Chances are that your current homeowner’s insurance policy is weaker than you think in terms of the financial protection it offers. That’s because many insurers have been steadily changing their coverage to increase deductibles and to add new loopholes protecting the insurance company from excessive loss. To make matters worse, homeowner’s insurance rates have climbed 69% over the past 10 years and now average approximately $1,000 per year.

Why the Big Homeowner’s Insurance Cost Increases?

Why the Big Homeowner’s Insurance Cost Increases?

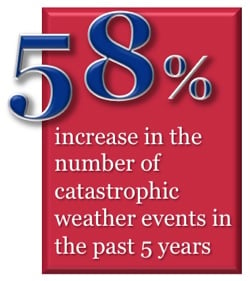

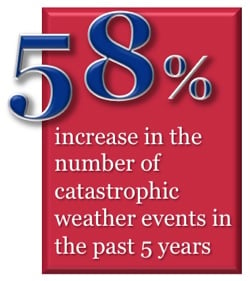

So why are insurers raising home insurance rates, cutting coverage, and increasing deductibles in Reading, Philadelphia, Allentown, Lancaster, and all across Pennsylvania and the US? Is it nothing more than unbridled greed? Hardly. Insurers are experiencing factors beyond their control that are driving up costs. The biggest factor alone, the weather, has resulted in a 58% increase in the number of catastrophic weather events in the past five years vs. the prior five, climbing from 602 to 953 according to insurance industry data. Of course, along with each disaster comes a series of insurance industry payouts to policy holders.

Another factor driving these changes is that states have denied insurers’ requests to increase their rates to the full extent needed to capture the true increases in weather-related payouts. As a result, insurers have resorted to shifting a much larger percentage of the cost of homeowner’s claims to their customers in an effort to remain solvent, and this has been done by cutting coverage. Many homeowners are on the hook for far more of the cost of repairs than they were five years ago. Homeowner’s insurance is among the least profitable forms of insurance, and, as they say, you can’t get blood from a rock, so something has to give, and that has been both the extent and cost of coverage.

Get Help: Homeowner’s Insurance Coverage Varies Widely

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

We Can Help

Are you and your family in a precarious position? Arrange for a homeowner’s insurance review with an independent agent. Why not make an appointment today? You’ll sleep better knowing you did the smart thing. Call us at (800) 947-1270 or (610) 775-3848, or click below to contact us.

Tags:

House Insurance Reading PA,

Homeowners Insurance Lancaster Pa,

House Insurance Allentown Pa,

House Insurance Lancaster Pa,

Homeowners Insurance Philadelphia Pa,

House Insurance,

Homeowners Insurance,

Homeowners Insurance Allentown Pa,

Homeowners Insurance Reading Pa,

House Insurance Philadelphia Pa,

Homeowners Insurance Harrisburg PA,

Homeowners Insurance York PA

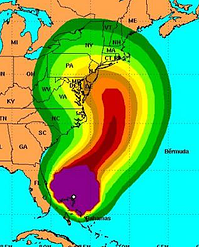

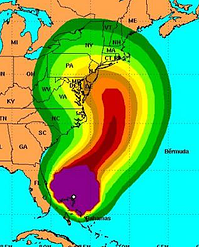

According to WFMZ-TV: "

Gov. Tom Corbett announced Thursday that Pennsylvania homeowners will not have to pay hurricane deductibles on insurance claimsstemming from damage caused by Hurricane Sandy.

"Insurance deductibles could have added significant costs to Pennsylvanians already struggling to clean up and rebuild after Hurricane Sandy," Corbett said. "Insurance companies have deployed catastrophe teams to Pennsylvania and they have been advised that hurricane deductibles should not be applied to any homeowner's insurance claims.""

For the full article, click here.

