep your drivers safe and your

A seat belt safety program is a must if you want to keep your drivers safe and your  More accidents mean higher

More accidents mean higher

Most truck owners and fleet managers understand the importance of

Most truck owners and fleet managers understand the importance of  The best way to lower

The best way to lower  The key to lowering

The key to lowering  If you want to reduce

If you want to reduce