Welcome to the Sandwich Generation?

Our world is changing. The “typical” family has changed and people are living much longer due to advances in medicine. These two ingredients have created a new generation – known as the Sandwich Generation. Gone are the days when a “typical” family consisted of a working husband, a stay-at-home wife and a couple of children.

Our world is changing. The “typical” family has changed and people are living much longer due to advances in medicine. These two ingredients have created a new generation – known as the Sandwich Generation. Gone are the days when a “typical” family consisted of a working husband, a stay-at-home wife and a couple of children.

Today, only 22 percent of all children under 15 are being raised by the “typical” family, according to a report for the Council of Contemporary Families. Another 23 percent are being raised by a single mother, 7 percent live with a parent who cohabits with an unmarried partner, 3 percent live with a single father, and 3 percent live with grandparents. In addition, nearly half of all American married couples are dual-career couples according to the Harvard Business Review.

Plus, people are living longer. When the 20th century began, life expectancy at birth in America was 47 years. Today, newborns are expected to live 79 years. If we continue increasing life expectancy at the rate we have been, people will be living to 100 by the end of this century. This means an increase in the number of aging parents – who are experiencing changing needs - will require some type of assistance.

According to Pew, “Nearly half (47%) of adults in their 40s and 50s have a parent age 65 or older and are either raising a young child or financially supporting a grown child (age 18 or older).” Nearly 30 percent of those aging parents need some type of assistance.

Long Term Care Insurance: Relief for the “Sandwich Generation”

Today, many individuals are responsible for the care of an aging parent. Some turn to professionals for help – hiring a caregiver or relocating their parents to a facility that can meet their changing needs – but paying for this long-term care can quickly drain your bank account. Long term care insurance can help ease the financial burden.

Here are some average costs of long-term care in the US, according to Longtermcare.gov:

$205 per day or $6,235 per month for a semi-private room in a nursing home

$229 per day or $6,965 per month for a private room in a nursing home

$3,293 per month for care in an assisted living facility (for a one-bedroom unit)

$21 per hour for a home health aide

$19 per hour for homemaker services

$67 per day for services in an adult day health care center

This financial burden often forces individuals to take it upon themselves to become the primary caregiver for an aging parent. In fact, more than 65 million Americans are the care giver for an adult family member. Before deciding to take this route, you should consider all of the “costs” this decision can create.

Financial Costs

There is almost always a financial impact if you become the caregiver. Nearly half of family caregivers spend more than $5,000 a year on out-of-pocket caregiving expenses, and about a third spend more than $10,000 according to a recent survey. Those who leave the workforce to provide care lose an average of more than $300,000 in income and benefits.

Health Costs

As you focus on the needs of your loved one, it’s very easy to forget to take care of yourself. About one in five family caregivers believe their health has gotten worse as a result of their responsibilities. Between 40% and 70% of family caregivers of older adults have significant symptoms of depression. Other common health problems of family caregivers include increased anxiety, heart disease, hypertension, sleep problems and fatigue. Therefore, quality health care insurance coverage is key.

Career Costs

Becoming a primary caregiver can also affect your job. Consider these statistics for working caregivers:

• 60% say their duties have had a negative impact on their jobs

• 68% make work accommodations

• 64% arrive late, left early and/or took time off in the middle of the day

• 17% took a leave of absence

• 9% reduced hours or took a less demanding job

• 5% turn down a promotion

Relationship Costs

Being a full-time caregiver can change your family dynamics and put a strain on your relationships with your spouse and children. It can also create stress and conflict with siblings when it comes to topics like financial support and sharing the caregiving responsibilities.

The Solution: Long-term Care Insurance

Providing long-term care to an aging loved one will always be an emotional and often trying experience for families. If you don’t want to become a burden to your family, you should consider long-term care insurance to protect your family’s finances, provide choices, and alleviate many of the “costs” associated with long-term care. Most importantly, long-term care insurance provides peace of mind for both you and your family.

Take the first steps in learning about long-term care planning and find out how solutions like long-term care insurance can protect both you and your family.

Take the first steps in learning about long-term care planning and find out how solutions like long-term care insurance can protect both you and your family.

For more information, contact American Insuring Group at (800) 947-1270 or (610) 775-3848.

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA).