Tags:

House Insurance Reading PA,

Homeowners Insurance Lancaster Pa,

House Insurance Allentown Pa,

House Insurance Lancaster Pa,

Homeowners Insurance Philadelphia Pa,

Insurance Reading Pa,

House Insurance,

Homeowners Insurance,

Homeowners Insurance Allentown Pa,

Homeowners Insurance Reading Pa,

House Insurance Philadelphia Pa,

Homeowners Insurance Harrisburg PA,

Homeowners Insurance York PA

Fire Prevention Month

October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.

October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.

Candles Burning Brightly

Candles are beautiful when lit, but care should be taken avoid turning that beauty into an event resulting in a homeowners insurance claim. Candles start over 15,000 fires in the U.S. annually. The top 5 days for candle fires are: Christmas, Christmas Eve, New Year’s Day, Halloween, and December 23.

Fire Safety - How Safe is Your Home?

How knowledgeable are you and your family about fire safety? The National Fire Prevention Association lists 28 things homeowners should know to help prevent home fires. We know you need homeowners insurance, but we hope you never have to use it. Therefore, please learn and follow our simple fire safety guidelines to avoid home fires.

Homeowners: Get Your Valuable Free Fire Prevention Report

Our free report explains:

- 15 cooking and candle safety tips

- 9 Christmas decoration safety tips

- 4 general fire safety tips

To receive your free report, courtesy of PuroClean, click here.

To receive your free report, courtesy of PuroClean, click here.

Want the guaranteed lowest prices on high-quality, affordable homeowner’s insurance? We quote many competing home insurance companies and guarantee the best deal on homeowners insurance, as well as insurance for your car, life, health, or business.

Contact us today for a free, no-obligation quote, or click for an > instant homeowner’s insurance quote.

Tags:

Homeowners Insurance Lancaster Pa,

Homeowners Insurance Philadelphia Pa,

House Insurance,

Homeowners Insurance,

Homeowners Insurance Allentown Pa,

Homeowners Insurance Reading Pa,

Homeowners Insurance Harrisburg PA,

Homeowners Insurance York PA

New Technologies Lead to Faster Cleanup and Recovery

The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie!

The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie!

Dry it Quickly to Avoid Replacement Costs

When water damage occurs, your goal should be to dry your property and all contents as quickly as possible. In the past, restoration experts had few options, often resulting in removing and discarding damaged drywall, carpeting, and padding and replacing them at great expense. Since then, the science of drying has taken major leaps forward, so these items can often be completely restored quickly and at a much lower cost.

Homeowners: Get Your Valuable Free Report and Learn How to Recover Quickly from Water Damage

Our free report will explain:

- How damaged carpet, padding, and drywall can be completely restored

- The powerful water extraction techniques that can save you money and get you back into your home quickly

To receive your free report, courtesy of PuroClean, click here.

American Insuring Group offers the guaranteed lowest prices on high-quality, affordable homeowner’s insurance by quoting lots of competing home insurance companies. We guarantee the best deal on homeowners insurance, as well as insurance for your car, life, health, or business.

Contact us today for a free, no-obligation quote, or click for an > instant homeowner’s insurance quote.

Tags:

Homeowners Insurance Lancaster Pa,

Homeowners Insurance Philadelphia Pa,

House Insurance,

Homeowners Insurance,

Homeowners Insurance Allentown Pa,

Homeowners Insurance Reading Pa,

Homeowners Insurance Harrisburg PA,

Homeowners Insurance York PA

The storm season is here, and it pays to be prepared with the right homeowners insurance policy. Homeowners insurance is designed to protect you from severe financial loss when your house is damaged. Major home damage in Reading PA, Berks County, Lancaster, Allentown, Philadelphia and other parts of the eastern U.S. often occurs due to flooding. Fortunately, today’s technologies can restore your home to pre-flooding condition, especially if you act quickly when water damage occurs.

Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report.

Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report.

