Contractors and handymen, do you remember the days before nail guns? When you had to use a hammer to nail something.

Contractors and handymen, do you remember the days before nail guns? When you had to use a hammer to nail something.

Today, you probably can’t imagine doing your job without a nail gun! They’ve probably made your job a lot easier, and, unfortunately, more dangerous, which can lead to increased workers compensation insurance claims and higher insurance costs.

According to the CDC, nail guns are responsible for approximately 37,000 emergency room visits every year. Sixty-eight percent of those injuries are work-related. Severe nail gun injuries can even cause death.

7 Risk Factors for Nail Gun Injuries

The CDC has identified 7 major risk factors that can lead to nail gun injury:

- Unintended nail discharge from double fire

- Unintended nail discharge from knocking the safety contact with the trigger squeezed

- Nail penetration through lumber workpiece

- Nail ricochet after striking a hard surface or metal feature

- Missing the workpiece

- Awkward position nailing

- Bypassing safety mechanisms

Nail Gun Safety Prerequisite: Know Your Triggers!

Before we can discuss ways to avoid nail gun injuries, it’s important to understand the different types of nail gun triggers.

There are two controls with every nail gun: a finger trigger and a contact safety tip on the nose of the gun.

- Full sequential trigger – This is the safest type of trigger. The controls need to be activated in a very specific order for the gun to fire, and nails can’t be bump fired – also called bounce nailing. Bump firing or bounce nailing is using a nail gun with a contact trigger held squeezed and bumping or bouncing the tool along the workpiece to fire nails.

- Contact trigger – This type of trigger fires a nail when the safety contact and trigger are activated in any order. A nail will be fired each time the safety contact is pushed in if you keep the trigger squeezed. Nails can be bump fired with this type of trigger. Contact trigger nailers are prone to double firing, according to the Consumer Product Safety Commission (CPSC).

- Single sequential trigger – To fire this type of trigger, controls must be activated in a specific order and nails cannot be bump fired just like the full sequential trigger. However – unlike the full sequential trigger – only the trigger must be released to fire the second nail.

- Single-actuation trigger – This trigger will fire a single nail when the safety and trigger are activated in any order just like the contact trigger. To shoot the second nail, you can release the trigger, move the tool and squeeze the trigger again without releasing the safety again. Nails can be bump

6 Ways to Avoid Nail Gun Injuries

The CDC offers six steps to help avoid nail gun injuries:

- Use full sequential trigger nail guns, which reduce the risk of unintentional discharge and double fires especially with inexperienced employees.

- Provide safety training to both new and experienced employees that covers topics such as how triggers differ and the leading causes of injuries and how to avoid them.

- Establish nail gun work procedures specific to your company that address risk factors.

- Provide personal protective equipment (PPE) such as safety shoes, high-impact eye protection, etc.

- Encourage reporting and discussion of injuries and close calls to draw attention to possible risks, so they can be avoided and to ensure that your employees are getting medical care when needed.

- Provide first aid and medical treatment. Sometimes, what seems like a minor injury can be more severe. For example, materials such as nail strip glue or clothing can become embedded, which can cause infection.

Play it Safe with Proper Workers Compensation Insurance!

It is your responsibility to provide the safest workplace environment for your employees. The fact that it also reduces your workers’ compensation costs is just icing on the cake!

It is your responsibility to provide the safest workplace environment for your employees. The fact that it also reduces your workers’ compensation costs is just icing on the cake!

To learn more about saving on workers compensation insurance, give American Insuring group a call at (800) 947-1270 or (610) 775-3848 or contact us online. Our independent agents are ready to get you solid coverage options at a great price. Call or click today.

The majority of workers’ compensation insurance claims are legitimate, and if an employee is injured on the job, they are entitled to the medical care and indemnity benefits stated in the workers’ compensation statutes. Unfortunately, there are also a number of fraudulent workers’ compensation claims every year.

The majority of workers’ compensation insurance claims are legitimate, and if an employee is injured on the job, they are entitled to the medical care and indemnity benefits stated in the workers’ compensation statutes. Unfortunately, there are also a number of fraudulent workers’ compensation claims every year. To learn more about protecting your company against WC insurance fraud or your