Businesses are discovering many uses for drones – also known as unmanned aircraft systems (UAS). In fact, total spending for military and commercial drones is expected to reach $89.1 billion over the next ten years. This translates into approximately 30,000 small commercial drones in use by 2020, according to the Federal Aviation Administration (FAA). In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an

In February 2012, congress mandated that the Federal Aviation Administration (FAA) find a way to integrate drones into U.S. airspace by September 2015. With that deadline looming, the FAA is nowhere close to finalizing its plans. This lack of regulation and the fact that there is very little loss history available at this point makes it challenging for insurance companies to develop policies. It's therefore likely that drone insurance rates may vary widely among insurance providers. Therefore, it's helpful to acquire drone insurance protection from an  For more information about drone insurance and other commercial insurance needs,

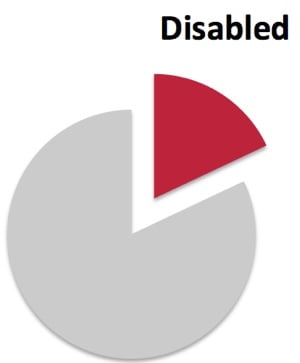

For more information about drone insurance and other commercial insurance needs,  More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.

More than 50 million Americans – 18% of the population – have disabilities, making them the largest minority group in the country. In addition, approximately 71.5 million baby boomers will be over the age of 65 by the year 2030; many will require special provisions to meet their age-specific physical needs.  You say you have good

You say you have good  The inability to get the right care, from the right provider, at the right time is one of the leading causes of increasing medical costs.

The inability to get the right care, from the right provider, at the right time is one of the leading causes of increasing medical costs.  Contact Us for Workers Compensation Insurance Assistance

Contact Us for Workers Compensation Insurance Assistance Did you recently get married? Have you started thinking about having children? Are you already pregnant? Congratulations! This is a very exciting time in your life!

Did you recently get married? Have you started thinking about having children? Are you already pregnant? Congratulations! This is a very exciting time in your life!

Fraud, waste, and abuse continue to drive up the cost of administering workers’ compensation programs. Workers’ compensation fraud, which accounts for approximately one-quarter of all insurance fraud, comes in all forms: injury while off work, multiple claims, injury concurrent with termination, and many more.

Fraud, waste, and abuse continue to drive up the cost of administering workers’ compensation programs. Workers’ compensation fraud, which accounts for approximately one-quarter of all insurance fraud, comes in all forms: injury while off work, multiple claims, injury concurrent with termination, and many more.  For additional methods to reduce the cost of workers’ compensation, including getting the best rate on quality workers comp insurance,

For additional methods to reduce the cost of workers’ compensation, including getting the best rate on quality workers comp insurance,  If you own a fleet of vehicles that are used exclusively for your business or you own a freight truck or delivery truck, you probably understand that you need commercial vehicle insurance on those vehicles. But what if you have one vehicle that you use to deliver pizzas? What if you use your personal vehicle to drive to job sites or to meetings?

If you own a fleet of vehicles that are used exclusively for your business or you own a freight truck or delivery truck, you probably understand that you need commercial vehicle insurance on those vehicles. But what if you have one vehicle that you use to deliver pizzas? What if you use your personal vehicle to drive to job sites or to meetings? Smart business owners know that insurance is important to protect their business and assets. But, knowing which ones are right for your business can be a challenge. No one wants to be caught without the right

Smart business owners know that insurance is important to protect their business and assets. But, knowing which ones are right for your business can be a challenge. No one wants to be caught without the right  These five business insurance questions are a great starting point for any business owner, but you don’t need to go it alone. The advice of a trusted and experienced independent insurance agent from American Insuring Group can help ensure that you obtain the right insurance at the right price for your business.

These five business insurance questions are a great starting point for any business owner, but you don’t need to go it alone. The advice of a trusted and experienced independent insurance agent from American Insuring Group can help ensure that you obtain the right insurance at the right price for your business.  Whether you’re a subcontractor or a general contractor – whether you build small backyard sheds or giant commercial buildings – whether you’re a one-man remodeling business or a multi-million dollar construction company, there are three types of insurance you need to consider. In other words, the size of your business and the size of the project make little difference. If you want to protect your investment, your employees, and even your business, there are three types of

Whether you’re a subcontractor or a general contractor – whether you build small backyard sheds or giant commercial buildings – whether you’re a one-man remodeling business or a multi-million dollar construction company, there are three types of insurance you need to consider. In other words, the size of your business and the size of the project make little difference. If you want to protect your investment, your employees, and even your business, there are three types of  For more customized information about your construction insurance or

For more customized information about your construction insurance or