Get Your Valuable Free Report: What to Do After the Storm

In addition to providing helpful details on what to check and who to call, your free homeowner’s report will explain:

- 2 things you can do to speed your insurance claims process

- How to protect yourself against contractor scams after the storm

- The key plumbing, roofing, and electrical items to check for when assessing damage

To receive your free report, courtesy of PuroClean, click here.

American Insuring Group is proud to offer you the guaranteed lowest prices on high-quality, affordable homeowner’s insurance from a multitude of competing home insurance carriers. With over 25 competing brands of insurance, we guarantee the best deal on homeowners insurance, as well as insurance for your car, life, health, or business. Contact us today for a free, no-obligation quote, or click for an > instant homeowner’s insurance quote.

Tags:

House Insurance Reading PA,

Homeowners Insurance Lancaster Pa,

House Insurance Allentown Pa,

House Insurance Lancaster Pa,

Homeowners Insurance Philadelphia Pa,

Flood Insurance,

Flood Insurance Reading PA,

House Insurance,

Homeowners Insurance,

Homeowners Insurance Allentown Pa,

Homeowners Insurance Reading Pa,

House Insurance Philadelphia Pa,

Homeowners Insurance Harrisburg PA,

Homeowners Insurance York PA

We purchase homeowners insurance to protect our homes, and for the peace of mind that house insurance protection can bring. But what can we do when mold builds up in our home, and how can we prevent it in the first place?

Homeowners in Pennsylvania, and in eastern and southeastern states in general, tend to live in humid climates with plentiful rainfall. This combination makes these homes more susceptible to moisture and mold buildup, especially in older homes with porous foundations. Therefore, homeowners must take extra care to watch for signs of moisture and mold, and to act quickly to resolve such problems before they become a serious health threat.

Homeowners in Pennsylvania, and in eastern and southeastern states in general, tend to live in humid climates with plentiful rainfall. This combination makes these homes more susceptible to moisture and mold buildup, especially in older homes with porous foundations. Therefore, homeowners must take extra care to watch for signs of moisture and mold, and to act quickly to resolve such problems before they become a serious health threat.

Is Mold in My Home, and What Can I Do?

Simply put, if you can see it or smell it, then you have mold, and should take immediate action to remove it. The first step is to find and eliminate the water source. Then the mold must be cleaned with a detergent solution and all materials must be thoroughly dried. Depending on the scope of the problem, professional help may be required, which may be covered under your homeowner’s insurance policy (contact us for details).

Get Your Free Report on Eliminating Mold in the Home

Our free homeowner’s report will show you:

- 4 Ways to Stop Water Buildup in the Home

- 4 Tips for Keeping Your Home Dry and Humidity Low

- 3 Keys to Eliminating Mold

To receive your free report, click here.

American Insuring Group specializes in affordable homeowners insurance from high-quality carriers. We offer over 25 competing brands of insurance to guarantee the best deal on the right insurance for your home, car, life, health, or business. Contact us today for a free, no-obligation quote, or click for our > instant homeowners insurance quote.

Tags:

House Insurance Reading PA,

Homeowners Insurance Lancaster Pa,

House Insurance Allentown Pa,

House Insurance Lancaster Pa,

Homeowners Insurance Philadelphia Pa,

House Insurance,

Homeowners Insurance,

Homeowners Insurance Allentown Pa,

Homeowners Insurance Reading Pa,

House Insurance Philadelphia Pa,

Homeowners Insurance Harrisburg PA,

Homeowners Insurance York PA

Many PA Homeowners Caught Without Flood Insurance Protection

Many homeowners throughout Berks County, Lancaster County, and elsewhere in Pennsylvania experienced surprising homeowners insurance claims in 2011 due to flooding. Sadly, many lacked proper flood insurance resulting in denied claims and financial hardships that could have easily been avoided. From Reading PA to Allentown, from Lancaster to Erie, and Philadelphia to Pittsburgh, homeowners were caught uninsured, underinsured, and unprotected against flooding.