To learn more about protecting your company against WC insurance fraud or your

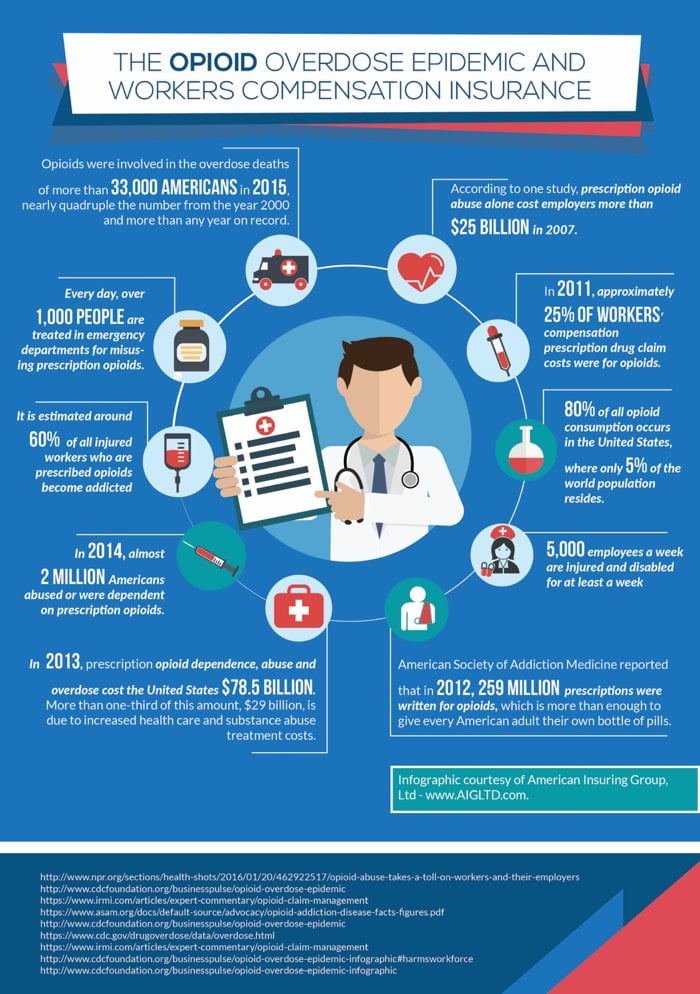

The Center for Disease Control (CDC) reported that every day, over 1,000 people are treated in emergency departments for misusing prescription opioids, and in 2014, almost 2 million Americans abused or were dependent on prescription opioids.

The Center for Disease Control (CDC) reported that every day, over 1,000 people are treated in emergency departments for misusing prescription opioids, and in 2014, almost 2 million Americans abused or were dependent on prescription opioids.  This “curse” often affects individuals who work with the

This “curse” often affects individuals who work with the  Reviewing defense attorneys and panels should be done on an ongoing basis because choosing the wrong workers compensation defense attorney for your business can cause missed opportunities, unnecessary litigation costs, and time. Just because you’ve built a relationship with one attorney doesn’t make him or her the best choice to defend your

Reviewing defense attorneys and panels should be done on an ongoing basis because choosing the wrong workers compensation defense attorney for your business can cause missed opportunities, unnecessary litigation costs, and time. Just because you’ve built a relationship with one attorney doesn’t make him or her the best choice to defend your  Having the right defense attorney for your workers comp claims will save you time and frustration and help you save money on your workers compensation insurance.

Having the right defense attorney for your workers comp claims will save you time and frustration and help you save money on your workers compensation insurance. Getting people back to work on time can help reduce the cost of

Getting people back to work on time can help reduce the cost of  Cold weather is here, and as the temperature dips,

Cold weather is here, and as the temperature dips,  Getting the right workers compensation insurance is also a key to lowering your costs while protecting your business. Let our professionals help you do both. We shop among competing insurance providers to make sure you get the right policy for your business at the right price.

Getting the right workers compensation insurance is also a key to lowering your costs while protecting your business. Let our professionals help you do both. We shop among competing insurance providers to make sure you get the right policy for your business at the right price. As an employer, you want to make sure that you have

As an employer, you want to make sure that you have  Subscribe to our blog to learn additional ways to control your workers’ compensation and other business and personal insurance costs. And be sure to

Subscribe to our blog to learn additional ways to control your workers’ compensation and other business and personal insurance costs. And be sure to  The Occupational Safety and Health Administration (OSHA) estimates that power industrial trucks (PIT), often called forklifts or lift trucks, cause approximately 85 fatal accidents each year, almost 35,000 accidents that result in a serious injury, and about 62,000 non-serious accidents. Accidents can be trajic for employees and can affect

The Occupational Safety and Health Administration (OSHA) estimates that power industrial trucks (PIT), often called forklifts or lift trucks, cause approximately 85 fatal accidents each year, almost 35,000 accidents that result in a serious injury, and about 62,000 non-serious accidents. Accidents can be trajic for employees and can affect  Most employers know that to reduce their

Most employers know that to reduce their  To learn more about lowering your workers comp costs,

To learn more about lowering your workers comp costs,