Many homeowners throughout Berks County, Lancaster County, and elsewhere in Pennsylvania experienced surprising homeowners insurance claims in 2011 due to flooding. Sadly, many lacked proper flood insurance resulting in denied claims and financial hardships that could have easily been avoided. From Reading PA to Allentown, from Lancaster to Erie, and Philadelphia to Pittsburgh, homeowners were caught uninsured, underinsured, and unprotected against flooding.

Over-the-ground flooding can cause severe property damage and often presents unique challenges to homeowners as they attempt to restore their homes and property, with or without the benefit of flood insurance coverage on their homeowner’s policy.

Flood Plains and Homeowners Flood Insurance – Don’t Be Fooled

As many Pennsylvania homeowners came to realize in 2011, flooding can occur outside of so-called flood plains, so acquiring flood insurance even if you are outside a flood plain can be the difference between financial protection and financial disaster when a surprise flood occurs. Hurricanes, tropical storms, and even thunderstorms can cause extensive flooding even hundreds of miles from the coast.

Property damage specialists at PuroClean offer the following tips for coping with a flood, minimizing property damage, and insuring a speeding recovery:

- Get professional flood cleanup help quickly

- Remove all water, mud, and sludge

- Remove and properly dispose of contaminated porous materials (including carpet, padding, drywall, paper, cardboard, insulation, and particle board furniture)

- Sanitize semi-porous materials (structural wood, solid wood furniture)

- Use professional-strength EPA-approved products to sanitize the remaining salvageable structure, fixtures, and contents

- Professionally and thoroughly dry the structure as quickly as possible using dehumidifiers and high-capacity air movers

- Install one or more air scrubbers to remove harmful airborne particulates

- Perform any needed repairs

To download PuroClean’s factsheet on recovering from over-the-ground flooding, click here.

Avoid a Financial Upheaval by Adding Flood Insurance Protection to Your Homeowners Insurance Policy

Remember, a flood can cause a major upheaval in the lives of any homeowner. Be sure to carry the proper flood insurance on your Pennsylvania homeowners insurance policy. Then, whether you hail from Reading or Lancaster, Philadelphia or Allentown, Pittsburgh or Erie, you will be grateful that you had the foresight to plan ahead. Your family will thank you as well.

Need flood insurance for your home in Pennsylvania or elsewhere? Contact the commercial and homeowners flood insurance experts at American Insuring Group near Reading PA. We’ll make sure you’re covered with the right homeowners flood insurance to get your home and property restored quickly and thoroughly. Click the Contact link above, or call us at (800) 947.1270 or (610) 775-3848.

Tags:

Homeowners Insurance Lancaster Pa,

Homeowners Insurance Philadelphia Pa,

Flood Insurance,

Flood Insurance Reading PA,

House Insurance,

Homeowners Insurance,

Homeowners Insurance Allentown Pa,

Homeowners Insurance Reading Pa,

Homeowners Insurance Harrisburg PA,

Homeowners Insurance York PA,

PA Flood Insurance

With the average homeowners insurance policy renewal premium rising by as much as 25% or more, most home insurance buyers are asking themselves how to pay less for a house insurance policy.

With the average homeowners insurance policy renewal premium rising by as much as 25% or more, most home insurance buyers are asking themselves how to pay less for a house insurance policy.

Big Storms, Big Damage, and Rising Homeowners Insurance Costs

Recent home insurance claims in Berks County, Reading, Allentown, Philadelphia, Lancaster, Harrisburg and elsewhere in Pennsylvania are paralleling the number of catastrophic storms to hit the U.S. recently. Homeowners insurance companies are filing for and receiving greater and greater premium increases for their policyholders. The pricing trend will likely continue for the next couple of years. As a result, smart homeowners will be looking for ways to reduce their rising house insurance costs.

Act Now to Jump Start Your Homeowners Insurance Savings

A smart way to begin is by calling American Insuring Group for a homeowners insurance rate comparison based on over 2 dozen Insurance companies we represent. Our professional staff will begin by getting quotes from these companies for the exact level of insurance protection you now carry. Then our agents will ask some in-depth questions about your home's construction and other factors to make sure your house insurance policy covers your home for its full reconstruction cost. That’s key, because if your house burns down or is destroyed by a storm you need to be covered for the cost to rebuild it on your property, which is typically more than the cost to purchase a similar used home in your area.

After we find you the best homeowners Insurance policy quote from our long list of companies, we’ll ask additional questions to make sure you have the right home insurance coverage for your particular needs and lifestyle.

Let the Insurance Savings Begin!

Next, we’ll show you all the ways we can save you big bucks on your house insurance, INCLUDING:

- UP TO A 15% DISCOUNT FOR INSURING YOUR AUTO AND HOME WITH THE SAME COMPANY

- UP TO A 25% DISCOUNT FOR INCREASING YOUR HOME INSURANCE DEDUCTIBLE

- UP TO A 15% DISCOUNT FOR HAVING A CENTRAL ALARM OR SPRINKLER SYSTEM

- UP TO A 10% DISCOUNT FOR NEW CONSTRUCTION

- UP TO A 30% DISCOUNT FOR BEING CLAIM FREE

- UP TO A 10% DISCOUNT FOR LONGEVITY WITH THE SAME INSURANCE COMPANY

- UP TO 20% DISCOUNT FOR UPDATING MECHANICALS

At American Insuring Group LTD, the BIG BUCKS savings run on and on and on! Call today for your Homeowners Insurance quote today. Remember our pledge: "If we can't save you money on your insurance, dinner is on US!" That applies to your house insurance policy regardless of where you live, from Reading to Lancaster, from Philadelphia to Pittsburgh, or Erie to Allentown.

Call us at 1800-943-2198 and start saving big bucks today.

Tags:

House Insurance Reading PA,

Homeowners Insurance Lancaster Pa,

House Insurance Allentown Pa,

House Insurance Lancaster Pa,

Homeowners Insurance Philadelphia Pa,

House Insurance,

Homeowners Insurance,

Homeowners Insurance Allentown Pa,

Homeowners Insurance Reading Pa,

House Insurance Philadelphia Pa

Insurance Savings & News You Can Use is being launched to help educate our customers and potential clients with insurance information you can use, including advice on how to save on car insurance, homeowner's insurance, life and health insurance, and business / commercial insurance.

Our agency, which is located near Reading, PA, will go in-depth to analyze insurance topics and make the confusing understandable. We'll do our best to make insurance coverage and terminology clear and concise, so you can make informed decisions on the coverage you need and get the savings you deserve. We hope to educate, inform, and engage you with our new blog, and we are eager to hear your questions and feedback.

Our agency, which is located near Reading, PA, will go in-depth to analyze insurance topics and make the confusing understandable. We'll do our best to make insurance coverage and terminology clear and concise, so you can make informed decisions on the coverage you need and get the savings you deserve. We hope to educate, inform, and engage you with our new blog, and we are eager to hear your questions and feedback.

We are happy to be at your service. Please join the conversation!

If you would like an instant online insurance quote for your car, motorcycle, truck, SUV, or recreational vehicle, please click below.

Tags:

Health Insurance Reading PA,

House Insurance Reading PA,

Business Insurance Reading PA,

Car Insurance,

Car Insurance Reading PA,

House Insurance,

Homeowners Insurance,

Life Insurance Reading PA,

Health Insurance,

Commercial Insurance,

Commercial Insurance Reading PA,

Life Insurance

Why the Big Homeowner’s Insurance Cost Increases?

Why the Big Homeowner’s Insurance Cost Increases? Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

Because house insurance coverage varies widely among insurers, and given that the specifics of what is covered and what is not are often buried in the insurance policy fine print, it is wise to seek the advice of an independent insurance agent to help you make sense of the coverages, deductibles, and loopholes within policies offered by various insurance carriers. An independent agent is uniquely positioned to help you find the best policy for your needs and budget because he or she represents multiple competing carriers, rather than just one. Don’t rely solely on an insurance company’s reputation or marketing. Instead get the facts so you can make an informed purchase.

According to WFMZ-TV: "

According to WFMZ-TV: " October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.

October is known as fire prevention month. Why? Because homeowners in cooler climates like those common to Reading, Lancaster, Philadelphia, Harrisburg, and Allentown, PA are beginning to fire up their heating systems, including space heaters. Not only that, but the holiday season is right around the corner, starting with lighting at Halloween, and then extensive kitchen use at Thanksgiving, and continuing through Christmas and New Year’s Eve.  To receive your free report, courtesy of PuroClean,

To receive your free report, courtesy of PuroClean,  The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie!

The bad news – you need to contact your Pennsylvania homeowners insurance agent because your home got hit by major water damage. The good news – today’s technology makes it possible to quickly restore damaged carpet, padding, drywall and more. That’s also good news in terms of costs for Pennsylvania homeowners insurance from Reading to Allentown, Harrisburg to Philadelphia, and Lancaster to Erie! Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report.

Do you know what to do or who to call when major storm damage occurs? Be sure to contact your homeowners insurance agent as soon as possible, and to take plenty of photos of the damage. Remember to watch for fallen power lines and standing water that may be electrically charged. Plumbing, roofing, and electrical systems and appliances should all be checked by a qualified professional. For more information, request our free report. Homeowners in Pennsylvania, and in eastern and southeastern states in general, tend to live in humid climates with plentiful rainfall. This combination makes these homes more susceptible to moisture and mold buildup, especially in older homes with porous foundations. Therefore, homeowners must take extra care to watch for signs of moisture and mold, and to act quickly to resolve such problems before they become a serious health threat.

Homeowners in Pennsylvania, and in eastern and southeastern states in general, tend to live in humid climates with plentiful rainfall. This combination makes these homes more susceptible to moisture and mold buildup, especially in older homes with porous foundations. Therefore, homeowners must take extra care to watch for signs of moisture and mold, and to act quickly to resolve such problems before they become a serious health threat. Many homeowners throughout Berks County, Lancaster County, and elsewhere in Pennsylvania experienced surprising homeowners insurance claims in 2011 due to flooding. Sadly, many lacked proper flood insurance resulting in denied claims and financial hardships that could have easily been avoided. From Reading PA to Allentown, from Lancaster to Erie, and Philadelphia to Pittsburgh, homeowners were caught uninsured, underinsured, and unprotected against flooding.

Many homeowners throughout Berks County, Lancaster County, and elsewhere in Pennsylvania experienced surprising homeowners insurance claims in 2011 due to flooding. Sadly, many lacked proper flood insurance resulting in denied claims and financial hardships that could have easily been avoided. From Reading PA to Allentown, from Lancaster to Erie, and Philadelphia to Pittsburgh, homeowners were caught uninsured, underinsured, and unprotected against flooding. With the average homeowners insurance policy renewal premium rising by as much as 25% or more, most home insurance buyers are asking themselves how to pay less for a house insurance policy.

With the average homeowners insurance policy renewal premium rising by as much as 25% or more, most home insurance buyers are asking themselves how to pay less for a house insurance policy. Our agency, which is located near Reading, PA, will go in-depth to analyze insurance topics and make the confusing understandable. We'll do our best to make insurance coverage and terminology clear and concise, so you can make informed decisions on the coverage you need and get the savings you deserve. We hope to educate, inform, and engage you with our new blog, and we are eager to hear your questions and feedback.

Our agency, which is located near Reading, PA, will go in-depth to analyze insurance topics and make the confusing understandable. We'll do our best to make insurance coverage and terminology clear and concise, so you can make informed decisions on the coverage you need and get the savings you deserve. We hope to educate, inform, and engage you with our new blog, and we are eager to hear your questions and feedback.